Latest Insights on RAD

Tesla’s Q3 Earnings: Slowing Sales and Free Cash Flow Drop October 28, 2019 American Investor Today, Investing, Technology Tesla’s stock rose by 20% last Wednesday, after the company reported earnings. Headlines touted about the surprising profits for the tech giant. But Charles Mizrahi knows to look beyond the headline hype. He breaks down Tesla’s earnings report for the third quarter of 2019 — and he shows you what the numbers say. (6-minute video)

Tesla’s Q3 Earnings: Slowing Sales and Free Cash Flow Drop October 28, 2019 American Investor Today, Investing, Technology Tesla’s stock rose by 20% last Wednesday, after the company reported earnings. Headlines touted about the surprising profits for the tech giant. But Charles Mizrahi knows to look beyond the headline hype. He breaks down Tesla’s earnings report for the third quarter of 2019 — and he shows you what the numbers say. (6-minute video)  The 5G Boom Is Here: Invest In This Life Changing Technology October 26, 2019 Investment Opportunities, Technology, Winning Investor Daily The new 5G internet is more than 10 times faster than 4G. This massive upgrade will enable a wide variety of new devices and industries, setting investors up for quick 100%-plus gains.

The 5G Boom Is Here: Invest In This Life Changing Technology October 26, 2019 Investment Opportunities, Technology, Winning Investor Daily The new 5G internet is more than 10 times faster than 4G. This massive upgrade will enable a wide variety of new devices and industries, setting investors up for quick 100%-plus gains. Trade War Update; Amazon Spends Big; Christmas Is Coming October 25, 2019 Great Stuff Friday Four Play: The “It’s Way Too Quiet” Edition If you’ve been following the Great Stuff Trade War Cycle chart, you know that we’ve been stuck at “No progress is made” for about two weeks. There have been no major headlines. No tweets from President Trump. Nothing. It’s been unusually quiet … almost too quiet. […]

Trade War Update; Amazon Spends Big; Christmas Is Coming October 25, 2019 Great Stuff Friday Four Play: The “It’s Way Too Quiet” Edition If you’ve been following the Great Stuff Trade War Cycle chart, you know that we’ve been stuck at “No progress is made” for about two weeks. There have been no major headlines. No tweets from President Trump. Nothing. It’s been unusually quiet … almost too quiet. […] Gold Miners Share Price Plunge — It’s Time to Buy Shares Now October 25, 2019 American Investor Today, Commodities, Gold, Investing The share prices of gold miners dropped by double digits over the past couple of months. Many investors are overreacting to the downturn, but not contrarian expert Matt Badiali. He sees this as a great buy-in opportunity. Today, Matt explains why you should go against the crowd and buy gold stocks. (2-minute read)

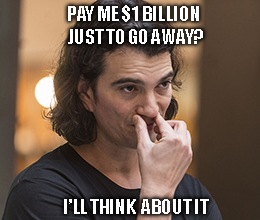

Gold Miners Share Price Plunge — It’s Time to Buy Shares Now October 25, 2019 American Investor Today, Commodities, Gold, Investing The share prices of gold miners dropped by double digits over the past couple of months. Many investors are overreacting to the downturn, but not contrarian expert Matt Badiali. He sees this as a great buy-in opportunity. Today, Matt explains why you should go against the crowd and buy gold stocks. (2-minute read) WeWork’s Lesson in Unicorn Chasing; Tesla Bears Get Crushed October 24, 2019 Great Stuff The Trouble With Chasing Unicorns I think it’s safe to say that I have a unique sense of humor. That’s putting it politely. It’s definitely not one you find very often in the financial realm. However, the saga of WeWork has brought out the inner cynic in more than a few op-ed writers lately. I […]

WeWork’s Lesson in Unicorn Chasing; Tesla Bears Get Crushed October 24, 2019 Great Stuff The Trouble With Chasing Unicorns I think it’s safe to say that I have a unique sense of humor. That’s putting it politely. It’s definitely not one you find very often in the financial realm. However, the saga of WeWork has brought out the inner cynic in more than a few op-ed writers lately. I […]