Recent plans to impose tariffs on steel and aluminum imports have economists worried. But this isn’t the first tariff announcement in recent months.

Lumber provides an example of how tariffs raise prices. Home prices are at record highs. In part, high prices reflect low supply. Another factor affecting prices is how expensive it is to build new homes.

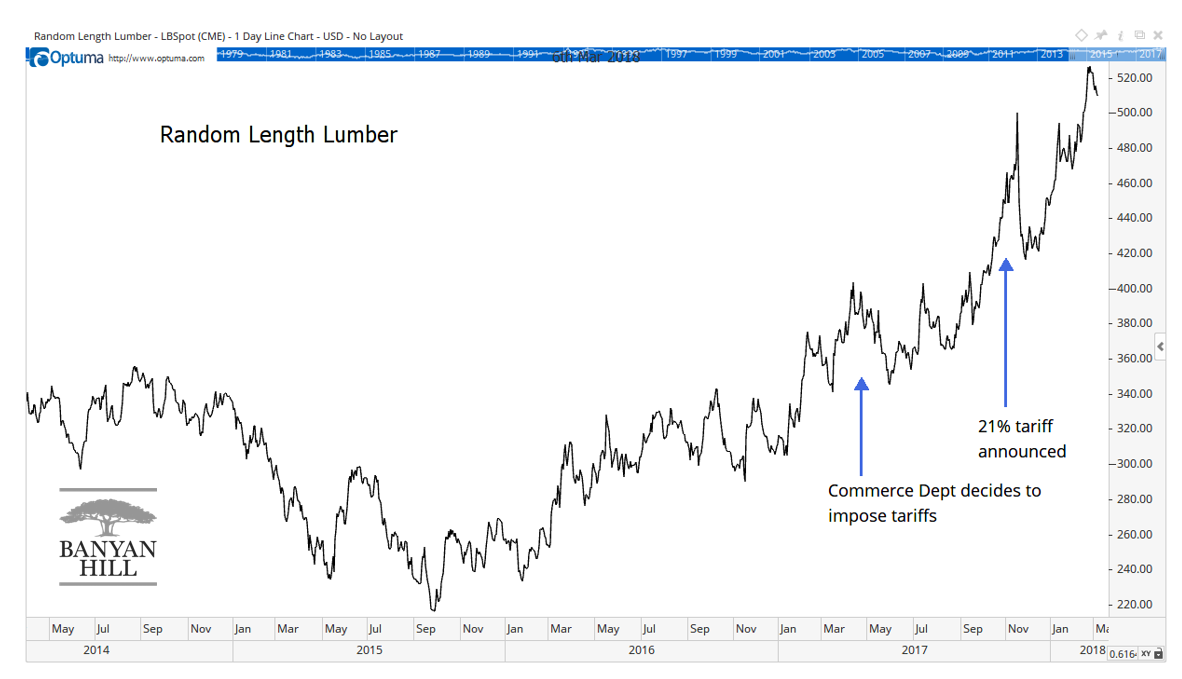

A home’s frame, the lumber studs builders nail walls and roofing to, accounts for about 18% of the value of a new home, according to the National Association of Home Builders. The price of these studs jumped after the Commerce Department imposed a 21% tariff on Canadian lumber in November.

The chart below shows lumber prices soared since November.

Prices didn’t move straight up. Yet the up moves were rapid.

There are also other factors driving prices up, including increased demand to rebuild homes damaged by hurricanes. But tariffs are raising prices and hurting consumers.

There is some good news. Homebuilders will search for alternative materials like steel and concrete if lumber prices continue to rise. High prices can boost innovation, even as they create hardship while consumers wait for those innovations to hit the market.

But lumber is a cautionary tale. Tariffs raise prices and will hurt more consumers than they help.

Tariffs also show that policy makers are out of touch and set to repeat mistakes like those seen in the 1930s. As I wrote in my Wednesday article for Winning Investor Daily:

Tariffs are back in the news. But policy makers seem unable to understand what that means to consumers. … Tariffs will hurt international trade, just like in the Great Depression. Stocks will fall, just like they did in the Great Depression. … It’s still possible to avoid a trade war. But if there is one, expect the consequences to be dire.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader