I was doing academic fieldwork the first time I ever saw cotton growing on a plant.

Heading to an outcrop of rock in eastern North Carolina, I saw a cut farm field. White wisps of leftover cotton that looked like snow-dotted green bushes. I collected some of it because of the novelty … it’s probably still around my office somewhere, tucked into an old field bag.

Down there, cotton fields are as normal as sweet potatoes or tobacco. When they harvest the fields, the cotton is packed into large, 480-pound bales. In that part of the country, one acre of cotton plants will yield about two bales. That’s a lot of cotton. One bale of cotton can become 215 pairs of jeans, 1,256 pillowcases or 313,600 $100 bills.

Even though the fluffy crop touches nearly every part of our lives, most investors don’t ever think about investing in cotton. But with cotton making a serious move, they should.

Cotton plants are useful for a multitude of things … from animal feed to soap to pharmaceuticals to rubber and plastics. We even use the fiber in the clothes we wear and the cosmetic puffs in that glass jar on your bathroom counter.

When we talk about cotton from a commodity point of view, there are three aspects: the seed (as cattle feed), the oil and the fiber (the bales I discussed earlier).

Right now, cotton fiber is in a bull market, with room for us to make money.

A Global Supply Shortage

According to the latest U.S. Department of Agriculture survey, the global crop this year will be about 105.4 million bales of cotton fiber. That figure is updated continually as crop news changes.

For example, in the latest version, China’s crop estimate rose by 500,000 bales, while Pakistan’s, Uzbekistan’s and Turkmenistan’s estimates fell by about 450,000 bales total.

Even with the rosiest of outlooks, that supply will not be enough to meet demand this year. Mills need about 112.5 million bales. We’re looking at a 7.1 million-bale shortfall — about 7% of the total crop.

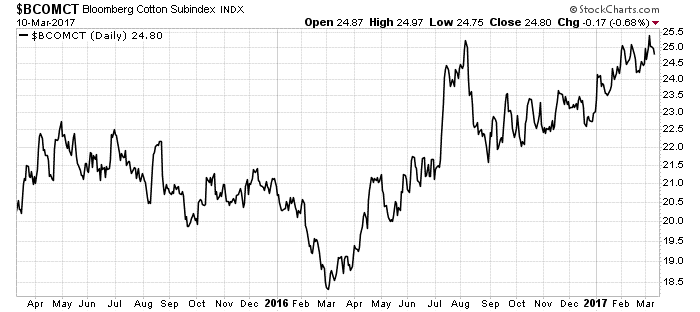

That is driving a bull market in cotton prices, as you can see below:

As you can see, the Bloomberg Cotton Subindex is up from about $18.50 a year ago to over $25 today, for a gain of 35%. However, we are still well below the 2011 high, when the subindex soared to over $50. Even a rally just to that level means a 100% move in the commodity.

Investing in Commodities Made Easy

Unfortunately, many investors avoid soft commodities, even in bull markets like cotton is in today. If we had this situation — demand exceeding supply by 7% — in something such as gold, we would see a huge rally in mining stocks. Even your plumber would be talking about it.

However, that doesn’t happen in soft commodities such as sugar, coffee and cotton. Most investors think it’s too hard to invest in commodities.

But that’s the sort of opportunity I will discuss in my newsletter, which we will be launching next month. I’m planning on seeing impressive gains like the 60,000 subscribers of Paul’s Profits Unlimited newsletter have been enjoying.

I won’t just hit on the same, tired natural resource investments. Natural resources move in cycles, some climbing while others are falling. It takes a lot of work to find uptrends when the main commodities such as oil and gold are headed down. But that’s where we will profit while others sit on the sidelines. We will be investing in trends that other investors have not noticed, and we will profit when they finally come on board.

In the case of cotton, there are a couple of simple ways to invest: either the iPath Bloomberg Cotton ETN (NYSE Arca: BAL) or the iPath Pure Beta Cotton ETN (NYSE Arca: CTNN).

Both of these exchange-traded notes use cotton futures to attempt to capture cotton’s gains. This is a speculation that is not for everyone. However, it looks great right now with the market undersupplied.

Good investing,

Matt Badiali

Senior Editor, Banyan Hill Publishing

P.S. My colleague Michael Carr will finally be revealing his trading strategy in a webinar on Tuesday, March 21. He’s spent over $300,000 of his own money improving and perfecting this strategy over the last 10 years … and he made more money from the stock market than he knows what to do with. Now he’s living the retirement lifestyle of his dreams … and he wants to show you how anyone can do the same. Click here to reserve your spot in this exclusive webinar.