There must have been a crystal ball sale at Costco that I missed…

As we head into earnings season, everyone and their mother is making predictions.

And that goes doubly for who will win — Trump or Harris.

Making predictions is not my bag.

Starting on Wall Street more than 40 years ago, I know how the game is played.

Wall Street analysts get paid big bucks to predict where a company’s earnings or revenue will be each quarter.

Hedge funds and other short-term traders build up positions going into earnings based on these forecasts.

If earnings or revenue or any other big number that was forecasted is not met, trigger-happy traders sell the stock.

They then jump to the next stock and play the game all over again.

And get this…

Sometimes, even if a company meets or exceeds expectations … the stock might sell off because they didn’t beat it by enough!

This really happens folks, I kid you not.

This is a game I don’t play.

But it should give you insight into why there is so much volatility in stocks over the short term.

And I know how to turn Wall Street’s guessing game into your gain.

Golden Opportunities for Savvy Investors

I only look at quarterly earnings in the context of how everything else is doing.

One quarter does not make a trend.

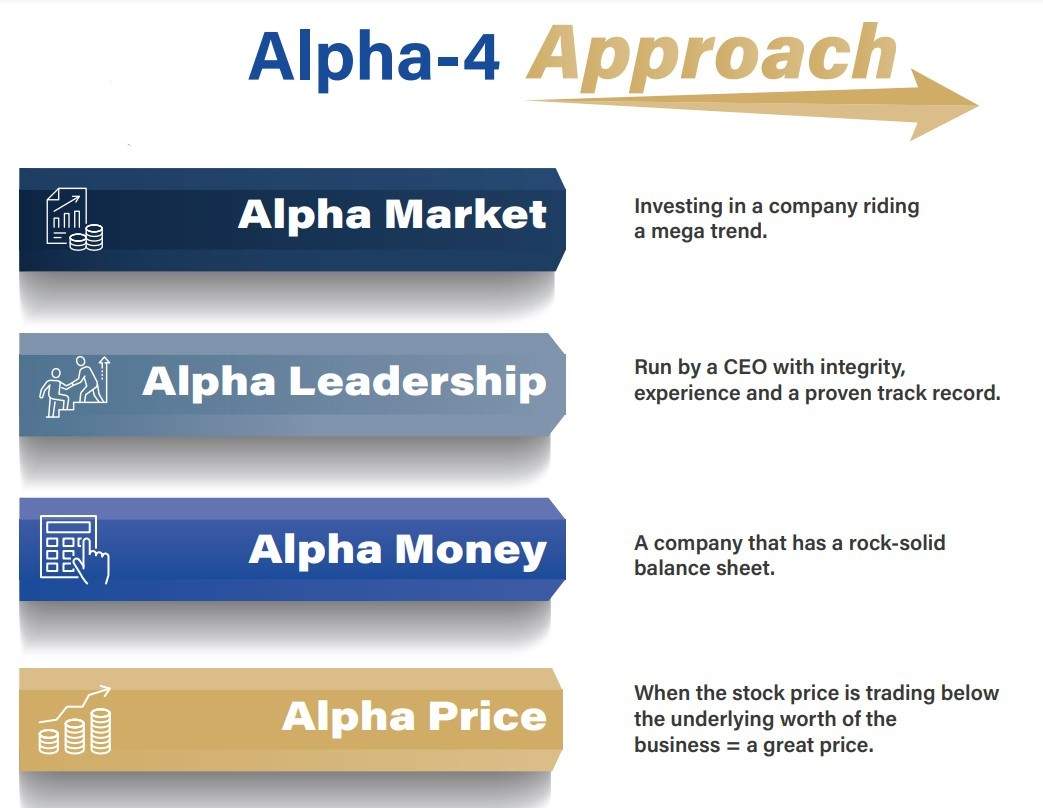

If the big picture is still intact — meaning the company is in a mega trend industry, run by an outstanding CEO, and the company has solid financials — one bad quarter doesn’t mean squat.

I can’t recall in over 41 years of investing and analyzing companies that I ever saw a company’s revenue and earnings rise each and every quarter for a long period of time.

And that’s because a business is not a straight line that goes up and to the right.

There will always be extraordinary circumstances that might push off rising earnings, or see revenue take a dip.

It’s no big deal.

If the long-term thesis is intact, these are nothing more than speed bumps.

In fact, short-term dips are great buying opportunities.

There’s nothing I like better than buying shares from trigger-happy hedge funds — especially when they are dumping stocks at great prices.

Missed 2024 Stock Market Predictions by a Country Mile

At the end of 2023, economists were predicting growth was going to slow in 2024 because of high interest rates.

Consumers were not going to be able to keep spending as their savings dwindle and they are going to take on high interest rates.

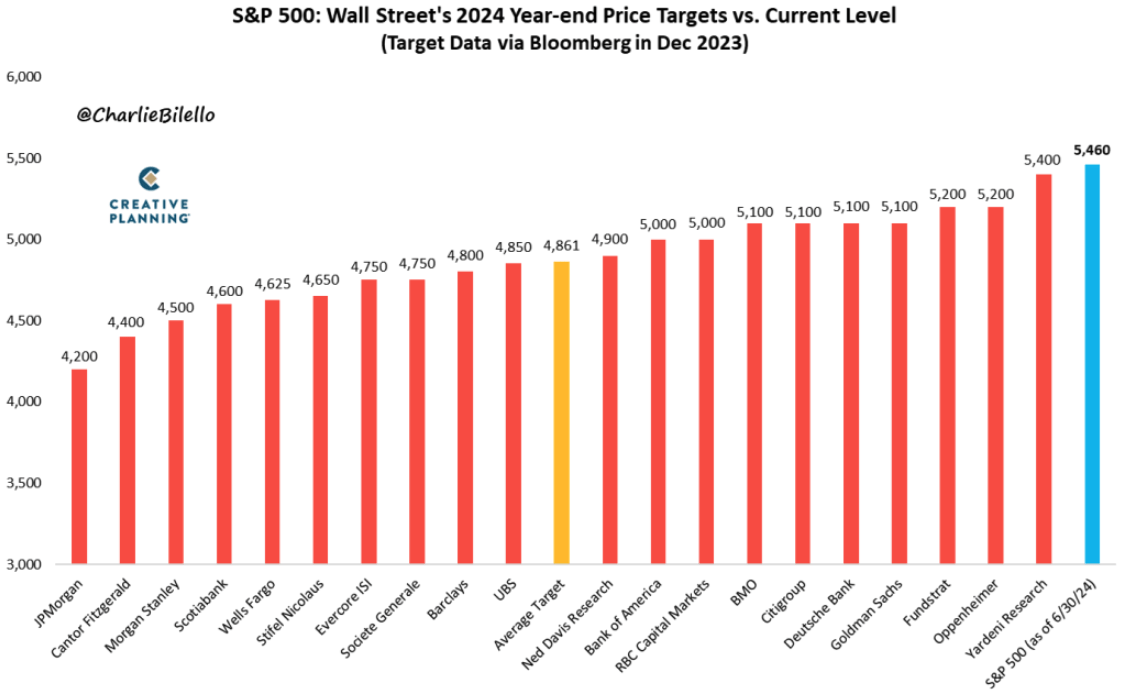

They said this does not bode well for the stock market. Now, check out how their predictions (below in red) stacked up compared to the stock market’s actual performance (in blue):

These are analysts from the major investment banks. These guys went to the best schools and have the best resources at their beck and call.

You think they’d be close to making accurate predictions, right?

The chart shows their forecast of where stocks would end in 2024.

With half the year gone, they are really doing poorly.

By June 30th, the S&P 500 (blue bar) beat every one of their year-end targets!

The average target (yellow bar) of S&P 500 is 4,861 — more than 10% below.

They missed it by a country mile.

The S&P 500 finished the first half of 2024 up 15% — its 15th-best start to a year going back to 1928.

The bottom line…

Keep It Simple Focus on Companies in Mega Trends with Great CEOs

It’s nearly impossible to accurately predict or forecast the market’s performance because there are too many variables to consider.

I’ve always found it much easier to focus on a company in an industry that’s in a mega trend, run by an outstanding CEO and then buy it at a great price.

It’s much simpler than trying to figure out where the business is heading than the market or the economy.

I like to stick to opportunities that are in my favor and not play the hard game.

My money doesn’t care how it’s made when it ends up in my brokerage account.

As Buffett said, you don’t get Olympic difficulty points by making it harder or easier.

So when the market is volatile (and it will be with the election and earnings coming up), what’s the best move you can make in your portfolio?

Keep it simple!

If you own great businesses with rockstar leadership, do nothing.

If you’re looking to buy, do it when the stock is trading at a great price.

If you need a reminder, here’s a checklist. Print it out. And sleep better at night:

Note: For a company in the biggest mega trend of today, run by a rockstar CEO, trading at a great price … look no further than right here.

I recently spoke with the chairman of this company and he said, “Think of it as if it’s the gold rush … and we are the guys selling the picks and shovels.”

And right now, this company is selling A LOT of picks and shovels…

Regards,

Charles Mizrahi

Founder, Alpha Investor

I’m very disappointed that I’m asked to purchase annual subscription to the information, I’m needing to learn from Banyon Hill. I’ve purchased three memberships and I’m still being asked to purchase another membership for access to micro-cap/Omega stocks coined by Charles Mitzrahi. I can’t afford another almost $2,000 for this. I’m truly disappointed.