The market’s recent volatility is unprecedented.

Since 1950, the market rose or fell by 2% in one of every 20 trading days.

In March, it has happened on 15 of the 18 trading days. That’s 83% of the time!

This is creating amazing opportunities. Stocks have recently traded at super low prices. They’ve sold off with little regard to quality.

To take advantage of them, the key is: Don’t overthink it. Investing doesn’t have to be hard.

For example, the travel and hospitality industry has been battered recently.

Hyatt Hotels Corp. (NYSE: H) traded down to nearly $24 on March 18.

That’s amazing. The stock almost reached $95 just one month before.

I thought Hyatt fell too much. It’s a well-run firm. When people can leave the house to visit its hotels again, they will.

Stocks rallied hard on March 24 and 25. At nearly $52, Hyatt shares are up 116% from their recent low.

But more recent volatility suggests stocks are likely to fall again.

If they do, I want to share with you a simple method to pick the biggest winners … by focusing on the biggest losers.

I looked at a few names in the travel space to see what kinds of opportunities are out there.

Casinos and Airlines Are Rolling Again

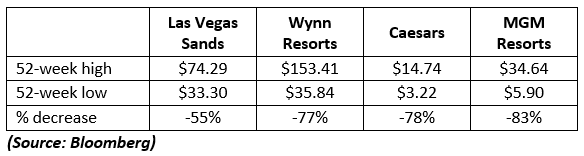

Casinos have struggled. So how do we find one to trade?

All we have to do is focus on the numbers. Here are the firms’ 52-week high and low prices:

The point I want to show you is simply math.

Three of these names fell more than 75%. If I assume each of these companies can return to their highs, they’ll have the most upside.

That’s an assumption, of course. But it’s a realistic way to compare the names.

I believe these are all solid companies.

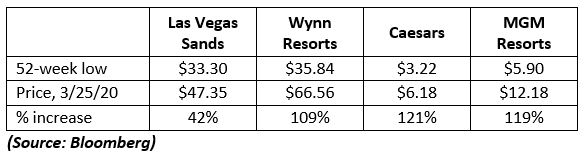

Here’s how each stock fared after bottoming:

Since they bottomed, the biggest losers outperformed.

For this sample and time frame, the assumption was correct. By buying the most hated of these names, shareholders maximized their upside when buyers returned to the market.

On the other end, Las Vegas Sands fell the least. Therefore, it has risen the least, too.

(As an aside, Las Vegas Sands only generated 15% of its revenue in the U.S. last year. While its Las Vegas properties are temporarily down, most of its operations in Asia are open.)

In the airline space, United Airlines fell more than 80% from its high. And since it bottomed on March 18, it’s up 106%.

Its loss and subsequent gain were larger than Southwest, Delta, American and Alaska Airlines.

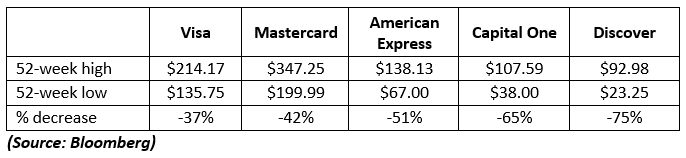

This Battered Industry Is Down by as Much as 75%

Let’s look at how some of the largest credit card firms have fared recently.

The numbers aren’t as bad as casinos and airlines, but they’re still weak:

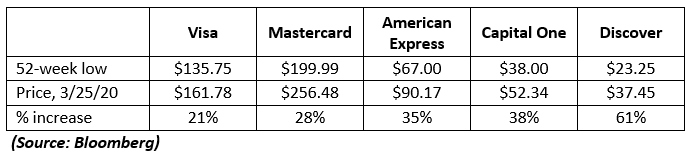

Since they bottomed, the biggest losers outperformed.

Investors who bought the most hated of these names maximized their upside when buyers returned to the market.

How to Find the Next Big Winner

This strategy is meant to be simple. It doesn’t analyze the nuances of each firm.

No stock is directly comparable to another. Each has differences.

For example, in the world of credit cards, Visa and Mastercard are credit card processors. They don’t lend you money. A bank does.

American Express and Discover do lend, though. And there are other differences, too.

These companies aren’t directly comparable. And it’s OK. We’re focused on simple math.

And the beauty of this is we can do it with other industries, too.

The name that struck me of those I reviewed was Discover Financial Services (NYSE: DFS). Even after jumping 61% from its low, it remains 60% below its high.

I believe people will keep using their credit cards. I also believe Discover can cut the gap between it and American Express, which is only down 35% from its high.

Today, Discover trades for four times last year’s earnings and two times free cash flow. It’s a solid company.

This market is volatile. Prices are moving a lot. I don’t believe you need to buy right away, though.

If Discover falls again, I would look to put on a small long position. (Down to less than $25, where it bottomed on March 19, would be ideal.)

At that price, even a small position could be quite lucrative.

Discover just jumped 61% in less than a week. That can happen again, all because the market is selling off with little regard for quality.

Bottom line: In this crazy market environment, the biggest losers will be the biggest winners.

Good investing,

Editor, Profit Line

P.S. Tomorrow, Jeff Yastine and I are releasing a trade with the incredible potential to make a 100% to 300% gain. Company executives have been pouring their money into this stock, which tells me that it’s about to go up — and fast. But you must act quickly; the trade alert with the complete details is going out tomorrow. To sign up now, click here.