Bitcoin Barons Or Electric Sheep?

Great Ones, there’s something happening here. What it is ain’t exactly clear. There’s a man with Bitcoin (BTC) over there, telling me I’ve got to beware.

I think it’s time we stop — Hey! What’s that sound? — and take a look at what just went down. Because this conversation is going to continue to come up for years to come.

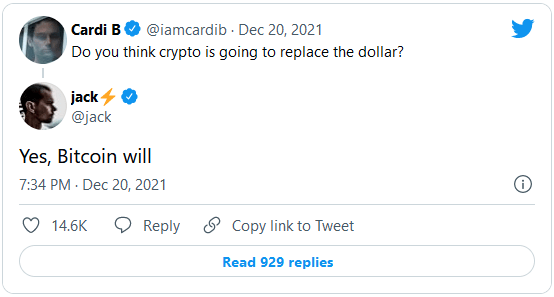

Last night, rapper Cardi B tweeted out: “Do you think crypto is going to replace the dollar?”

Now, I know what you’re thinking: “Cardi B? What’s a Cardi B?” Or: “Cardi B? In what world would I care what she has to say about crypto?”

And you’re right. Nobody cares about what Cardi B thinks about crypto or the U.S. dollar. Well, nobody except for maybe Jack Dorsey, Block (NYSE: SQ) CEO and former CEO of Twitter (NYSE: TWTR).

Good ol’ Jack replied to Cardi B’s tweet with three words: “Yes, Bitcoin will.”

As you can see, the brief chat quickly prompted nearly 1,000 replies and more than 14,000 likes. As of this morning, there were thousands of replies and nearly 50,000 likes.

The Cardi B/Jack D exchange also prompted a slew of mainstream financial headlines, from the straightforward to the extremely wordy:

- Bitcoin Will Replace the Dollar: Jack Dorsey — CoinDesk.

- Bitcoin will replace the dollar, Jack Dorsey tells Cardi B in response to the rapper’s crypto question — Business Insider.

At this point, y’all are probably questioning my sanity. Let me put that to rest.

No, I don’t care what Cardi B thinks about the U.S. dollar or bitcoin or cryptocurrencies. But I do tend to take note when Jack Dorsey weighs in on the topic.

Back in June, Jack said that he would leave both Twitter and the-company-formerly-known-as-Square (now Block) to work on bitcoin if he had to:

It’s no coincidence that, right after leaving Twitter to focus on Square, Jack changed Square’s name to Block … a direct reference to the blockchain that cryptocurrencies are built upon.

Block has its fingers in multiple cryptocurrency projects, including a $220 million bitcoin investment, money-transfer service Cash App, music-streaming service TIDAL and cryptocurrency businesses Spiral and TBD54566975 — all of which support bitcoin.

And no, TBD54566975 is not a typo. That’s Jack’s newest dive into the bitcoin universe. TBD, for short, is a bitcoin financial services business that wants to make bitcoin more mainstream, calling the crypto the “native currency of the internet.”

Alright, I get it Mr. Great Stuff. A couple of celebrities talked about bitcoin and the U.S. dollar. So what? What’s the takeaway here?

Well, for one thing, the exchange helped fuel a 5% bitcoin rally today. For another, this type of celebrity focus will continue to drive mainstream bitcoin acceptance.

Despite the fact that Wall Street insiders, the mainstream financial media and everyone in the know … including Great Stuff … talks about cryptocurrency and bitcoin on the daily, most people still don’t know what bitcoin or crypto are, nor do they want anything to do with it.

Anecdotal case in point: When I ran this story idea past visiting family members this morning, they were decidedly against bitcoin replacing the U.S. dollar. And, I’m sorry to say, Jack, but you’re going to have a hard time convincing some people to use digital bitcoins over digital U.S. dollars.

But, as my sister just told me: “Ultimately, us plebeians aren’t going to have a choice in the matter. We’ll just suck it up and deal like we always do.”

I feel that more than I should, I think. Do you? Let me know what you think about bitcoin replacing the U.S. dollar in the inbox.

But you don’t have to just “suck it up,” Great Ones. As I’ve said for a long time now, you need to get in on cryptocurrencies and blockchain … now!

And what better way to do that than with your friendly neighborhood crypto king?

In his exciting new Banyan Hill presentation, Crypto’s Third Wave, cryptocurrency expert Ian King will be revealing, for the first time anywhere, the specific steps to take now to potentially make 12 times your money over the next 12 months.

Go here now to check out this special cryptocurrency presentation.

Don’t You Know That You’re Toxic?

You know what isn’t cool, Walmart (NYSE: WMT)?

Illegally dumping more than 1 million batteries, electronics, cleaning supplies, latex paint cans and other hazardous waste into California’s landfills … and hoping nobody notices.

I guess that didn’t work out too well, considering 58 California state inspections between 2015 and 2021 found Wally World trash compactors coated in hazardous waste materials that were supposed to be properly disposed of.

Naturally, Walmart disagrees with the state’s findings. “Our compactors are far cleaner than the state average,” said Walmart spokesman Randy Hargrove. Right. And I’m the Queen of Sheba.

If Walmart’s toxic history has anything to show for it — this isn’t the first time Walmart’s been in trouble over hazardous waste — WMT investors can expect lawsuits and legal fines to follow. Not that they care too much, with WMT shares down a mere 0.4% on today’s trashy news…

Said no Rite Aid (NYSE: RAD) investor ever. Destined to always be the “other other pharmacy stock,” Rite Aid just reported earnings that left Wall Street running for the Pepto.

Revenue missed expectations, while Rite Aid’s earnings loss somehow came in above analysts’ even-more-pessimistic expectations.

On the plus side, Rite Aid boosted guidance, as the pharmacy has a brilliant moneymaking plan up its sleeve: Simply … closing up shop. The chain plans to shutter 63 stores, which would net it $25 million in EBITDA benefit.

Apparently, that was enough to soothe investors’ stomachs and send the stock soaring 17% today. I imagine this is how RAD investors felt reading the report:

RAD shareholders, this business is falling apart.

Oh noooo!

But we can sell our stores to stay afloat!

Oh yaaay!

Talk about chopping off your nose to spite your Rite Aid.

Nike (NYSE: NKE) nailed its latest earnings report, with revenue rising to $11.36 billion from $11.24 billion a year ago and earnings coming in a full $0.20 per share higher than analysts expected.

Much of this demand came from Nike’s online merchandise, with digital sales growing 11% in the latest quarter and now accounting for more than 25% of Nike’s global revenue. Of course, this is still just a small taste of what’s to come now that Nike’s getting in on the NFT game and bringing its digital digs to the metaverse.

How Nike and its metaverse mate RTFKT plan to keep other people from copying their designs remains to be seen. (NFT? Meet “save as” and “screenshot.”) But for now, Nike’s shareholders consider the company’s forward focus a slam dunk and sent NKE shares 6% higher on today’s upbeat earnings announcement.

Is that … late-stage Bon Jovi? Seriously? I’m disgusted.

I know, it’s almost as unexpected as positive news in the chip sector. But leave it to memory-maker Micron (Nasdaq: MU) to say the magic words literally every investor wanted to hear:

Supply chain shortages? Easing up?! That’s all you needed to say, Micron! But it didn’t stop there…

Micron beat analysts’ expectations for earnings and revenue, expecting memory demand to continue long into the next decade (much foresight, wow).

And what’s this? Data center sales soared over 70% year over year?! Holy cats, MU investors have nary seen such an impressive report since said supply chain shortages started. Wall Street reacted in kind, sending MU shares up as much as 10% on the news.

“Don’t hertz me, no more!” — Electric vehicle (EV) company Nikola (Nasdaq: NKLA) to the SEC, probably.

That’s right, Great Ones. Nikola’s bill has finally come due … to the tune of $125 million. But considering the EV maker is being charged with defrauding investors ahead of its SPAC merger to drum up financial support, Nikola should be thankful it’s just driving away with a fine.

Not that Nikola or its founders have admitted to any wrongdoing, mind you. The company refuses to either confirm or deny the SEC’s claims and only released this brief statement regarding the ruling: “We are pleased to bring this chapter to a close as the company has now resolved all government investigations.”

I’m sure you are, Nikola. I’m sure you are. Now, if only NKLA investors could put these allegations in the rear-view window, maybe the stock could finally regain full power. Yeah … as if.

And that wraps us up for today, Great Ones! You may notice a slightly slimmer Great Stuff this week — well, before the cookie binge begins — while the team and I run for the hills amid the holiday festivities.

Specifically, you’ll hear from us briefly on Christmas Eve … and then not again until Tuesday, December 28. So, don’t worry. You haven’t been hit by the Gmail spam Grinch.

We’re just taking a long break this weekend to celebrate all that’s worth celebrating, and I encourage y’all to do the same!

Let me know what greatness you’re getting up to this week at GreatStuffToday@BanyanHill.com. We’d love to hear from you! In the meantime, here’s where else you can find us:

- Get Stuff: Subscribe to Great Stuff right here!

- Our Socials: Facebook, Twitter and Instagram.

- Where We Live: GreatStuffToday.com.

- Our Inbox: GreatStuffToday@BanyanHill.com.

Until next time, stay Great!

Regards,

Joseph Hargett

Editor, Great Stuff