The U.S.-China trade war is dragging on the price of metals.

In February, the U.S. kicked off the start of the trade war with tariffs on solar panels. This was followed up with tariffs on steel imports.

Since then China has been playing defense, striking back against new tariffs on American goods at every turn.

China has earmarked $130 billion worth of American goods for tariffs. That includes soybeans, pigs and liquefied natural gas — all major points of demand for American suppliers.

That’s compared to over $250 billion in Chinese exports destined to see higher prices in the U.S.

The trade war cuts deep for China. The tariffs on its exports will decrease demand. At home, citizens will see prices for many items increase by as much as 25%.

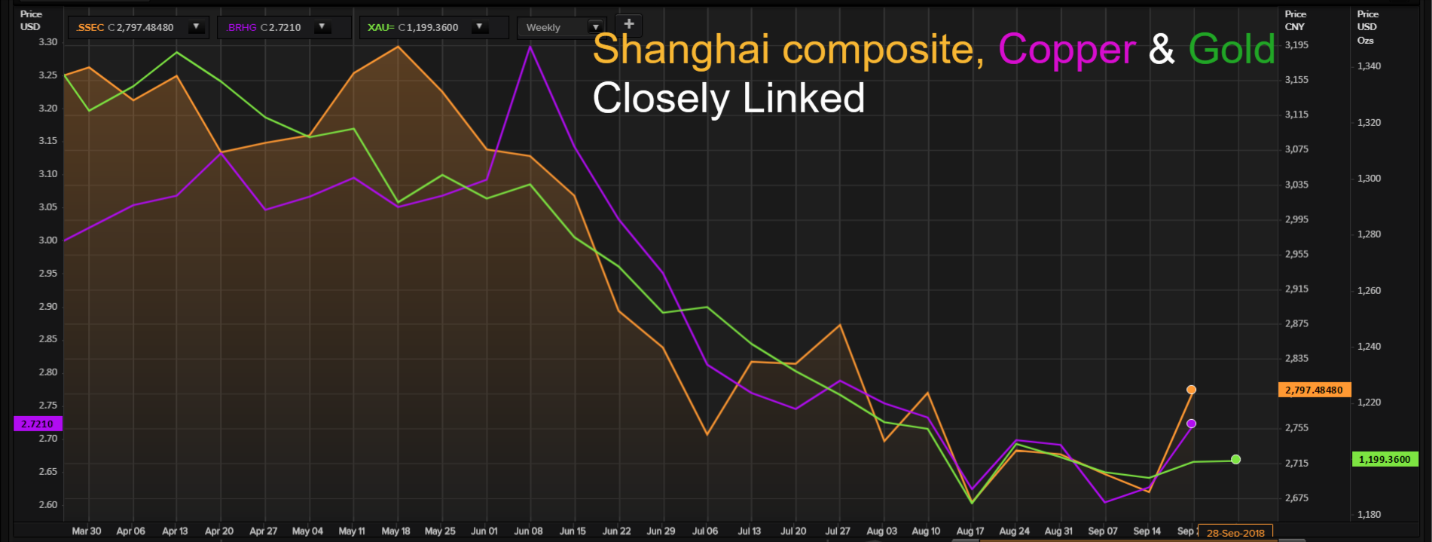

The result is a weakening Chinese economy. The Shanghai Composite Index, which tracks the Chinese stock market, is down to multiyear lows.

Markets are favoring the U.S. in the trade war. The U.S. dollar is steadily strengthening against the Chinese yuan.

The result is commodities are cheaper for the U.S., but more expensive for China.

That’s having a real effect on demand for metals.

China is set to consume 24 million tons of copper in 2018, accounting for half of the world’s supply.

Both gold and copper are now closely tracking the Shanghai index.

This relationship means that the short-term outlook for metals is weakening.

With national pride on the line, the trade war is looking less likely to have a resolution by November.

Chinese billionaire and Alibaba co-founder Jack Ma believes the trade war could drag on for decades.

Base and precious metals are likely to stay near their recent lows until a path toward a resolution appears.

But that doesn’t mean the entire natural resource space will see a bear market.

In Real Wealth Strategist, we are monitoring the trade war. The natural resource space holds great opportunities outside of metals, like marijuana and oil.

Good investing,

Anthony Planas

Internal Analyst, Banyan Hill Publishing