Something strange is occurring in crude oil futures. The peculiar action looks bullish even though the narrative is clear as mud…

- Iranian oil exports are declining. Less supply on the market is bullish.

- China and India cut back on imports of Iranian crude oil. Less need for controversial barrels is bearish.

- Saudi Arabia and OPEC increased oil production enough to make up for lost Iranian barrels. Shoring up global supply and expectations is bearish.

- U.S. tariffs on China will dent Chinese crude oil demand. Lower demand from a major oil consumer is bearish.

- Permian oil pipeline capacity has reached its limit. Many Permian producers plan to suspend some operations until new capacity comes online. Lower production is bullish.

Altogether, it does not warrant conviction.

West Texas Intermediate (WTI) crude is stuck between $65 and $70 per barrel. Maybe because futures traders are more uncertain than usual.

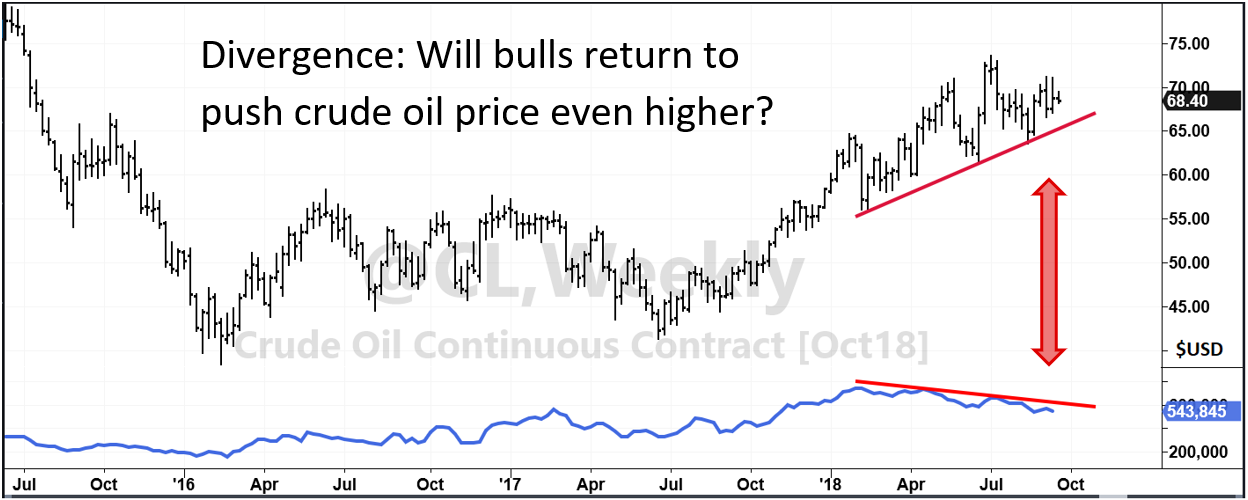

Large speculators reduced their collective bullish crude oil trades since February. At the same time, the price of crude oil trended higher.

That rarely happens. Check it out…

The black bars are the price of crude oil. Going up.

The blue line is crude oil speculators’ net position. Bullish but going down.

This type of divergence hasn’t happened since 2002. That was the beginning of a steady climb for the price of oil. WTI crude futures went from $105 to $145 per barrel in about 18 months.

Think about that move. Price increased 38%. Was it predictable?

Speculators tempered their enthusiasm. Even though they reduced their bets, price kept climbing. Oil’s resilience helped restore bullish conviction.

Today’s divergence looks similar. Price is steady. When enthusiasm returns, expect a sharp rally.

Today, WTI is at $68.50. A 38% rally would take crude to $93 by 2020.

Or it could happen a lot faster. I’m preparing for a strong rally within a few weeks.

But I’m waiting for futures traders to make the first move. Be ready.

Good investing,

John Ross

Senior Analyst, Banyan Hill Publishing