The electric vehicle (EV) trend is not just a passing attraction. If this year’s crisis with gas prices has told us anything, it’s that EVs are the real deal. And they’re gearing up for a gold rush in the next few years.

A new generation of electric vehicle companies are vying to become the next Tesla — the next global automaker.

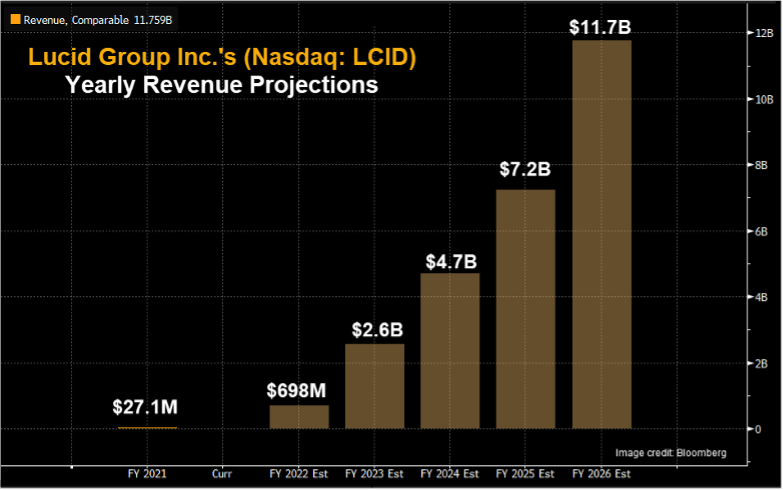

These startups are trading at discounted prices. And their yearly revenue projections are expected to skyrocket +1000% higher in the next five years!

As my colleague Ian King says: “The time to make life-changing wealth is during bear markets. That’s when great stocks are trading at unfairly beaten-down prices.”

Today I’m sharing one EV startup company that I’m following closely. It could be a major EV competitor, and a great 2.0 tech investment for your portfolio.

The Next-Gen EV You Should Be Watching

The Luxurious Lucid Air

As you all probably know by now, I’m a huge gearhead. So I’m always checking out cars that catch my eye.

This past weekend, I saw an EV that may be in the running to be a future global automaker: a Lucid Air luxury electric sedan by Lucid Motors.

“The longest range, fastest-charging luxury electric car in the world. With incredible horsepower and an unrivaled range of up to 520 miles per charge, it’s like no car you’ve ever known.”

Lucid’s Air sedan is easy to spot, with its sleek, bright and luminous wraparound headlights and stylish wide body.

Founded in 2007, the company initially supplied battery packs and drivetrains for electric buses in China.

According to BloombergNEF, Lucid decided to enter the passenger EV market in 2013.

But first, it needed the right EV to attract buyers.

Lucid hired Tesla’s Model S chief engineer, Peter Rawlinson, and Mazda’s director of design, Derek Jenkins. Together they produced the Lucid Air.

Lucid Motors as an Investment

Lucid Group Inc. (Nasdaq: LCID) is a publicly traded company.

It plans to launch the Gravity SUV in 2024. And from 2025 through 2030, the EV maker plans to produce smaller sedans and SUVs, as well as introduce a coupe and pickup truck model to its product lineup.

Its goal is to produce 500,000 vehicles annually.

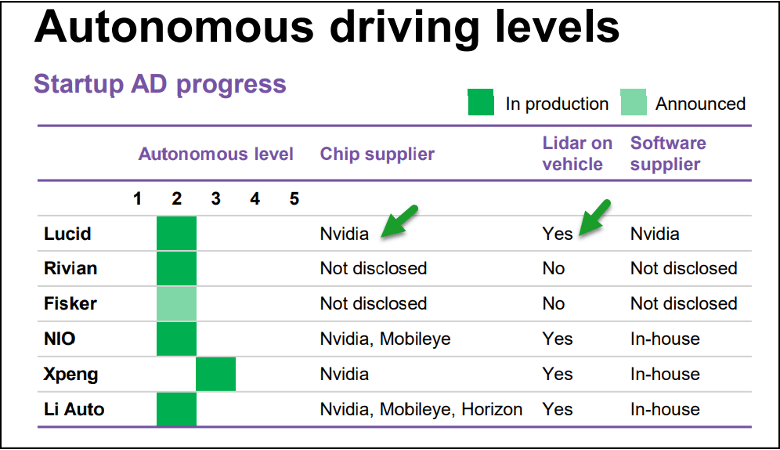

Plus, Lucid is one of the leaders in installing autonomous driving tech using Nvidia chips.

But here’s the interesting part.

The Public Investment Fund of Saudi Arabia is the majority owner of Lucid. Its headquarters is in Newark, California, with cars manufactured in Arizona.

And according to Bloomberg research, Saudi Arabia has a strategic interest in Lucid.

The Kingdom of Saudi Arabia, which is one of the world’s largest oil producers, has plans to build a second Lucid manufacturing facility in its kingdom.

The plan is to grow and diversify Saudi Arabia’s economy beyond oil as part of Vision 2030.

Wow. An EV maker poised to make manufacturing inroads in an oil-rich country?

Now that’s an EV startup to watch!

Investing in an EV Startup

With a stock price that’s down about 60% year to date and slashed 2022 production guidance, you may be tempted to pass Lucid by.

But launching an EV brand and scaling up is a near impossible feat, especially in today’s supply chain crunch. (Tesla had the same problem in its early years.)

But according to Peter Rawlinson, Lucid’s CEO and CTO:

Our revised production guidance reflects the extraordinary supply chain and logistics challenges we encountered.

We’ve identified the primary bottlenecks, and we are taking appropriate measures — bringing our logistics operations in-house, adding key hires to the executive team and restructuring our logistics and manufacturing organization.

We continue to see strong demand for our vehicles, with over 37,000 customer reservations, and I remain confident that we shall overcome these near-term challenges.

I checked Bloomberg’s yearly revenue predictions.

If Lucid can find solid footing and grow production and deliveries, its revenue could reach $11.7 billion by 2026 from just $27 million in 2021.

How to Gear Up for the Next Gold Rush With This EV Startup

If you’re game, consider checking out Lucid Motors. It’s an EV startup, but it’s making a lasting impression on the ever-growing EV market. It’s a stock that I’m definitely watching as the EV revolution presses on.

It could even give Tesla a run for its money!

Remember, with Lucid:

- The stock price is currently trading at just the mid-teens.

- Its goal is producing 500,000 EVs per year.

- Its revenue could reach $11.7 billion by 2026.

And if you’re interested in Ian’s take on other EV startups to invest in, please check out his financial service, Strategic Fortunes.

Right now, he’s recommending a stock that’s deeply involved in the supply chain and development of Fisker Inc. (NYSE: FSR), another promising EV startup.

To get more details on Ian’s stock pick, just go here!

Until next time,

Director of Investment Research, Strategic Fortunes

Disclaimer: We will not track any stocks in Winning Investor Daily. We are just sharing our opinions, not advice. If you want access to the stocks in our model portfolio with tracking, updates and buy/sell guidance, please check out Strategic Fortunes.