The market has developed a bad case of anxiety this year. We’ve already had two minor corrections in 2018, and investors across the board are growing increasingly nervous that the next one could be the big one.

This market jitter has been exacerbated by a lack of participation by the more stable hands on Wall Street. In short, institutional investors and big, “smart money” players are all but out of the game. The majority of those left trading this bull market are retail investors like you and me.

My colleague Ted Bauman and I had a discussion on this topic at our last team meetup in Florida a couple weeks ago. Shortly after, Ted elaborated on the topic with his article “Why Investors Are Bailing Before the Next Stock Market Correction.”

Ted tells us what we should already know: You don’t want to be the only one left in market waters when the sharks come out to feed. That said, there is a benefit to staying in these trading waters a little bit longer.

That benefit comes from picking up value stocks that get unduly punished for minor infractions. Without the stabilizing effect that institutional investors have on the market and individual stocks, we are seeing some undo and erratic behavior.

We’ve all seen companies get hammered this year despite stellar quarterly financial reports and solid fundamentals.

iRobot Corp. (Nasdaq: IRBT) comes to mind. Earlier this year, the company trimmed guidance to focus on solidifying market share. IRBT stock plunged 20% following that news.

The shares are now up 100% since that post-earnings plunge, and up more than 41% since I recommended buying IRBT stock on August 3.

Today’s free trade idea falls within similar lines: A retail company whose stock recently plunged more than 8% due to a minor infraction. It’s bargain hunting time.

A Showroom No Longer

After the close on Monday, Best Buy Co. (NYSE: BBY) released its second-quarter earnings report. The results were stellar.

Best Buy reported a 17% rise in earnings and a 5% gain in revenue for the quarter. Both figures beat Wall Street’s targets.

Furthermore, the big-box electronics retailer lifted full-year guidance to earnings of $4.95 to $5.10 per share, well to the high side of the consensus estimate for $5.01 per share.

Same-store sales grew by a larger-than-expected 6% in the quarter. In other words, more people are shopping at Best Buy stores.

This is doubly impressive when you realize that electronics were among the first products to move to online shopping venues like Amazon. Best Buy is winning those customers back.

It’s time to admit that Best Buy has finally cast off the “Amazon showroom” moniker.

About That 8% Drop…

I can hear many of you asking: “If earnings were so impressive, then why did Best Buy stock drop 8%?”

The answer lies with online sales growth. Best Buy said that online sales grew 10%, which was in line with the company’s own projections. Wall Street, however, was expecting growth of 12%.

Online sales are nothing to make light of. They make up 15% of Best Buy’s total domestic sales.

However, Best Buy still commands 15% of the overall U.S. consumer electronics market, compared to just 10% for Amazon. What’s more, it has doubled its web business in the past five years.

So, are underwhelming online sales worth noting as a concern? Certainly. Were they worth an 8.4% plunge in BBY stock? Certainly not.

What’s more, this little bit of news overshadowed a significant acquisition.

Last week, Best Buy snapped up GreatCall, a company that provides emergency response services to more than 900,000 paying subscribers. It does so via mobile products and wearables that connect users to agents who can then notify caregivers or emergency medical help.

Given the aging U.S. population, this is a smart and potentially very lucrative move for Best Buy. And it was all brushed aside this week by a jittery market lacking smart-money participation and leadership.

Investing in Best Buy Stock

Investors have already realized their mistake in sending BBY stock down so sharply. The shares are trading more than 4% off their post-earnings lows.

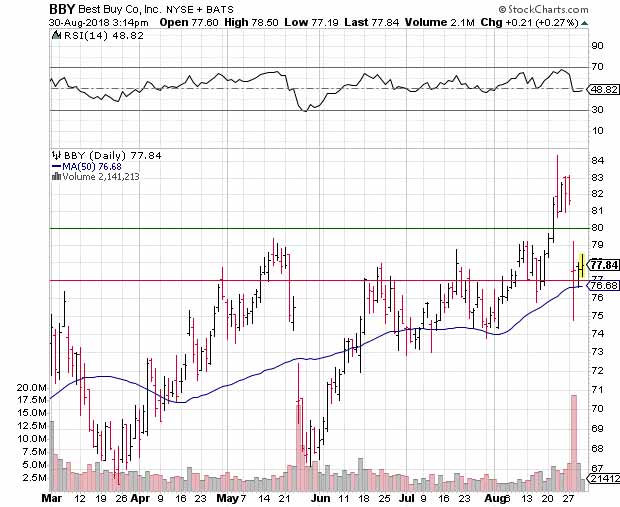

This rebound has taken BBY stock back above key support at its 50-day moving average. The stock’s 14-day Relative Strength Index was also corrected lower, and now has plenty of room to rise before overbought conditions become a concern again.

As you can see from the chart above, the $77 to $80 area is home to quite a bit of congestion. In other words, BBY stock has become volatile in this area in the past.

This range should now prove supportive for the shares and is our target buy range for BBY stock.

Don’t worry if the shares bounce around a bit in this area. Without real leadership, the market is bound to be a bit bumpy.

However, once BBY breaks out above $80, the stock will trend steadily higher through the end of the year and the holiday shopping season.

Until next time, good trading!

Regards,

Joseph Hargett

Assistant Managing Editor, Banyan Hill Publishing