Latest Insights on APLE

Stocks to Buy in 2023: Less Than 5% Will Win December 22, 2022 Banyan Edge, Investing, Stocks If you're looking for stocks that will outperform in 2023, look no further than these less-than-5% to keep winning...

Stocks to Buy in 2023: Less Than 5% Will Win December 22, 2022 Banyan Edge, Investing, Stocks If you're looking for stocks that will outperform in 2023, look no further than these less-than-5% to keep winning... 2 Inflation Losers, and 2 Big Winners August 24, 2022 Investing, Trading Strategies, True Options Masters High inflation is driving widespread changes in consumer behavior — and it's handing us plenty of trades...

2 Inflation Losers, and 2 Big Winners August 24, 2022 Investing, Trading Strategies, True Options Masters High inflation is driving widespread changes in consumer behavior — and it's handing us plenty of trades... New Streaming King: Disney Devours Netflix in Subscriber Growth August 11, 2022 Great Stuff I’m Going To Disney Land… Great Ones, I just ran away from Netflix (Nasdaq: ). Now I’m going to Disneyland. I just joined a new streaming service … I’m going to Disneyland. I just watched the multiverse … I’m going to Disneyland. I just flipped off Reed Hastings … I’m going to Disneyland. I just […]

New Streaming King: Disney Devours Netflix in Subscriber Growth August 11, 2022 Great Stuff I’m Going To Disney Land… Great Ones, I just ran away from Netflix (Nasdaq: ). Now I’m going to Disneyland. I just joined a new streaming service … I’m going to Disneyland. I just watched the multiverse … I’m going to Disneyland. I just flipped off Reed Hastings … I’m going to Disneyland. I just […] The Fed’s $8,000/Year “Mortgage Tax” June 28, 2022 Big Picture. Big Profits., Investment Opportunities, News, U.S. Economy Inflation is caused by a mismatch between supply and demand. The Federal Reserve can’t increase the supply of goods and services. So, to control prices it must engineer “demand destruction.” That’s as nasty as it sounds. I’ve already explained how the Fed uses the “wealth effect” to make households with lots of stocks cut spending … and why that strategy won’t work with U.S. wealth concentrated in so few hands. I also explored how big changes in the U.S. and global economy since the 1970s will force the Fed to raise interest rates A LOT to bring inflation down. Today, we’re going to look at the impact of their demand destruction on U.S. households.

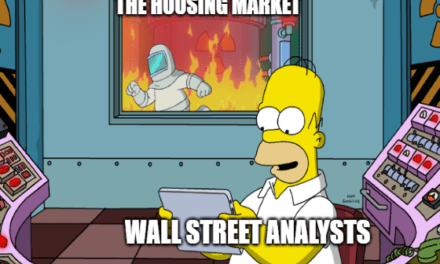

The Fed’s $8,000/Year “Mortgage Tax” June 28, 2022 Big Picture. Big Profits., Investment Opportunities, News, U.S. Economy Inflation is caused by a mismatch between supply and demand. The Federal Reserve can’t increase the supply of goods and services. So, to control prices it must engineer “demand destruction.” That’s as nasty as it sounds. I’ve already explained how the Fed uses the “wealth effect” to make households with lots of stocks cut spending … and why that strategy won’t work with U.S. wealth concentrated in so few hands. I also explored how big changes in the U.S. and global economy since the 1970s will force the Fed to raise interest rates A LOT to bring inflation down. Today, we’re going to look at the impact of their demand destruction on U.S. households. Burning Down The Housing Market; Tesla’s Trouble Is Just Getting Started June 16, 2022 Great Stuff A House Is A House Is A House… Happy Thursday, Great Ones, and welcome to another Thursday Throwdown, where — oof, good God, what’s going on with the market?! We’re doing that sell-off-the-whole-world thing again, huh? If you couldn’t tell by now, the Fed ratcheted up interest rates yesterday … and Wall Street is none […]

Burning Down The Housing Market; Tesla’s Trouble Is Just Getting Started June 16, 2022 Great Stuff A House Is A House Is A House… Happy Thursday, Great Ones, and welcome to another Thursday Throwdown, where — oof, good God, what’s going on with the market?! We’re doing that sell-off-the-whole-world thing again, huh? If you couldn’t tell by now, the Fed ratcheted up interest rates yesterday … and Wall Street is none […]