Investors are worried. Concerns include high valuations, low volatility, an ageing bull market and an economy unable to grow quickly. Of course, these concerns aren’t new. Investors have worried about these things for years. And these are all good reasons to worry. But, stock momentum tells us stocks are in a safe zone.

That’s a relatively rare time when prices move up. Crashes and large sell-offs occur when this indicator is out of the safe zone.

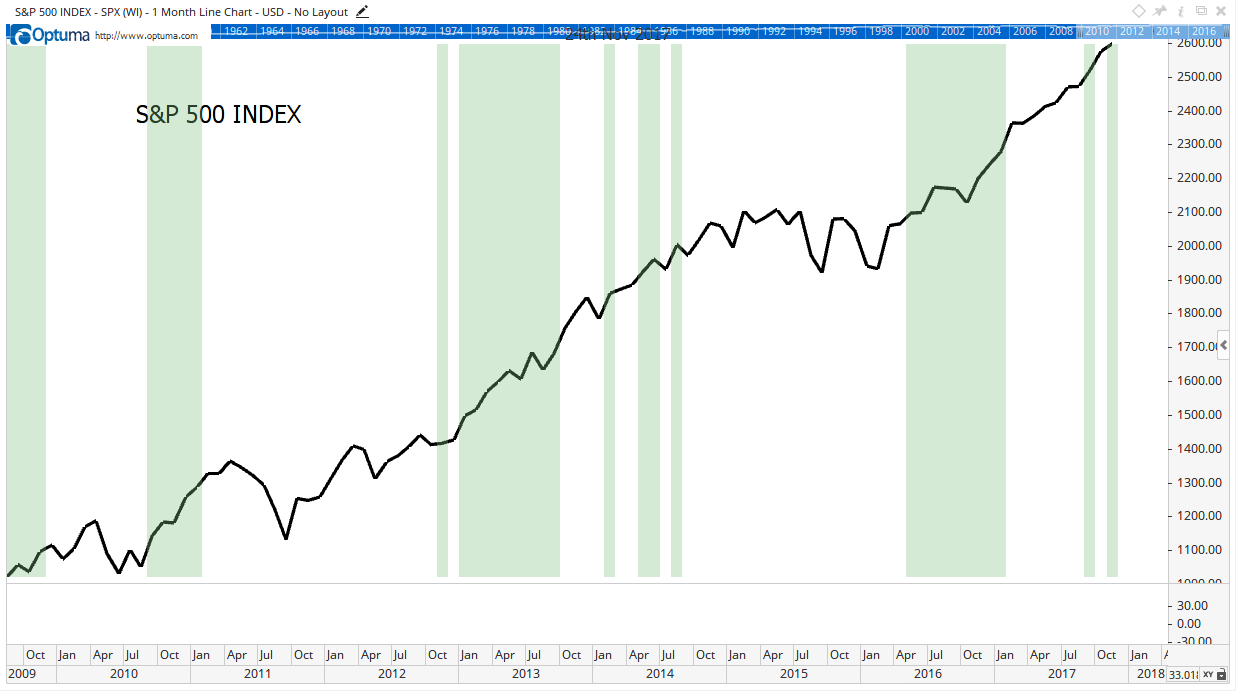

In the chart below, green shows the safe zone. It’s a long-term chart of the S&P 500 Index using monthly data. That makes it useful for long-term investors.

This indicator measures stock momentum — a measure of how fast stocks are rising. Research proves stock market momentum is difficult to reverse. Price gains almost always lead to more price gains.

The safe zone indicator shows when stock momentum is bullish and rising. It’s designed to show only the strongest part of a bull market. The time to sell is when it’s bullish but falling.

Market crashes and large downturns always occurred outside the safe zone. Bottoms also form outside of the safe zone.

That means this indicator isn’t a traditional stock market timing tool. Instead of telling us when to buy or sell, it tells investors how aggressive they should be. According to the chart, now is the time to maximize potential gains with aggressive investment options.

What’s more, the current safe zone coincides with the strongest month of the year. Since 1928, the S&P 500 index closed higher 74% of the time. The next best month, April, has a win rate of 64%. The odds favor investing aggressively in December.

Now is the time for high risk, high return strategies. Consider buying call options on PowerShares QQQ Trust (Nasdaq: QQQ) or iShares Russell 2000 ETF (NYSE: IWM).

QQQ tracks the Nasdaq 100 index. These are the most volatile tech stocks.

IWM tracks small-cap stocks. These are the stocks with the largest average returns in the long run.

Call options can magnify the gains of these indexes and could deliver a gain of more than 100% by the end of the year.

Regards,

Michael Carr, CMT

Editor, Precision Profits