Great news: I got married this weekend!

Now I’m getting ready to go on a honeymoon to the U.S. Virgin Islands.

I still have to make the standard travel preparations, such as:

- Packing my bags…

- Double-checking my ride to the airport…

- And, of course, bringing cash in case I need it.

You can never be too prepared when you’re about to go on a trip.

But aside from when I travel, I don’t really carry cash with me.

In fact, I don’t use cash much at all.

And I know I’m far from alone.

According to the Federal Reserve, only 19% of payments were in cash last year.

The pandemic obviously had a role in that. But cash payments were declining before then.

For example, 40% of payments were in cash back in 2012. By 2019, that number had fallen to 26%.

And now, payments processor Stripe is adding another reason not to use cash.

The startup announced on Tuesday that it will enable crypto payments.

Stripe’s platforms are used for transactions in 43 countries.

And over 2 million businesses use Stripe.

So, this news is a HUGE deal for the crypto world.

A Big Step for Crypto Adoption

Stripe is one of the fastest-growing payment platforms.

It’s a convenient way to pay with U.S. dollars and other currencies (and, soon, cryptos as well).

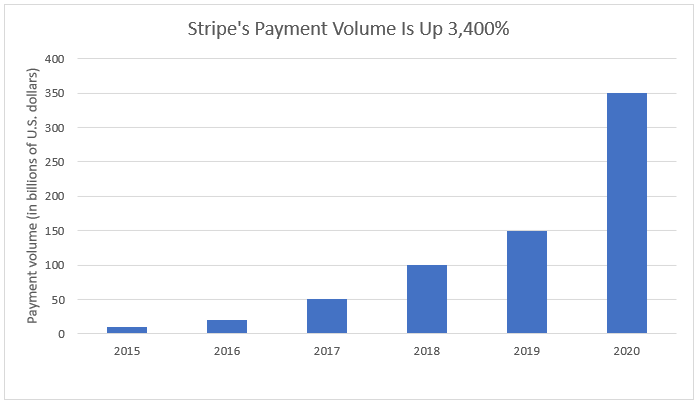

In 2015, it only handled $10 billion in payments. But by 2020, that number grew to $350 billion.

That’s 3,400% growth in just six years!

(Source: CB Insights.)

Stripe’s platforms will make it much easier to spend and accept cryptos.

That’s a big step for crypto adoption. And as more people trade cryptos, their prices will soar.

Cryptos Are Beating the U.S. Dollar

Stripe isn’t the only company that’s joining the crypto space:

- Square launched bitcoin trading in 2018.

- PayPal added cryptos to its platform last year.

- MasterCard said in February that it will support crypto payments.

- AMC plans to accept bitcoin and other cryptos at its theaters.

- Google Pay will soon allow crypto payments.

- Apple even approved NFT marketplace Curate on its App Store.

It’s easy to see why these companies are warming up to cryptos.

As I mentioned earlier, fewer people are carrying and using cash these days.

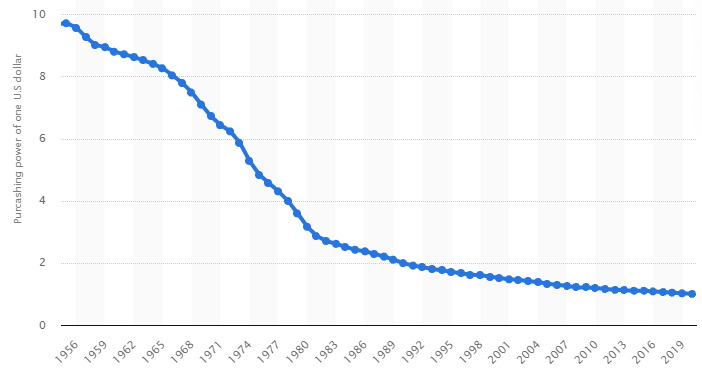

And the U.S dollar continues to lose value. Just check out its performance in the chart below:

Purchasing Power of 1 U.S. Dollar

(Source: Statista.)

As you can see, the U.S. dollar has lost value every year since 1955.

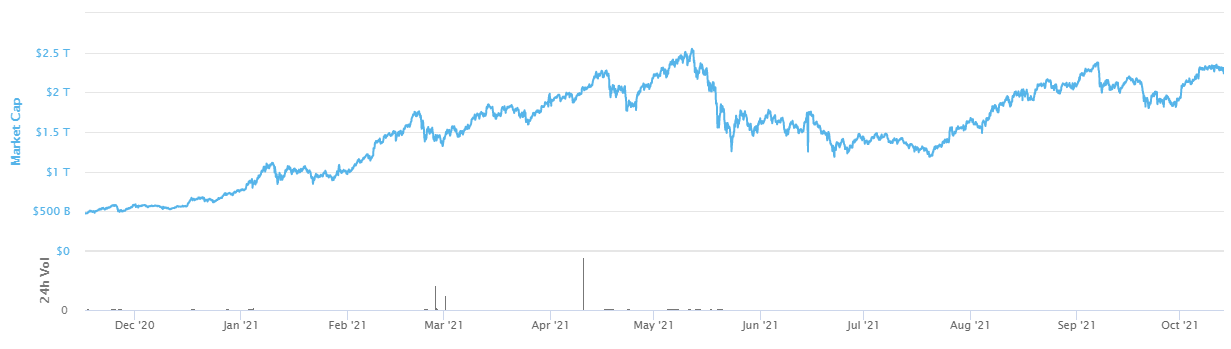

Meanwhile, the crypto market has made incredible gains in the past year.

Total Crypto Market Cap

(Source: CoinMarketCap.)

Since November 2020, the crypto market surged from $500 billion to over $2.3 trillion!

It’s not even a contest anymore. Cryptos are the clear winner.

Prepare for “Crypto’s Third Wave”

You can make massive gains in the crypto markets. That is, if you have the right trading system powering your portfolio.

Subscribers of Ian King’s Next Wave Crypto Fortunes service have already booked half-position gains such as:

- 1,061%…

- 1,924%…

- And 3,981%.

This goes to show the incredible gains you can make in these markets.

And Ian’s new “Crypto’s Third Wave” report could match that.

The three cryptos in this report will change the way we bank, invest and game.

Ian is excited to share his latest research with you. To watch his brand-new presentation now, click here.

Regards,

Assistant Managing Editor, Banyan Hill Publishing

Morning Movers

From noon till open Eastern time.

OncBioMune Pharmaceuticals Inc. (OTC: OBMP) is a precision medicine company developing cancer immunotherapy products. It is back on the list today with no news and a 60% rise as investor excitement over biotech penny stocks continues.

Relay Therapeutics Inc. (Nasdaq: RLAY) is a clinical-stage precision medicine company that is up 13% today, continuing its rally from earlier this week when it announced the pricing for new shares under a secondary stock offering.

Ocugen Inc. (Nasdaq: OCGN) is a biopharmaceutical company that focuses on developing gene therapies to cure blindness. It also has a partnership with Bharat Biotech to help it commercialize its COVID-19 vaccine, Covaxin. It is up 11% today on the news that India approved Covaxin for children ages 2 and up.

Jardine Cycle & Carriage Ltd. (OTC: JCYGY) is a Singapore-based conglomerate with segments in real-estate, manufacturing, financial services and much more. It was driven up 11% today by the broader uptrend in Southeast Asian stocks based on an optimistic outlook for the Asian markets in the near future.

Ambarella Inc. (Nasdaq: AMBA) develops semiconductor solutions that enable high-definition video compression and image processing. It is up 10% this morning on positive media attention from multiple sources.

Ginkgo Bioworks Holdings Inc. (NYSE: DNA) is a synthetic biology company that develops platforms for cell programming. It has been rallying since William Blair and Morgan Stanley initiated coverage on the stock with an outperform rating. It is up 10% this morning.

Rolls-Royce Holdings plc (OTC: RLLCF), the U.K.-based aerospace and defense company, is up 9% today. The stock was driven up by the news that the company secured a $2.6 billion contract to supply 650 engines for the U.S. Air Force’s B-52 bombers.

Dutch Bros Inc. (NYSE: BROS), the drive-thru coffee chain, has been expanding its operations and number of locations since going public in September. This growth caused a number of analyst firms to initiate coverage on the stock, leading to its 9% rise this morning.

TaskUs Inc. (Nasdaq: TASK), the provider of outsourcing services, is up 9% today, continuing its rise from Wednesday when the stock bounced back from a monthlong downtrend.

LegalZoom.com Inc. (Nasdaq: LZ) operates an online platform for legal and compliance solutions. It is up 8% this morning on the news that it is partnering with the NBA for an initiative that will award $6 million in grants and LegalZoom services to support thousands of small businesses throughout the country.