Over the holidays, my family and I ventured to New York to catch a few Broadway shows. One of them was a big-time magic production, something my son wanted to see … a sort of homage to the start of the 20th century and the “Golden Age of Magic.”

Was it filled with never-before-seen tricks? No, not really.

But the performers were so skilled, along with the dramatic music and lighting effects … maybe I didn’t suspend disbelief, but the less rational side of my brain was happy to look the other way for a few entertaining hours.

That’s how you sell tickets for a magic show on Broadway.

In the order of grand illusions, Wall Street has one of its own: the idea that America’s shale oil producers will somehow rush in and save us from higher oil prices in the months and years to come.

The shale oil industry is in no shape to ride to the rescue of American consumers by quickly ramping up production.

You can see that in shale firms’ hedging activity. As Bloomberg noted last month, when oil prices crossed $50 per barrel after the December OPEC meeting, U.S. shale producers rushed to hedge those prices.

The key here is what this says about shale oil producers’ view of risk. For the time being, they’d rather just muddle through and take a lesser, but guaranteed, payout at $50 per barrel for their future oil production — rather than gamble on making a lot more money by staying unhedged when prices hit $60.

It’s the prudent thing to do. But the tricky part is this…

Shale companies need all the cash they can get. Because in the fracking game, old wells are quickly depleted. They have to be replaced with new ones. That takes a continuous flow of cheap money.

It was easy enough to do when oil was above $100 and the long-term cost of fracking a well was around $50 to $60 per barrel. Today, that’s just enough to keep the lights on and service the ball-and-chain load of debt that came with the bargain.

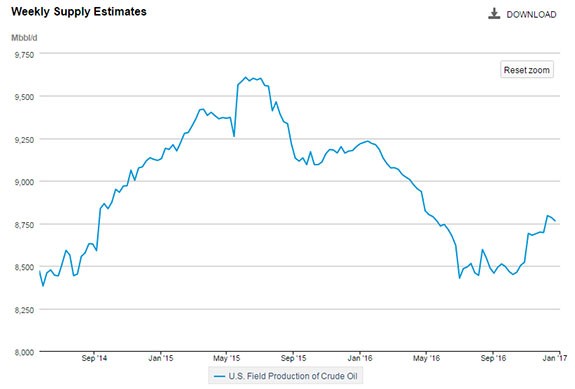

So when you look at the chart of America’s oil production over the past three years, don’t expect a parabolic rise to the heights of 2015 when oil fracking companies were pumping out more than 9.5 million barrels a day.

The Mother’s Milk of Shale

Nor are banks interested in ramping up their lending to shale companies, despite 2016’s rebound in oil prices.

Late last month, Reuters noted that out of the nearly three dozen major shale oil companies it tracks, only one-third — 12 companies — saw increases in credit lines. The rest had their access to bank credit either cut or left unchanged.

Banks are also not likely to forget the drubbing they took writing off piles of bad debt when the bubble burst in 2014 and 2015.

What about bond investors? Could they be expected to pick up the financing slack as they did during the fracking boom?

Don’t count on it. Interest rates are higher, so borrowing costs are more expensive than at the peak of the boom.

And it doesn’t help to sell new speculative-grade bonds when, despite higher oil prices in the past year, the wave of shale-related bankruptcies is set to rise.

In the past two years, 114 drillers and oil field services firms went belly-up, according to the Texas law firm Haynes and Boone, which specializes in bankruptcy filings.

But as Moody’s notes, still more companies will likely join those ranks because $21 billion in bonds, borrowed during the boom years, needs to be paid back to investors in 2018. It keeps rising from there to a peak in 2021, when nearly $29 billion comes due.

Perhaps the best perspective on the future comes from veteran bankers to the oil industry: “This will leave a bad taste in our mouth for years,” said one banker to the Houston Chronicle last summer when his firm had to write off nearly $10 million in busted loans.

Said another: “There might be an expansion, but not a boom. Credit is going to be limited for quite some time.”

But without credit (more accurately, cheap credit), U.S. production can’t grow in a major way. That’s why our editors, such as Total Wealth Insider’s Jeff Opdyke and I, continue to note the long-term path higher for oil prices.

Kind regards,

JL Yastine

Editorial Director