Populism is sweeping the world. That’s a common theme in British voters opting out of the European Union, U.S. voters choosing an inexperienced politician and similar outcomes around the world.

Voters want change. They’re electing candidates with new ideas promising different results. Often, an election leads to gains in stocks.

Next up in this election pattern is Mexico. The chart below shows the market action points to a rally, and the catalyst could be the new president, Andrés Manuel López Obrador.

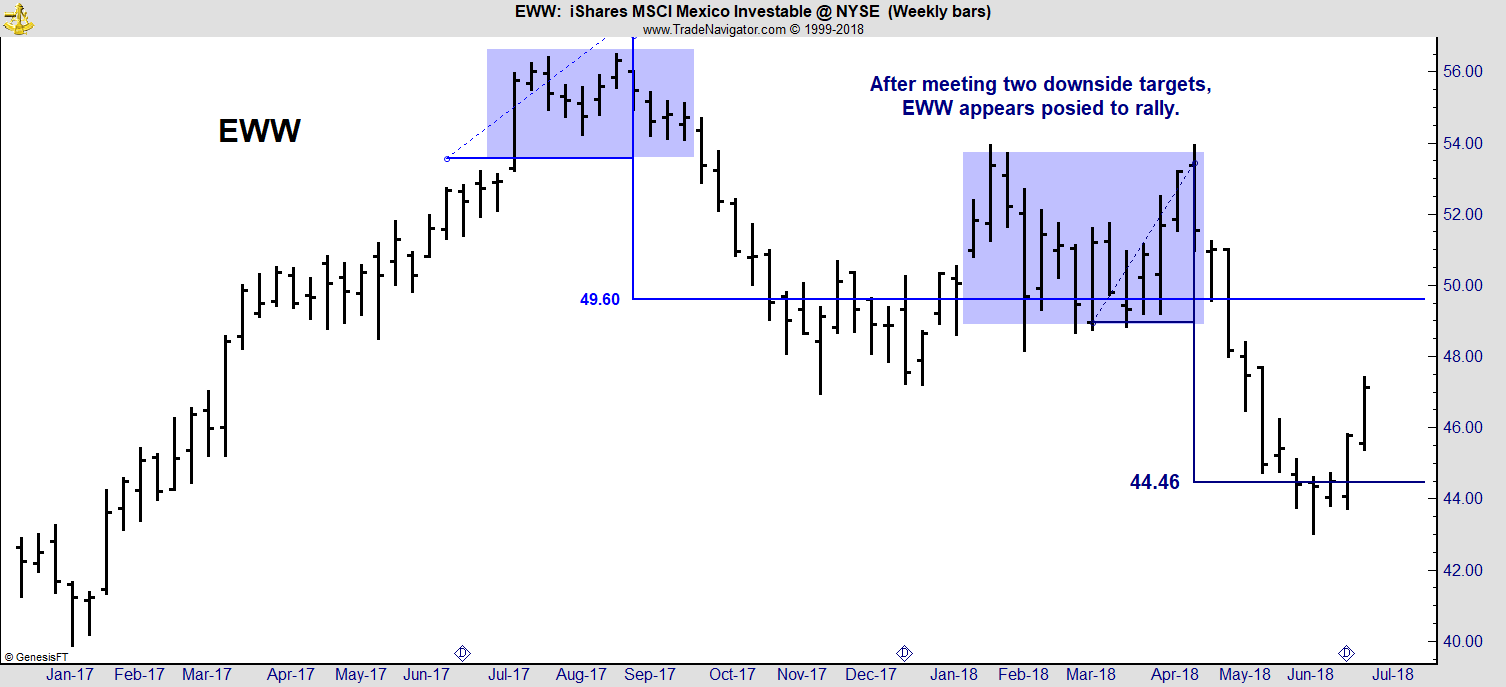

This is a chart of the iShares MSCI Mexico ETF (NYSE: EWW). That’s an exchange-traded fund (ETF) that tracks a diversified basket of Mexican stocks. It’s an excellent way to invest in a rally in that stock market.

The chart shows EWW sold off last year. The rectangle at the top of the chart shows a double-top pattern. Prices fell to the $49.60 target provided by that pattern.

After that, a brief rally leads to another double-top pattern. That pattern provided a price target of $44.46.

Prices reached that target in early June. These examples show pattern analysis works well for the market.

Now, the presidential election could push stocks higher.

Of course, actual policies don’t always exactly match campaign rhetoric. But the rhetoric in Mexico has been radical.

Obrador promises economic reforms to help poorer citizens. His promises include freezing the price of gasoline in Mexico for three years. He also favors increased spending on social programs funded by new debt.

These policies could boost the economy in the short run. They will increase consumer spending. But they could lead to problems in the long run.

EWW is already moving higher, and the chart above provides a complete trading strategy. The ETF is a buy right now. The initial target is about $54, a potential gain of more than 10%. A new 52-week low below $43.50 is a sell signal.

In the U.S., it took less than three months to gain more than 10% after the presidential election in 2016. History says now is an ideal time to buy EWW looking for a similar price move.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader