Emotions make it harder for traders to make good decisions.

We want to make money, and we want to make it now … even if it means ignoring risks.

Successful traders find ways to manage their emotions.

That’s why I teamed up with Real Wealth Strategist Editor Matt Badiali to develop a system that could excel in a bear market as well as in a bull market. One that could perform well in a backdrop of high volatility or low volatility.

We decided the system should be less discretionary and more systematic.

In other words, we squeezed the emotion out of it.

By adding repeatable rules and tactics, we reduce the chances our impulses will get us into or out of a trade at the wrong time. Here’s an example…

Timing Trades With the BaR

We pieced together a momentum indicator to optimize our trade entry timing.

We call it the BaR. That’s short for black and red, which are the colors the indicator uses to represent momentum.

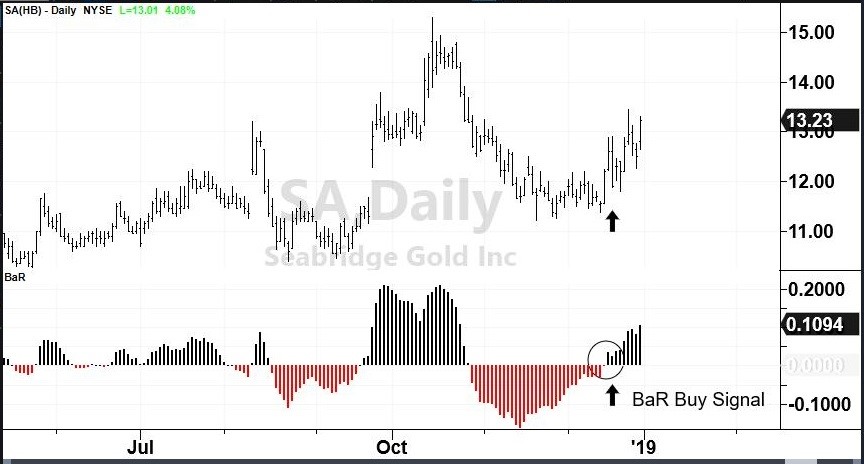

Have a look at the latest BaR signal our system produced.

That’s a daily chart of Seabridge Gold Inc. (NYSE: SA).

The black-and-red indicator along the bottom is the BaR.

It’s a comparison of moving averages. The black bars represent bullish momentum. The red bars represent bearish momentum.

Once we uncover trade setups with pattern analysis, we filter those setups through the BaR to produce signals.

The BaR turned from red to black on December 18 when Seabridge shares traded at a key price point.

That’s a buy signal, and we took it.

We bought call options on Seabridge Gold. (Call options are a limited-risk, leveraged bet that the price of underlying shares will rise.)

Based on this Monday’s closing price, shares of Seabridge are up 8% since December 19. Our call options are up 40% during that stretch!

The BaR is just one piece of the system that produces results like that.

It’s a system that has us excited for 2019 no matter what it brings.

Stay tuned in the coming weeks. Matt and I will share more about how you can take advantage of the BaR indicator to make massive profits.

Happy New Year!

John Ross

Senior Analyst, Banyan Hill Publishing