Latest Insights on VIX

Spread Trades: 10X Less Risk, Same Steady Income August 19, 2022 Investing, Trading Strategies, True Options Masters Unlike 99% of income traders, Amber Hestla doesn't settle for unlimited risk. How? An overlooked tool called spread trades...

Spread Trades: 10X Less Risk, Same Steady Income August 19, 2022 Investing, Trading Strategies, True Options Masters Unlike 99% of income traders, Amber Hestla doesn't settle for unlimited risk. How? An overlooked tool called spread trades... The 3 Steps to Steady Options Income August 17, 2022 Investing, Trading Strategies, True Options Masters In order to be a successful options trader, you need well-defined processes — like Amber's 3-step income strategy...

The 3 Steps to Steady Options Income August 17, 2022 Investing, Trading Strategies, True Options Masters In order to be a successful options trader, you need well-defined processes — like Amber's 3-step income strategy... Profit From the Market’s Plunge June 21, 2022 Big Picture. Big Profits., Investment Opportunities, Trading Strategies Last week, we saw a lot of doom and gloom surrounding inflation, the Fed’s recent rate hikes and our entry into bear market territory. But what if I told you the market’s plunge could actually be a path toward quick profits? Today, I'll be revealing two factors to spot weak stocks and when/how to play the downside.

Profit From the Market’s Plunge June 21, 2022 Big Picture. Big Profits., Investment Opportunities, Trading Strategies Last week, we saw a lot of doom and gloom surrounding inflation, the Fed’s recent rate hikes and our entry into bear market territory. But what if I told you the market’s plunge could actually be a path toward quick profits? Today, I'll be revealing two factors to spot weak stocks and when/how to play the downside. Consumer Sentiment Crashes, Ulta Splashes & DocuSign Faxes June 13, 2022 Great Stuff It’s Times Like These… Great Ones, I was all ready to come into today like a new day rising … a brand-new sky to hang the stars upon tonight. I figured that after last week’s barrage of bad news and Wall Street’s accompanying sell-off, the markets would even out a bit. After all, most of […]

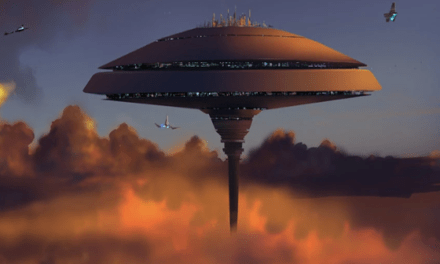

Consumer Sentiment Crashes, Ulta Splashes & DocuSign Faxes June 13, 2022 Great Stuff It’s Times Like These… Great Ones, I was all ready to come into today like a new day rising … a brand-new sky to hang the stars upon tonight. I figured that after last week’s barrage of bad news and Wall Street’s accompanying sell-off, the markets would even out a bit. After all, most of […] Microsoft Closes The Console Curtain; Nio’s Future Remains Uncertain June 9, 2022 Great Stuff Microsoft’s Cloud City Today, Great Ones, we’re launching headfirst into a great adventure. We’ll start by joining Microsoft (Nasdaq: ), zoning out for an hours-long gaming sesh — hey, it is almost Friday — and generally getting lost in the clouds. Hold up, we gotta talk about that image up there. Is that … Cloud […]

Microsoft Closes The Console Curtain; Nio’s Future Remains Uncertain June 9, 2022 Great Stuff Microsoft’s Cloud City Today, Great Ones, we’re launching headfirst into a great adventure. We’ll start by joining Microsoft (Nasdaq: ), zoning out for an hours-long gaming sesh — hey, it is almost Friday — and generally getting lost in the clouds. Hold up, we gotta talk about that image up there. Is that … Cloud […]