Latest Insights on FB

The Fed Can’t Fix Inflation … Because It Didn’t Cause It December 17, 2021 Big Picture. Big Profits., Investing Chair Jay Powell did a masterful job convincing the markets this week that the Federal Reserve would address inflation. But can the Fed actually do anything about it? In this week’s video, I review the history of the Fed’s easy-money policies to show why it can probably do no such thing. The Fed is following […]

The Fed Can’t Fix Inflation … Because It Didn’t Cause It December 17, 2021 Big Picture. Big Profits., Investing Chair Jay Powell did a masterful job convincing the markets this week that the Federal Reserve would address inflation. But can the Fed actually do anything about it? In this week’s video, I review the history of the Fed’s easy-money policies to show why it can probably do no such thing. The Fed is following […] 3 EV Makers With Big Plans for 2022 December 16, 2021 Technology, Winning Investor Daily Here are a few upcoming EVs that you need to pay attention to.

3 EV Makers With Big Plans for 2022 December 16, 2021 Technology, Winning Investor Daily Here are a few upcoming EVs that you need to pay attention to. Bank It or Tank It: Time to Get Bullish! December 16, 2021 Bank It or Tank It, Quick Takes, Stocks, True Options Masters Other investors may be worried, but Chad Shoop is extremely bullish — so much so that five stocks landed on his Bank It list today...

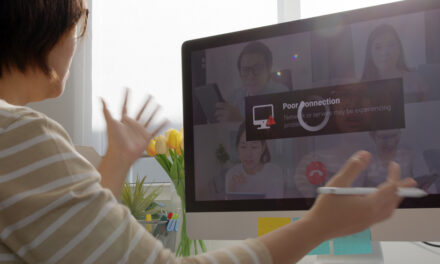

Bank It or Tank It: Time to Get Bullish! December 16, 2021 Bank It or Tank It, Quick Takes, Stocks, True Options Masters Other investors may be worried, but Chad Shoop is extremely bullish — so much so that five stocks landed on his Bank It list today... Crypto Can Eliminate Internet Outages Forever December 15, 2021 Cryptocurrency, Technology, Winning Investor Daily Amazon’s historic nine-hour internet outage affected everything from Roombas to online test-taking platforms.

Crypto Can Eliminate Internet Outages Forever December 15, 2021 Cryptocurrency, Technology, Winning Investor Daily Amazon’s historic nine-hour internet outage affected everything from Roombas to online test-taking platforms. Time to Cash Out? December 15, 2021 Big Picture. Big Profits., Trading Strategies, U.S. Economy Break out the games! Every year, when my kids start their Christmas break, we tend to play a lot more games as a family to pass the cold winter days. We have our favorites. Cashing Out The world’s richest often make splashy headlines for their splurges. This time around, it’s about what they’re selling. That’s […]

Time to Cash Out? December 15, 2021 Big Picture. Big Profits., Trading Strategies, U.S. Economy Break out the games! Every year, when my kids start their Christmas break, we tend to play a lot more games as a family to pass the cold winter days. We have our favorites. Cashing Out The world’s richest often make splashy headlines for their splurges. This time around, it’s about what they’re selling. That’s […]