Stock prices have been dropping since October. Yet they can still drop more.

That’s because, even after double-digit declines, stocks remain overvalued.

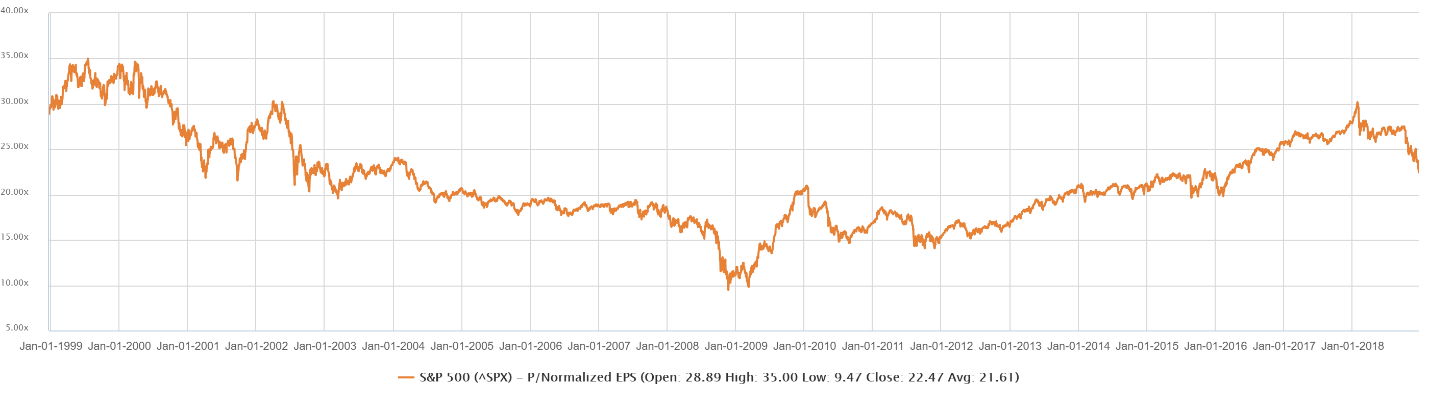

The chart below shows the price-to-earnings (P/E) ratio for the S&P 500 Index. The P/E ratio measures the value of stocks.

Low readings show stocks are a bargain. High readings warn of possible declines.

This chart confirms the bear market is just beginning.

(Source: CapitalIQ)

Right now, after a steep decline, the P/E ratio is about 22.5. The last time the P/E ratio was this low was in March 2016, right before the index rallied 22% over 12 months.

But there’s almost no chance of a rally this time.

Based on the P/E ratio, stocks are more overvalued than they were at any time from 2004 to 2016.

That 12-year run included an important market top. Before the 2008 bear market, stocks were overvalued, trading at 19 times earnings.

To get back to 19, the P/E ratio needs to drop about 15%.

That assumes earnings hold steady. But earnings drop in a recession, and there’s a good chance of a recession next year.

Federal Reserve Chairman Jerome Powell confirmed that when he said the economy faces headwinds. He added that the Fed will not be as aggressive as expected in 2019.

Those were ominous warnings from a Fed chairman.

All indicators continue to point to a large decline in stocks over the next few months. That includes fundamental indicators like P/E ratios and technical indicators like momentum.

In bear markets P/E ratios often fall below 10. The low in 2009 was 9.8. That’s more than 55% below the current level.

The risks outweigh the rewards in this market. While bulls note that stock market valuations are near three-year lows, rational investors know valuations are well above average.

This is a time to reduce risk. It is also time to consider put options to pursue gains as prices fall.

Regards,

Michael Carr, CMT, CFTe

Editor, Peak Velocity Trader