Cree Inc. (Nasdaq: CREE) has a special place in my heart. It was the first company I put together an in-depth research report on.

It was back in my college days, and my team was tasked with finding a valuation for Cree: What was the company worth?

A lot has changed in the stock then, but I consider it my first taste of what investing in the markets is really like — a roller coaster ride.

This is a company that used to just focus on lighting products. Pretty boring stuff, but the government was writing regulations that would eventually buoy the company’s LEDs bulb sales.

That was years ago. Today, Cree has done the impossible and made the jump from a boring light bulb company (though it still offers bulbs) to a high-tech semiconductor company. In 2015, Cree decided to separate out its semiconductor business — Wolfspeed. Since then, semiconductors have grown to become the largest area of revenue for the company.

It’s a wildly different industry that’s gained the stock extra attention over the past year.

In today’s video, I’ll break down everything you need to know about Cree and its new look. From its fundamentals and sentiment to what the price chart is telling us to expect over the next 12 months:

Evaluating CREE Stock

Summary:

- When Cree started out, it was known as just a lighting company.

- The company has transformed over the last 10 to 15 years and now looks to become a leader in the semiconductor industry.

- Take a look at the fundamentals, sentiment, and technicals to find out if you should “Bank” or “Tank”

Cree Inc. (CREE) is a company that goes way back for me, because it’s one of the first companies that I ever did a full, in-depth research report on.

Back in college, we created valuation models, did the pro formas, and looked at everything. We got to sit down with the company’s management in Raleigh, near my hometown in North Carolina.

And this company has really transformed over the last 10 to 15 years from what was just a lighting company, looking to benefit basically from the shift to LEDs being mandatory in all households and become an industry leader.

The company still is, in a sense, but it’s made a complete turnaround and has sold half of its lighting business and is now a semiconductor company.

So, I’m excited to dive into Cree today as our “Bank It or Tank It” stock and figure out if it’s a stock that we want to bank on going higher or a stock that’s going to tank and head lower.

We’re going to start with Cree’s fundamentals to take a look at how this transition from lighting products (mainly LEDs) over to the explosive industry in semiconductors has been an extreme benefit to a smaller cap like CREE.

CREE: The Fundamentals

Let’s first take a look at the revenues and net income to see how that’s shaping up…

Source: S&P Capital IQ

At first glance, it looks like they’re trying to make a W bottom here, with net income, two dips in 2019 and September 2020. The line graph on the chart is net income; the bars are the total revenues.

You can see that, in 2017, Cree was up near breakeven on net income. Since then, revenue climbed for three straight years, while net income continued to fall lower.

Cree isn’t expected to get back to profitability until 2023. That’s when its revenues are expected to bounce back strongly, as well.

Who knows what will happen 2023? With the declining trends in revenue and consistent losses in net income, the company is going to have to do a lot to turn this around.

Part of this has to do with that shift that I was talking about, where it sold off a large part of its lighting business in the last couple of years.

For net income, it will start to see more profitability. Cree’s getting into semiconductors and selling its chips to these other smart-technology products, like electric vehicles or smart homes. It’s still trying to find its footprint in these companies.

When we take a look at the quick comparables, you’ll see that Cree’s not like Advanced Micro Devices (AMD) or Micron (MU). This is a small-cap company that can really benefit tremendously just from getting a few contracts.

But when we look at the net income and revenue, from what we see over the last couple of years and for expectations, it’s not pretty.

I like to see the stocks that are consistently growing revenues and net income. And this stock has a lot of volatility to it.

Cree is a very volatile stock. It’s seeing some pretty massive drops, 50% to 60%, while the rest of the market is smooth sailing.

Let’s take a look at some of its competitors…

Source: S&P Capital IQ

I added on Micron and Advanced Micro Devices that weren’t originally part of what the S&P Capital IQ platform had selected as a key competitor with CREE. Probably because it’s such a small-cap stock.

If you look at Cree’s market cap, it’s a $12.5 billion company, whereas Advanced Micro Devices is $114 billion, and Micron is $87 billion. The largest ones on the list before adding AMD and MU were Maxim Integrated Products (MXIM) $25 billion and Skyworks (SWKS) at $27 billion — less than half of Micron.

The semiconductor industry is very high tech, with explosive growth, and these are the chip stocks that are going to provide everything that’s going to help make 5G technology impactful in our daily lives. These are the companies that are providing those chips to make that happen.

They’re going to make sure that these devices coming online have the speeds and are capable of adapting to this market, and investors know it. That’s why everybody loves semiconductor stocks. It’s one of the hottest industries in the market right now.

Take a look at the total revenues, net income growth and the compound average annual growth rate (CAGR) over the last three years.

CREE only has the number for revenues, -15.6% — not very good. It’s well below the mean of 4.3%. And you can see some of these other companies, like Micron, Skyworks, Semtech (SMTC), Maxim, and Cirrus Logic (CRUS) all had negative revenue growth over the last three years, even though this is an industry growing enormously fast. So, we’re just seeing this trend lower over the last three years for these stocks.

Source: S&P Capital IQ

Now, you can see that the sector achieves a very high price-to-earnings multiple, considering the average for the S&P 500, is usually around 20. Once it creeps up to 25, that’s considered extremely high.

For this industry, the whole semiconductor out of the quick comps is 58.2 times earnings — a hefty price tag that you get on these stocks because of the tech industry they’re in and the growth they come with.

The short interest is a red flag. Short interest gives us an idea of how many people are willing to bet on the stock to go lower. For CREE, it’s way above the mean for all the other companies. It’s at 12.2%. The average overall, is just 4.1%.

We’re seeing an extremely high, short interest for CREE because it’s transitioning. Semiconductors weren’t Cree’s focus over the years. Remember, back when I was looking at the stock 10 to 15 years ago, nothing came up about semiconductors. When we talked to management, that was not in its plans at the time.

It was a lighting products company being first to market, having the best LED products and having patents on the technology it was moving forward with. Just over the last few years Cree transitioned into being more of a semiconductor stock. And because of that, there’s volatility. That’s why we’re seeing investors still a little wary of what to do with CREE, betting on it to go lower.

Investor Sentiment

I always like to look at the analyst ratings for the company, because it just gives us an idea of the sentiment that’s around the industry for the stock.

Source: S&P Capital IQ

When we look at CREE, out of 13 analysts, according to S&P Capital IQ, that covered the company, they have it listed as a Hold.

They’re not really bullish or bearish.

Maybe that has to do with the big rally that we’ve seen. But once we take a look at the next price chart, we’ll have a better idea of what’s going on with CREE and why a lot of these analysts listed it as a Hold … and … whether or not we want to bank or tank CREE today.

Now, I have a few things I wanted to point out…

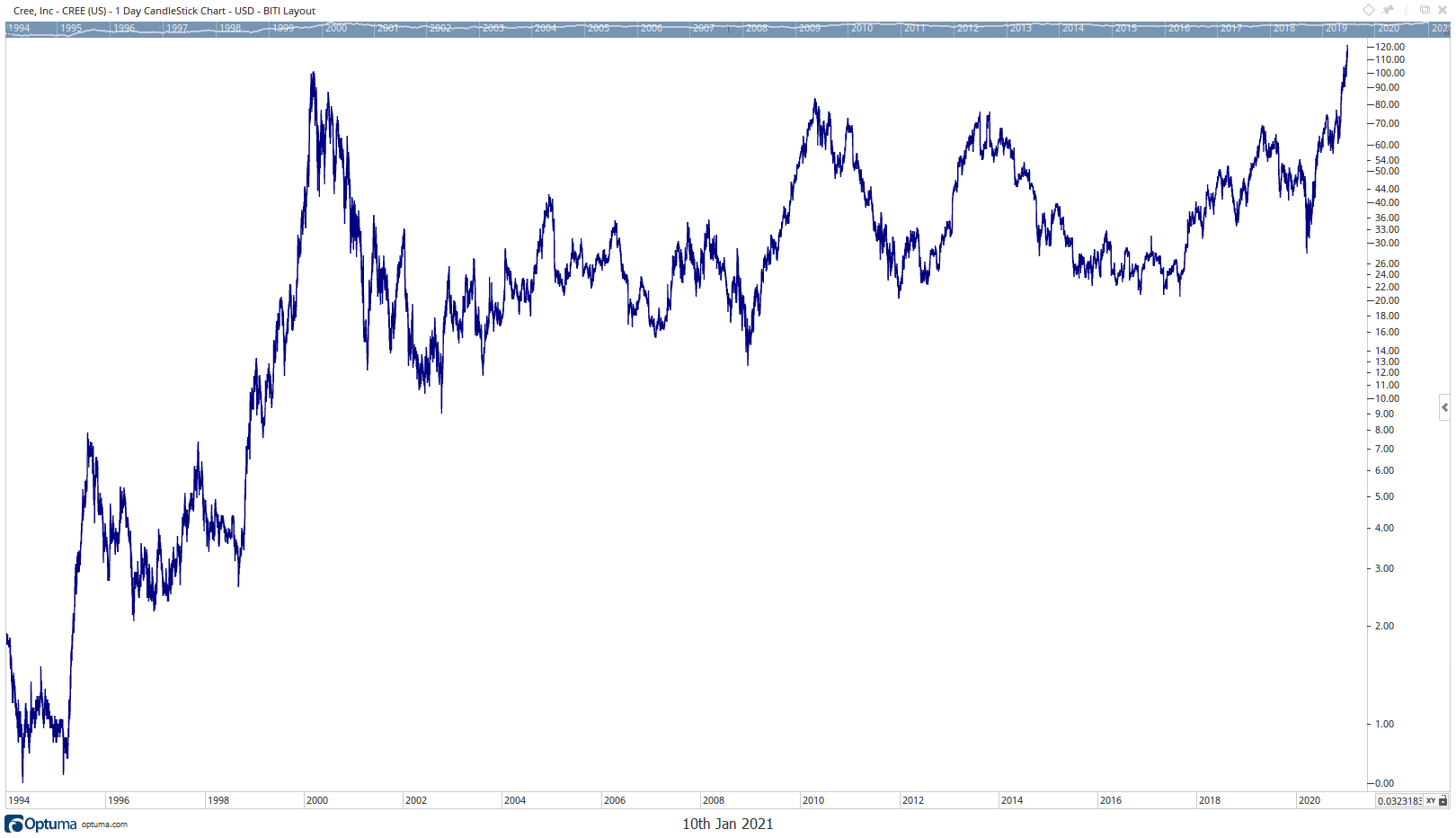

Source: Optuma.com

We’re looking at the stock all the way back to its roots, back in 1993, when this company became public, all the way up until today.

It’s shown in logarithmic scale to keep everything in perspective, where the price moves are based on percentages, so that a doubling of price from $1 to $2 takes up the same space as $50 to $100. This gives you a perspective of the rollercoaster ride this stock has been on. You can see the dotcom bubble back in the 2000s. Then it flatlined for about a decade.

What’s interesting to note is that the pop you see was after the financial crisis. When I was studying the stock and taking a look at the valuations, everything checked out.

This was a company that really had a great position in the LED market. Cree was financially sound and it was rated as a buy.

The point that I wanted to show you is, it was on a rollercoaster over the last decade and from 2010 to 2011, it crashed 70%. That’s a massive drop with nothing broad in the market going on.

This is just an extremely volatile company. These are insane rallies and insane crashes that you’re seeing in the stock and what really makes out to just be pretty short-term swings for CREE.

Source: Optuma.com

Recently, the stock has gone through another sharp rally. Since the lows in March, the stock is up an incredible 323%.

It broke right through the red resistance line back in November as JPMorgan acknowledged the direction Cree seems to be heading in and said that the semiconductor business offers “growing momentum.”

The stock hasn’t looked back since.

After the massive rally, shares are due for a pause. It can’t shoot higher throughout 2021, but it’s a stock I still believe will finish the year with a higher share price.

So, for this stock, the fundamentals were all over the place and a little too risky for what I would like to see, to give me a check mark for the fundamentals.

But after the sentiment shift for the stock and growth it has seen, the company is going to be added to my Bank It list.

CREE won’t be able to achieve the same growth it has in recent months, but a double-digit gain is still in the cards for this year as it continues to build on its semiconductor segment.

Today, We Expect the Unexpected

Back in college, when we put our report together on Cree, it was just before the 2008 financial crisis.

We turned over every rock in the company’s financials, had multiple calls with management, looked at competitors, created a pro forma financial analysis spreadsheet and more.

You name it … we did it to determine the valuation of this company.

When all was said and done, we unanimously rated the stock a “buy.”

Based on our analysis, it was an undervalued stock that was for sure heading higher.

But it didn’t.

Instead, 2008 hit and shares plummeted 60% right around the time they should have been trading at our one-year price target.

I remember thinking we must have missed something.

Turns out I was right.

The major financial crisis wasn’t something we could see from looking at the balance sheet of Cree. All the data, the financials, the pro forma valuation, valuation metrics — it was all backwards looking.

This information covered what had already happened. We are taking old information and projecting it forward, expecting the same type of environment to continue.

It helped shift my whole mindset on trading, and now I focus on proven strategies that deliver consistent gains regardless of the stock market environment.

Whether we are in a multi-year bull market or experiencing another global catastrophe, we now know how to find profitable trades.

And we do it with options.

This has been a pivotal tool to timing the swings in the market over weeks and months, not years. Now I’m helping everyone learn how to master options with my new weekly letter, Weekly Options Corner.

It’s completely free, but only available to those looking to master options. If you want to learn how to trade options from the ground up, you can click here to join.

I’ll highlight everything you need to know about options, plus the details of the moneymaking strategies that I have implemented over the years.

Regards,

Chad Shoop, CMT

Editor, Quick Hit Profits