Record Deliveries, Record Pessimism

When it rains, it pours.

What started out as a skirmish for connectivity with my internet service provider has turned into all-out warfare. Charter/Spectrum … we’re going to have words about the area-wide outage today. Some of us have actual work to do.

Due to a combination of extenuating circumstances, you’re getting a mini Great Stuff today … a fun-sized Great Stuff, if you will. All the same snark and cosmic market coverage packed into an itty-bitty living space.

Without further ado, here are today’s biggest need-to-know stories:

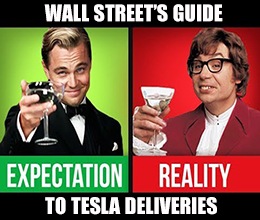

1. On the record: Tesla Inc. (Nasdaq: TSLA) reported record third-quarter vehicle deliveries of 95,000 units last night. But that wasn’t enough for Wall Street, and CEO Elon Musk is largely to blame. Earlier in the quarter, Musk hyped deliveries of 100,000 units. And, like the fools they are, Wall Street believed him.

The biggest standout, however, was JMP Securities, which downgraded TSLA stock to “market perform” on demand concerns. I don’t know how you see record deliveries and come away with “demand concerns,” but that’s where we are in the Tesla hype cycle right now. I can’t help but see this as a buying opportunity.

2. Double your fun: Everyone is having product reveal events lately, so Microsoft Corp. (Nasdaq: MSFT) decided to join in the fun. On Wednesday, the $1 trillion behemoth took the wraps off the Surface Neo — an all-new, dual-screen computer — and a dual-screen phone dubbed the Surface Duo.

Yes, you read that right. Microsoft is making smartphones again.

What’s even more shocking is that the Surface Duo runs Android … not Windows OS. The device is sleek, clamshell foldable and sports two 5.6-inch displays on a 360-degree hinge. Unlike most of the Duo’s competitors, it’s small enough to fit in your pocket.

Oh … there were also wireless Surface Earbuds. Many analysts and financial rags are talking about these, and I have no idea why. Like I said about the Amazon and Apple earbuds, you can find much cheaper solutions from knockoff vendors that work just as well.

3. Beat, raise … burn?: It’s not often that you see a stock fall after a beat-and-raise quarterly report, but that’s where Constellation Brands Inc. (NYSE: STZ) found itself this morning. The problem is Constellation’s investment in Canadian cannabis company Canopy Growth Corp. (NYSE: CGC).

According to the report, Constellation recorded losses totaling $484.4 million on its Canopy investment. Those losses pushed Constellation to a net loss of $2.77 per share. Excluding Canopy, earnings rose to $2.91 per share.

Investors shouldn’t worry too much, as Canopy has the inside track on edibles, infused beverages, extracts and other products … all of which are slated to hit the Canadian market in Cannabis 2.0 — the second phase of Canada’s legalization legislation — this quarter.

Now, if Canopy and Constellation have you down, I’ve got the perfect pick-me-up. Banyan Hill experts Matt Badiali and Anthony Planas just homed in on a pharmaceutical company that’s changing the face of the marijuana market. It’s only a matter of time before this cannabis stock goes beyond the recommended buy price, so you must act now!

Click here for details on this cannabis game changer.

That’s it for today…

“But what about the haiku contest?”

I hear you, and I’ll get to all your submissions tomorrow. You can thank Charter for the extra day to get your submissions in. Just send your works of art to GreatStuffToday@banyanhill.com.

“So, what am I supposed to do with all this extra free time?”

Excellent question! Have you thought about taxes lately?

No, I’m serious!

In April 2018, more than 44% of Americans paid $0 in federal income taxes. Got your attention now?

If you would like to join that crowd — legally, that is — click here now to discover some clever ways that you, too, could pay $0 in federal income taxes.

Great Stuff will be back tomorrow with your irregularly scheduled programming.

Until next time, good trading!

Regards,

Joseph Hargett

Great Stuff Managing Editor, Banyan Hill Publishing