Latest Insights on SEV

Stop Worrying and Learn to Love Volatility December 9, 2021 Investing, Trading Strategies, True Options Masters Chad Shoop loves volatility, and so should you! With options, you can profit on both sides of the trade — so long as you understand this...

Stop Worrying and Learn to Love Volatility December 9, 2021 Investing, Trading Strategies, True Options Masters Chad Shoop loves volatility, and so should you! With options, you can profit on both sides of the trade — so long as you understand this... Lovesac’s Lovefest; Roku’s Rabble Rousers; A Stitch Fix In Time… December 8, 2021 Great Stuff Lovesac, Baby! If you see amazing earnings at the side of the road, it means a 9% rally for Loooovesac! Lovesac, yeah yeah! We’re heading down the Wall Street highway, looking for a Lovesac getaway. Heading for a Lovesac (Nasdaq: ) getaway. I got me some earnings — they’re as big as a whale — […]

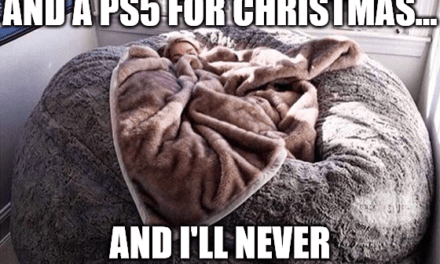

Lovesac’s Lovefest; Roku’s Rabble Rousers; A Stitch Fix In Time… December 8, 2021 Great Stuff Lovesac, Baby! If you see amazing earnings at the side of the road, it means a 9% rally for Loooovesac! Lovesac, yeah yeah! We’re heading down the Wall Street highway, looking for a Lovesac getaway. Heading for a Lovesac (Nasdaq: ) getaway. I got me some earnings — they’re as big as a whale — […] BIG Market Moves Mean BIG Opportunities December 7, 2021 Trading Strategies, Winning Investor Daily When the market moves this much, day trading has the potential to be lucrative.

BIG Market Moves Mean BIG Opportunities December 7, 2021 Trading Strategies, Winning Investor Daily When the market moves this much, day trading has the potential to be lucrative.  Fed Tightening? Time to Change Your Financial Wardrobe December 7, 2021 Big Picture. Big Profits., Economy, News At first, it was tough to forgo almost all carbohydrates except those from vegetables … especially from a guy renowned for his pasta dishes. And my breakup with rice was especially poignant, given my love of South and Southeast Asian food. But I made the changes — and today I’m better for it. The Federal Reserve’s recent hawkish turn suggests a different kind of belt-tightening is just around the corner. Just as I had to give up some things to achieve the goal of a stable, healthy me, financial markets must make some changes if the Fed starts tightening interest rates. What are they likely to be, and how could they affect your portfolio?

Fed Tightening? Time to Change Your Financial Wardrobe December 7, 2021 Big Picture. Big Profits., Economy, News At first, it was tough to forgo almost all carbohydrates except those from vegetables … especially from a guy renowned for his pasta dishes. And my breakup with rice was especially poignant, given my love of South and Southeast Asian food. But I made the changes — and today I’m better for it. The Federal Reserve’s recent hawkish turn suggests a different kind of belt-tightening is just around the corner. Just as I had to give up some things to achieve the goal of a stable, healthy me, financial markets must make some changes if the Fed starts tightening interest rates. What are they likely to be, and how could they affect your portfolio? Why You Should Never Enter Trades Without an Exit Plan December 7, 2021 Investing, Trading Strategies, True Options Masters Many traders open a position without a sound exit plan. Not Mike Carr — his upcoming ETF strategy uses logic to determine when to sell.

Why You Should Never Enter Trades Without an Exit Plan December 7, 2021 Investing, Trading Strategies, True Options Masters Many traders open a position without a sound exit plan. Not Mike Carr — his upcoming ETF strategy uses logic to determine when to sell.