Do you remember when “six to eight weeks delivery” was standard for mail orders?

It wasn’t even that long ago.

As someone who grew up in the ‘90s — back before e-commerce got big — I remember the frustration of waiting for a package to arrive.

One time I even waited months for an order of comic books. When I finally contacted the company, they admitted they forgot to ship it in the first place.

Today, lots of major retailers, including Amazon, Target and Best Buy, offer two-day shipping. And it’s virtually guaranteed that your order will make it to your home.

But as fast and convenient as two-day delivery is, it will soon be obsolete.

That’s because the world’s largest retailer aims to upgrade its deliveries in a high-tech way.

Unparalleled Speed and Ease

Last week, Walmart announced it’s teaming up with Ford and a startup called Argo AI to launch a delivery service operated by self-driving vehicles.

Ford will build specialized vehicles equipped with Argo’s state-of-the-art autonomous driving technology.

Walmart’s new service will launch in Miami, Austin and Washington, D.C., later this year.

With a fleet of autonomous vehicles, Walmart aims to deliver groceries and other items to customers “with unparalleled speed and ease.”

“Consumer expectations continue to shift to next-day or same-day delivery — especially in the urban core where there is a higher concentration of deliveries,” Ford said in a press release.

Walmart’s move makes sense from a business standpoint.

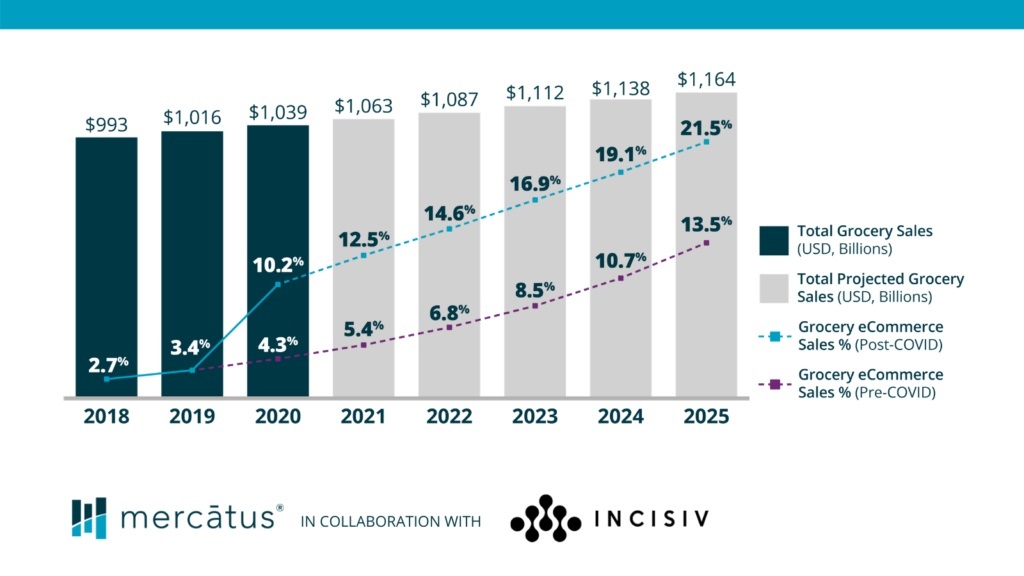

A report from grocery e-commerce firm Mercatus estimates that deliveries will account for 21.5% of U.S. grocery sales by 2025, up from 10.2% in 2020.

That would make the U.S. grocery delivery business a $250 billion market.

As e-commerce booms, customers are going to expect faster delivery times and lower costs.

Driverless vehicles are the answer to that.

E-Commerce and Our Digital Economy

Self-driving delivery vehicles are going to be everywhere in the future. It’s inevitable.

But e-commerce isn’t the only tech trend you need to pay attention to. That’s because every aspect of the U.S. economy is shifting toward digital experiences.

Between work-from-home software, fintech and even the metaverse, our lives are focused around convenient online solutions more than ever.

Ian King calls it the “New American Economy.” It’s a digital revolution transforming our country … and creating opportunities for huge stock market windfalls.

You can find out more by watching Ian’s special presentation.

Morning Movers

From open till noon Eastern time.

Cassava Sciences Inc. (Nasdaq: SAVA) is a clinical-stage biotechnology company that develops drugs for neurodegenerative diseases. The stock is up 14% today on positive results from a study of its leading Alzheimer’s drug, Simufilam.

Embraer SA (NYSE: ERJ), the Brazilian aerospace manufacturer, is up 12% this morning after Goldman Sachs upgraded its rating on the stock to a buy, saying that the company should benefit from the coming rise in demand for new aircrafts as COVID-era conditions for the aviation market start to fade.

QuantumScape Corp. (NYSE: QS), the solid-state lithium battery maker, is up 12% today continuing its upward trend that started a couple days ago on the news that it secured a deal with a top 10 automaker.

BlackBerry Ltd. (NYSE: BB), the cybersecurity company, is up 12% this morning after reporting earnings for Q2. The company beat quarterly revenue estimates and reported a lower-than-expected loss.

Traeger Inc. (NYSE: COOK), the grill maker, is up 12% today after investors saw a buying opportunity when the stock approached a 52-week low yesterday.

Enovix Corp. (Nasdaq: ENVX) designs and manufactures next-generation 3D silicon lithium-ion batteries. It is up 12% today on the announcement of a major milestone — it started manufacturing battery cells from its first automated factory in California.

Novavax Inc. (Nasdaq: NVAX), the vaccine maker, is up 11% this morning after announcing it has filed for World Health Organization emergency use listing of its COVID-19 vaccine. It is also being driven up by data from a late-stage clinical study showing the vaccine achieved an efficacy of 89.7%.

RBC Bearings Inc. (Nasdaq: ROLL) manufactures and markets engineered precision bearings and related components. It is up 11% today after announcing the pricing for common shares and convertible preferred shares that are part of a secondary offering.

Bombardier Inc. (OTC: BDRBF), the aircraft manufacturer, is up 10% this morning after introducing the Challenger 3500, a new sustainably designed midsize business jet.

Joby Aviation Inc. (NYSE: JOBY) is a developer of electric vertical take-off and landing aircraft. It is up 10% after Morgan Stanley initiated coverage on the stock with a strong buy rating and a price target of $16.