Space: The final frontier. These are the voyages of the starship Enterprise…

Captain James T. Kirk says this at the start of every Star Trek episode.

The original TV series started airing in 1966. Today, it’s one of the most recognizable and highest-grossing media franchises of all time.

Star Trek was able to make money from the idea of outer space.

And in the real world, space stories seemed like a great idea with plenty of investing promise…

Virgin Galactic is the world’s first commercial spaceline. Rocket Lab provides access to space satellites. Astra Space is launching satellites into low Earth orbit.

Investors became suckers for a good story. They bought in … hook, line and sinker.

But it turns out that these companies trying to capitalize on space exploration aren’t great businesses to invest in.

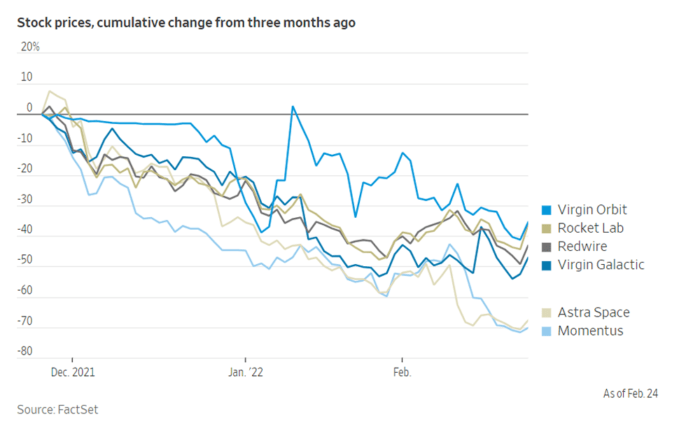

In the last three months, gravity has pulled their stock prices back to Earth.

Virgin Galactic is down 47%. Rocket Lab has dropped 36%. And Astra Space is down 70%.

(Click here to view larger image.)

I’ve seen this movie so many times before…

Falling Back to Earth

A great idea and promise of instant riches suck investors in.

The investment banks and company insiders sell their shares to a gullible public.

Wall Street’s marketing fuels the greed glands of average investors. They can’t buy shares of the shiny, new idea fast enough. Stock prices soar to the moon.

But then, they come crashing back down to earth. And average investors are left holding a huge bag of losses.

What most investors don’t realize is that the stock price follows the value of the business, not the other way around.

That, in a nutshell, is why I’ve never recommended a space stock. Because with space stocks, there was no value to be had…

Many of them were roach motels. Money went in, and never came out.

And those who invested in them learned this the hard way: At the end of the day, price is what you pay, and value is what you get…

Melting Ice Cubes

I don’t buy stocks like people buy lottery tickets — with a dollar and a dream.

And neither should you.

I’ve learned this by watching Warren Buffett for the past several decades.

Buffett and his business partner Charlie Munger own stocks based on the long-term value of the businesses. As they say:

And in Alpha Investor, we’re the same way.

If you buy stocks based on valuations like we do, there’s a floor built-in. The businesses are worth something of real value: cash, customers and profits.

Most times, story stocks — like space startups — have no floor. Their businesses are money losers and deeply in debt.

They’re like melting ice cubes. Each day, they’re worth less and less … especially in the volatile markets we’re seeing now.

Even quality companies with real value and earnings are being discounted these days.

But that gives us a great opportunity. It means we can buy these businesses at attractive prices that don’t come around often.

For Alpha Investors looking to take advantage of this, look no further than my most recent recommendation.

Yesterday, I gave all the details on one company that’ll benefit from the semiconductor industry’s tailwinds and the chip shortage. (And it’s not a chipmaker!)

If you missed it, you can catch up right here.

And if you’re not an Alpha Investor yet, it’s never too late to join! Don’t miss out on this buying opportunity. Find out how you can access my latest recommendation right here.

Regards,

Founder, Alpha Investor