Right now, solar and wind generate about 12% of the world’s power.

But that number will climb a lot over the coming decades.

In fact, solar and wind should supply half of all global power by 2050.

And that creates a massive investment opportunity.

In today’s video, Steve Fernandez and I discuss why solar stocks will soar in the years ahead.

(If you’d prefer to read a transcript instead, click here.)

Ian King: Hey everyone. Ian King here with your Winning Investor Daily weekly update. Joining me this week is my colleague Steve Fernandez.

Steve, what’s happening out there? What’s going on for Thanksgiving this week?

Steve Fernandez: I’m going to visit some family.

Ian: Oh, yeah. So, any hot topics of conversation? Are you going to tell them to buy some Ethereum this year?

Steve: Yeah, we’ve talked about Ethereum in the past. They did buy Ethereum in the past. They just got a new house, so we’ll talk about that, probably.

Ian: Oh, great. Congratulations!

So, Steve, I know we’re going to talk about solar this week. Is your family’s new house — are they considering putting some solar panels on the house, or do they have them already?

Steve: I know that they’ve considered it. I know that a lot of the new homeowners around here are considering it, for sure.

The Current Renewable Energy Trend — Solar

Ian: OK, so that brings us to what we’re going to discuss this week.

I know, Steve, you’ve got a chart that you want to share with our viewers on the percentage of global power generation.

Why don’t you put that chart up there and explain what this is all about and what’s happening. What is this big trend we’re seeing?

Steve: Sure. Right now, solar and wind in particular occupy somewhere around 10% to 12% of global power generation. That’s expected to climb a lot — probably closer toward 40%, 45%, maybe even 50% by 2050.

I know you and I are in the camp that solar will probably dominate that even though the chart doesn’t show that. We’ll talk about some of the reasons for that here in a bit.

Ian: Yeah, I know. I agree with you. I think solar is going to outpace wind, specifically for the idea that it’s very decentralized.

You can purchase solar panels on your house, and for the first time, you can combine them with a cheap battery. This is another part of this convergence of technology that’s leading to an explosion in the energy sector.

Let’s talk about lithium-ion batteries.

Everybody talks about batteries and how they’re driving electric vehicles. Every automaker is putting tens of billions of dollars into battery development — but this is actually going to be key for energy just as much as it is for mobility.

Talk about the prices of lithium-ion batteries over the last decade and what we could see going forward in the 2020s.

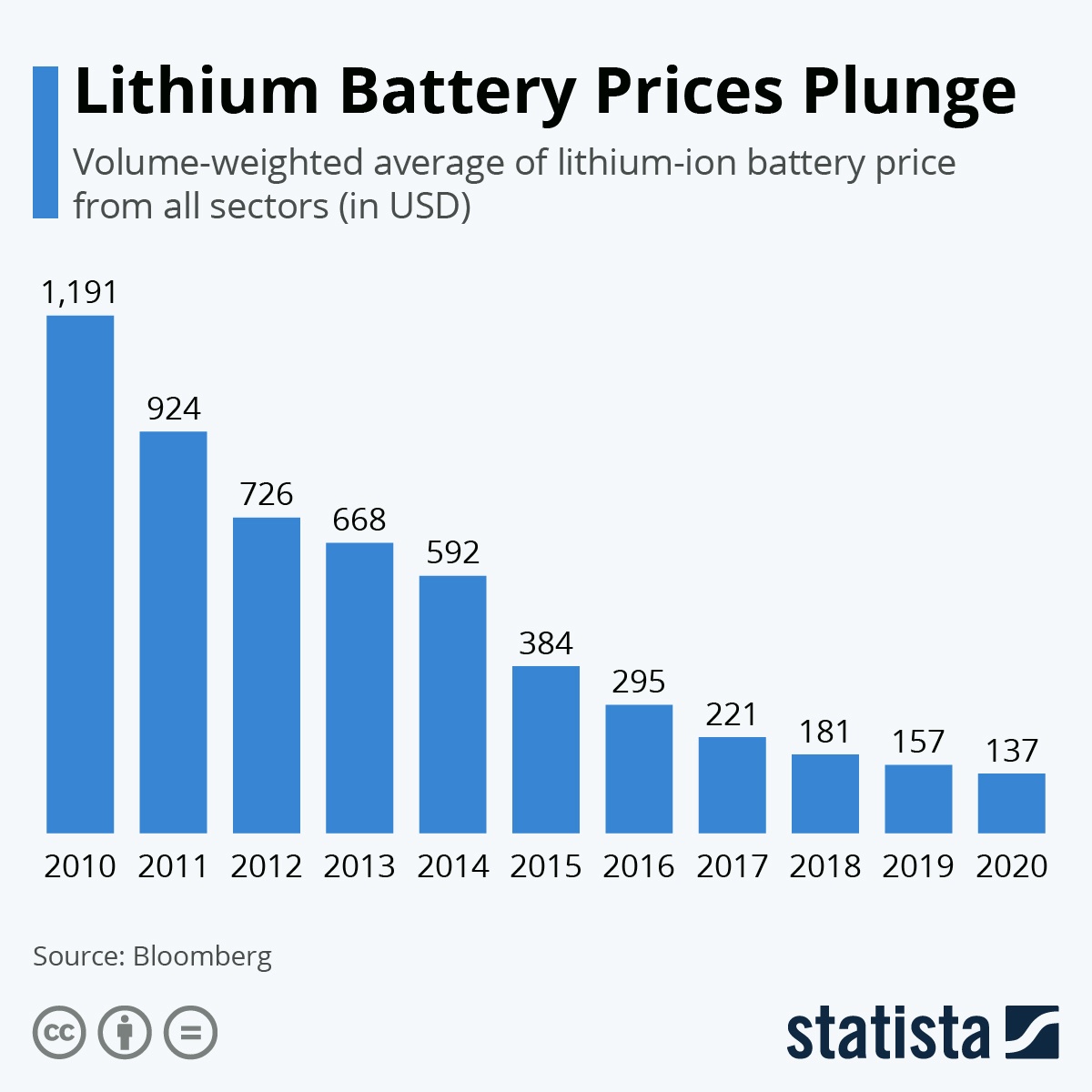

Steve: Sure. Lithium-ion batteries, as you can see in this chart, have declined dramatically — over 90%.

It’s hard to say in the near term where those prices will be because there have been lithium shortages, etc. But we’re looking at probably another 50% decline in the next decade or so.

That’s going to be, like you said, influential for renewable energy adoption, electric vehicle adoption.

And when you think about it, I think about 33%, one-third of an electric vehicle’s cost, is the battery. Think about that from a “power storage at your home” standpoint as well. It occupies a lot of the cost.

What’s Driving This Trend?

Ian: Yeah. I totally agree with you. So, we’ve got this technology that’s becoming cheaper. And at the same time, it’s just getting an infusion of capital from governments around the world.

I know that the European Union passed an $800 billion bill earlier this year, or maybe it was late last year, focused on clean and renewable energy.

And here in the United States, we just had the Build Back Better bill passed in the House, which is most likely going to get approved in the Senate.

We looked at this earlier. I just want to share with our viewers that there’s $550 billion in clean energy investments. And $300 billion of that is going to go to support clean energy investments in deployment, improving energy efficiency and encouraging vehicle electrification.

Now, there’s a significant number of investment tax credits in this bill geared toward what’s called “clean energy storage” or “standalone energy storage.”

I think this is so key for the solar markets because you’re now going to get a tax credit on the battery that you put in your garage, as well as the solar panels that you put on your roof. You pair those two together.

You know, you’re talking about the ability to actually live off the grid so you don’t ever have to worry about the power grid. And we talked about this as well: There are some states, like California, where they’ve had rolling brownouts, and some areas had blackouts because of the wildfires.

And in all areas of the country, whether it be floods or storms, the number of power outages has gone up significantly in the last couple of decades, just as a result of natural causes.

So, I think this is really going to facilitate and energize the solar sector even more, which will lead it to outpace investors’ expectations in the 2020s. What are your thoughts on that, Steve?

Steve: I agree. I think it’s attractive from a residential standpoint — especially if, like you described, the government is throwing money at you to go make that decision and switch over to solar energy, for example.

But let’s not forget about the utility side of things, where the real investment is coming in.

These are where the utility companies are really taking all of their operations right now, which might be natural gas, for example, and now that’s becoming solar. So, utility-scale battery storage will help power that trend.

And I know you talked about a little bit over $1 trillion between Europe and the U.S. in terms of renewable energy investment.

I was looking at some data from Bloomberg. It looks like we’re going to need about $1.7 trillion per year in today’s dollars to really accelerate that renewable energy adoption if we want to have completely renewable energy by 2050. So, I expect that to continue.

The easiest way to do that, like you said, is tax credits or some sort of incentive to cover that production or that investment. So, yeah, let’s see what happens, but I expect the same to occur.

The Future of Solar

Ian: It’s not just tax credits, though. I mean, you certainly see government mandates. In California, all new homes have to be built with a solar installation now. And I think other states are looking at that too.

But the driving catalyst for this as well is, you might not think that there’s global warming, you might not believe in it — but the millennials, Generation Y, this is the cause that they’re taking up.

Think about this from a demographic perspective: Millennials are the prime working age. I think the average age of millennials is 32, and that’s also the average age of first-time homebuyers.

The next couple of decades, the trends in investment are going to be shaped by their tastes and the things that they want. And one of those causes is global warming and how we’re going to fix that.

So, solar and renewables is an investment that I really believe has legs here and is just going to keep running over the next decade.

Steve: Yeah, I agree. We’re seeing that now. I mean, governments around the world are pressured, like you said, whether it be by millennials or just those groups of people that really want to drive cleaner energy sources.

For example, this month, the U.S. and 19 other countries had committed to stop financing fossil fuel projects altogether by the end of the year. So, basically, they’re saying: “If you want to put up a new plant, we’re not going to help you pay for it.” And that’s dramatic. That’s drastic. Instead of that, they’re just putting that toward renewable energy sources.

So, yeah, as the public, as our citizens get younger, they’re really shaping our country. There’s going to be pressure because these are the people who are voting these elected officials into office. They don’t really have a choice.

Ian: So, as a millennial, Steve, you’re going to tell your family at Thanksgiving dinner that it’s time to get solar on the house, huh?

Steve: I’ll have to. I mean, if they’re going to pay you for it, why not, right? If the government’s going to pay you? Great.

Ian: Awesome. Steve, thanks again for this week’s webinar. I want to thank everyone for tuning in. Also, let us know in the comments what you discussed on your Thanksgiving holiday with the family. We’d love to hear what those hot topics are.

I’m Ian King, he’s Steve Fernandez, and thanks again for tuning in. We’ll see you next week. Take care.

Regards,

Editor, Strategic Fortunes

Morning Movers

It’s Black Friday, so the stock market closed early today.

Enjoy your holiday shopping! We hope you find some great deals.