China is the “mouth of the world” when it comes to commodities and the data shows that China will have a significant, positive impact on mining investments during 2018.

Look at any list of the world’s largest commodity consumers, and China is at the top.

It consumes half the world’s thermal coal production (used for power generation). It uses nearly half of all the aluminum, nickel, zinc, copper, iron ore and lead production.

So, when demand from China goes up, it usually sends prices up too. That’s great news for copper.

According to Bloomberg, November’s copper imports hit a record. The data is still preliminary, but according to that data, natural gas, copper, coal, iron ore and soybean imports are all up.

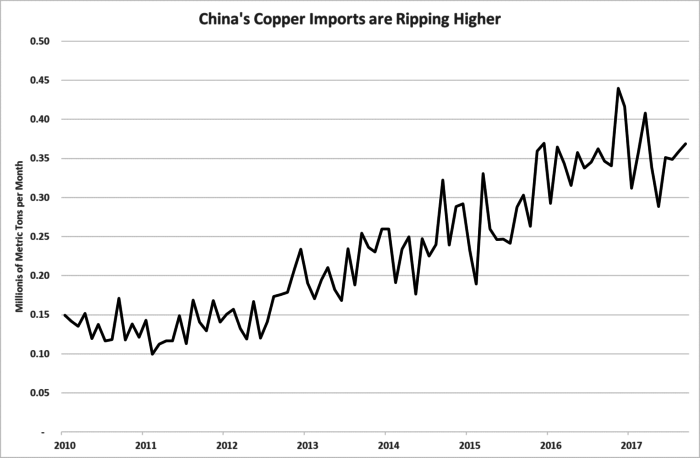

The chart below shows China’s copper imports through September 2017:

Remember, this chart doesn’t show October or November data … which should be a record high.

This is great news for the ongoing bull market in copper and base metals. The copper price is up 20% since it bottomed in 2016. However, it’s pulled back almost 10% from its October 2017 high. Copper stocks like Southern Copper Corp. (NYSE: SCCO) and Freeport-McMoRan Inc. (NYSE: FCX) are down 5% and 12%, respectively, from their recent highs.

We need to view those pullbacks as opportunities. The bull market in copper and other base metals reflect strong demand from China right now. Mining companies that produce copper and zinc are going to make much more money in 2018 than they did in the last few years.

This should be a fantastic year for mining investments.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist