Friday Four Play: The “Bad Company” Edition

Economy … always on the run. Wall Street is the rising sun.

We were born, portfolios in our hands. With great research, we’ll make our final stand.

That’s why they call me … Great Stuff, and I can’t deny.

I’m here to make sure you don’t invest in bad, bad companies … till the day I die.

Yes, dear reader, we’re rebel souls. On days like today, when we discuss detractors to this overhyped bull market rally, deserters we are called.

But to ensure our investing future, we chose truth and threw away the sword … so to speak.

First up, we have U.S. July retail sales. Last month, retail sales rose just 1.2% compared to expectations for a 2.3% gain. Overall, sales actually came in above average. Excluding autos, sales rose 1.9%, ahead of expectations.

The caveat here is that sales began to cool toward the end of the month as the pandemic worsened. With the Centers for Disease Control and Prevention warning that this fall will be the worst ever for American health, I can’t see how retail sales will maintain this rebound, especially without government assistance.

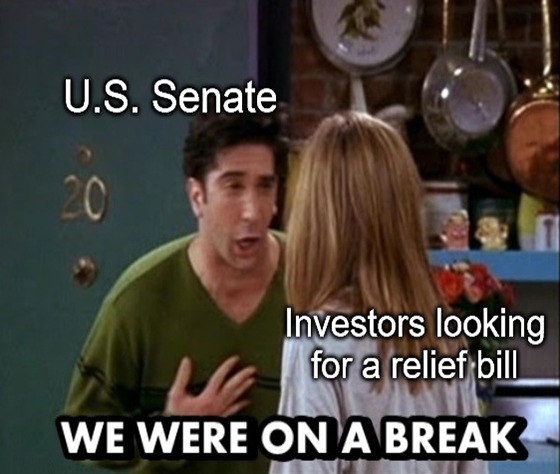

Second, speaking of government assistance…

The U.S. Senate just went on break for a month without reaching a COVID-19 relief deal. That leaves millions of Americans and small businesses without aid or eviction protections for at least another month.

To quote Mel Brooks: “It’s good to be the king.”

It’s clear the pillars of the pandemic economic recovery are crumbling. However, the strongest support still remains: the Federal Reserve’s unlimited stimulus. As this epic tug of war between the real economy and Wall Street’s vision rages on, it can only mean one thing for you, dear reader — more volatility.

We’ve been on an upward trend for a while, inspired by green shoots of economic recovery. Those shoots are starting to wither just as the Dow, the S&P 500 and the Nasdaq all trade near all-time highs. Remember, volatility swings both ways — it’s about to get ugly.

So, stick with Great Stuff. You all know our name. Guiding you through this market is our claim to fame.

Editor’s Note: This new video ad shows how you could use research to beat the market as much as 3-to-1. It costs just $4 a month. Yes, just $4! Click here for details.

And now for something completely different … it’s time for your Friday Four Play.

No. 1: Bye-Bye, Apple Pie

A long, long time ago, I can still remember how Microsoft Corp.’s (Nasdaq: MSFT) antitrust loss used to make me smile. And I knew then I had my chance to do the internet browser dance, and maybe I’d be happy for a while.

But Apple Inc.’s (Nasdaq: AAPL) App Store made me shiver, with every 30% “tax” developers delivered. Alphabet Inc.’s (Nasdaq: GOOG) Google Play store joined them on the doorstep, app makers couldn’t take one more step.

I can’t remember if I cried when I read about how Fortnite died. But Epic’s lawsuit touched me deep inside. This might be the day the App Store dies.

OK, “dies” is an exaggeration, but Apple (and Google) might say bye-bye to a rather large cut of their American app store pies.

Here’s the deal: Video game maker Epic launched its extremely popular game Fortnite on both the Apple and Google app stores.

The company complained about excessive rules and having to exclusively use both parties’ app payment systems, which guaranteed Google and Apple large cuts of Epic’s profits on the stores.

Epic then launched a way to buy Fortnite’s in-game currency outside of the App and Play stores, prompting both Google and Apple to ban Fortnite for violating their app store rules. Immediately after the ban, Epic filed an antitrust lawsuit.

Epic was ready to go, complete with emails from Apple CEO Tim Cook, a very well-worded legal filing, documents from the recent Big Tech shakedown on Capitol Hill and even an in-game video parodying Apple’s famous 1984 advertisement.

“Rather than tolerate this healthy competition and compete on the merits of its offering, Apple responded by removing Fortnite from sale on the App Store…” Epic said in its legal filing.

This fight is just beginning. Apple and Google have deep pockets filled with cash, pocket lint and probably a few senators. Epic has quite a valid legal argument and is no slouch in the cash department either.

If Epic wins, the next time Apple drives its Chevy to the App Store levee, that levee just might be dry.

No. 2: Applied Great Stuff Picks

Great news, Great Stuff Picks investors! We’re finally making some real progress on our Applied Materials Inc. (Nasdaq: AMAT) semiconductor pick.

AMAT shares rallied roughly 5% today after the company beat Wall Street’s fiscal third-quarter earnings and revenue expectations:

- Earnings: $1.06 per share. Expected: $0.74 per share.

- Revenue: $4.4 billion. Expected: $4.19 billion.

Applied even issued fourth-quarter guidance above expectations. We call that a beat-and-raise in the industry, because … well … the company beat and raised. It can’t all be weird Illuminati-level secret phrasing.

What does that mean for Great Stuff Picks readers?

It means we sit on a gain of about 12% since December 31. I know, I know. It’s not the biggest gain in the world, but it’s ours. And, considering we recommended AMAT before the pandemic, I think we’re doing well, all things considered.

I mean, the S&P 500 is up only 4.3% during the same period. I’d call that a win.

Our reasoning for getting into AMAT remains: The company is still a crucial supplier of semiconductor manufacturing equipment. There is pent-up demand for semis … well, AMD semis anyway … and Applied Materials will continue to grow from here.

The takeaway: Hold AMAT.

No. 3: Blink 128%

Quick: What’s the electric vehicle (EV) sector’s biggest-gaining breakout stock this year? It’s not Tesla Inc. (Nasdaq: TSLA), though we’ll get to it in a minute.

Blink Charging Co. (Nasdaq: BLNK) is one EV stock that, if you had bought in at the March low, would’ve handed you an 860% gain trough to peak.

Of course, that’s the rub with getting into penny stock territory — you would’ve had to first sit through a 58% decline from February until that March low.

Anyway, the past is the past and Blink’s earnings last night ensured that its track to the future is underway.

Miami-based Blink runs a charging station network to help flesh out the country’s EV infrastructure. Shout-out to Tommy D.’s curiosity on BLNK earlier this week; I appreciate your email! (Have you written in to us yet? Tell us what stocks you’re curious about at GreatStuffToday@banyanhill.com.)

Last quarter, Blink’s loss of $0.11 per share missed Wall Street’s estimate by a penny, like two electric ships in the night. But the real highlight is Blink’s revenue growth, rising more than 128% year over year.

For a tiny-but-growing startup, it hardly gets better than this. The penny-pinching earnings loss is minor by comparison, with Blink still spending cash to build out and market its network and services.

OK, you know the drill by now with these high-fliers: Blink has long-term potential, shown by its impressive revenue growth in a booming industry, yada yada. Concerns over its albeit justified spending will mix with profit-taking, so there will more steam to lose to further today’s slight pullback.

We may keep an eye on BLNK. You know, because … Blink and you’ll miss it.

Everyone’s jumping and jiving in the energy market, but no one’s rocking down electric avenue without charging stations and a heavy helping of battery power. Here’s more…

There’s an energy market gearing up for a 20,300% surge, and one tiny American company holds all 100 patents on this technology. Go ahead and check out what may be the most lucrative story of 2020!

No. 4: Electric Land Is in My Eyes

Stop me if you’ve heard this one before: Tesla got back-to-back upgrades, and the stock rallied (just a tad) in short order. Bears capitulated, but everyone still gasped: “OMG, who’s still buying TSLA for that much?”

Then the buying starts again.

We’re back in another Groundhog Day loop spurred by, well, all of the above.

Tesla did, in fact see two upgrades from sell to hold — which is as much of the story as you really need to know. Longtime bears from Morgan Stanley and Bank of America saw the light of Prophet Elon, raising their price targets on the electric wizard to $1,360 and $1,750 respectively.

Now, neither analyst stuck their neck out too much here: TSLA is up over 280% so far this year as we speak, and both price targets still imply a slight pullback from current levels. Though, the real message here is two egg-faced bears afraid to be on the wrong side of a rally.

One interesting note from Barron’s, just for the heck of it: “Valuation has been the biggest point of contention. Tesla is worth $800,000 per car delivered, more than 100 times the valuation of Ford and General Motors.”

I get it. You get it. But for legions of post-stock-split TSLA schmucks, valuation concerns for Tesla is like risk tolerance for Steve-O: not even a point of consideration.

Great Stuff: I Love to See the Crowd

The best part about this rock-and-roll fantasy we call Great Stuff?

Hearing from you! Do your part to destroy our inbox: GreatStuffToday@banyanhill.com. Set us ablaze with your fiery rants and diatribes, market related or otherwise. We’d love to feature you in our weekly Reader Feedback sections!

In the meantime, you can check us out on Facebook, Instagram and Twitter.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff