As the pandemic ravages the U.S. economy, many major companies have fallen victim — the latest is GNC.

Earlier this week, the nutrition chain filed for bankruptcy. It announced that it will close up to 1,200 of its 5,200 U.S. stores.

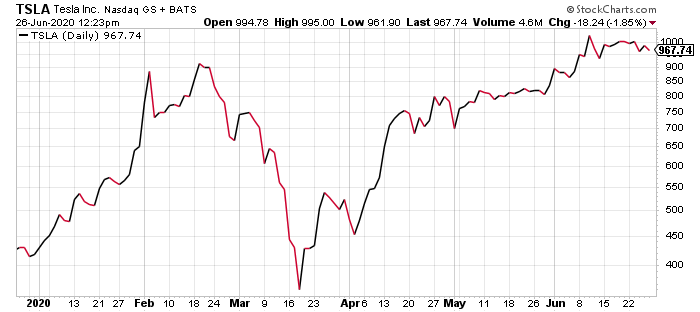

But the stock market has winners too … huge winners. Tesla Inc. (Nasdaq: TSLA) is one of them.

The automaker’s stock broke the $1,000 mark for the first time earlier this month. Shares are currently more than 5% above their February high:

With a market cap of $180.2 billion, Tesla is now the most valuable automaker in the world. It recently surpassed Japan’s Toyota ($176.7 billion) and Germany’s Volkswagen ($72 billion).

Tesla’s Road to $4,000 and Beyond

My colleague Ian King saw Tesla’s potential when he recommended it to readers of his Automatic Fortunes research service in August 2019.

Back then, TSLA was only worth $234 a share. Today, it’s worth $967 a share — a whopping 313% increase in less than a year.

And that’s with a global pandemic that shut down production and crippled the entire auto industry.

Once COVID-19 subsides, TSLA’s stock price will keep going up and make new all-time highs.

In fact, Ark Investment Research has a $4,000 price target for TSLA. And it believes shares have the potential to go even higher than that.

A New Era for American Companies

Tesla isn’t the only American company that’s thriving despite the pandemic — it is far from it.

In fact, the Nasdaq Composite Index, which includes U.S. tech stocks such as Apple, Facebook and Microsoft, soared to a new all-time high earlier this week.

There’s clearly a massive investment opportunity right now. Ian King is calling it “Rebound 2020.”

He believes more money will be made in the next six months than at any time in the last century.

And in his new video, Ian tells you exactly how it will be done.

Regards,

Assistant Managing Editor, Banyan Hill Publishing