Periodically, subscribers to my Bauman Letter and Profit Switch services ask if I personally invest in the stocks I recommend.

The short answer is no.

Some investment newsletters allow their stock pickers to hold personal positions in their recommendations.

At Banyan Hill, however, we believe we have an obligation to make recommendations purely on their potential benefits for you, with no potential profit to us.

Nevertheless, there’s plenty I can tell you about my investing strategy … particularly in unsteady market conditions.

For a useful summary of those conditions, watch this Your Money Matters video.

While the short-term news has changed, the broader fundamentals I mention remain in place:

- Soaring index-level gains concealed increasing weakness in the market throughout 2021. As I expected, many investors faced a rude awakening in the first quarter of 2022.

- Once the “COVID earnings bump” faded, we saw companies give up the better part of their last year’s gains. Though they’re on the rebound, we can’t rely on those same companies to drive further market gains.

- With consumer sentiment sinking, the appetite for risk is in decline. The days of easy double- and triple-digit gains on new companies are over for now.

Like any active investor, I adjusted my approach based on the circumstances.

So today, I’m going to show you how I’m managing my personal portfolio … and where you can go to get the same great gains I’ve been enjoying over the last few years.

For a Solid House, Lay a Good Foundation

The first thing to know about me as an investor is that, like many of you, I’m playing catch-up.

I got a late start.

Most of my early career was in a nonprofit in South Africa. My colleagues and I understood we were deferring investment in ourselves in favor of investing in the world around us.

But I’m not a young man anymore. So, I have an incentive to make gains as quickly as I can.

When it comes to stocks, risk-adjusted return is crucial. Yet given my age, I can’t afford to take on as much risk as someone in their 30s or 40s.

So instead, I’ve spent the last decade accumulating shares in quality income-producing companies.

And I’m not talking about traditional stocks, either.

I hold real estate investment trusts (REITs), business development corporations (BDCs), closed-end funds (CEFs) and high-yielding exchange-traded funds (ETFs). I usually hold about 15 to 20 such positions to diversify against drawdowns in any one of them.

There’s a reason I concentrate on these alternative business structures. You see, it’s rare for a conventional company to offer the yields I want.

Of the 50 stocks in the S&P 500 dividend aristocrats list, only three pay a yield of over 5% — and declining earnings threaten cuts to two of them.

But the assets I buy can use leverage and other strategies to boost dividend yield.

The current yield on cost across all my income-producing investments is around 7%.

Brick by Brick, Course by Course

The next element of my strategy is to reinvest those dividends. I want the benefits of compounding.

Every time a company issues a dividend, it’s automatically reinvested in shares of that same company. That way I get a payout on an ever-increasing number of shares. The cycle repeats monthly or quarterly as the case may be.

If you keep doing that over time, this is what happens:

(Click here to view larger image.)

That’s great.

But you can do a lot better if you look for the best dividend-paying opportunities.

The chart above is based on the average dividend yield of the S&P 500. But that yield has been falling steadily for a decade. It’s now a paltry 1.32%.

(Click here to view larger image.)

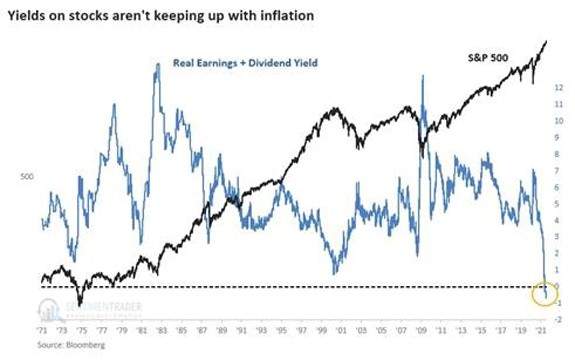

Even worse, the S&P 500 yield isn’t even keeping up with inflation:

(Click here to view larger image.)

Now, let’s assume you invest $100,000 in a portfolio like mine, with an average yield of 7% and an average annual dividend growth rate of 5%. Also, assume annual share price growth is the historical average of 8%.

Here’s the difference over 20 years between my portfolio (blue) and one invested in the S&P 500 (orange), both with reinvested dividends:

(Click here to view larger image.)

In terms of share price value, my strategy has outperformed the S&P 500 by a little less than $70,000.

But in terms of the dividends you’ll receive every year once you start using them for retirement, my portfolio is going to give you more than $76,000 a year … versus less than $7,000 from the index-based portfolio!

Call it the 10X+ dividend approach.

Endless Income Within Reach

Of course, I also look for more explosive opportunities.

But I limit those to about 10% to 15% of my portfolio. And I never invest more than 10% of that “mad money” in any one company.

But the core of my portfolio remains dividend payers. Every month I add an equal amount to every position. My brokerage account calculates the projected annual value of the current dividends from each position. Every month, the total potential payout gets closer to my retirement target.

But there’s one thing I must do that you don’t have to.

I keep a close eye on each position, prepared at any time to liquidate one threatened with falling dividends and shift to a better option. Particularly with REITs, BDCs and CEFs, I must watch my portfolio like a hawk.

But you don’t have to do that. I will do it for you.

I’ve designed The Bauman Letter’s Endless Income model portfolio to hold the best income stocks available.

And since it’s an actively managed portfolio, I tweak it when needed to keep your income at its peak.

Don’t miss it.

Stay smart and tough,

Ted Bauman

Editor, The Bauman Letter