Once again, the Saudi rhetoric machine swings into gear. And as usual, the market follows right along.

Saudi Arabia does a masterful job of talking the price of oil higher. The headlines are full of Saudi talking points. Without ever taking any action, the Saudis manipulate the oil price.

The headline from Reuters said: Saudi Arabia ready to extend oil output cut deal: Crown Prince.

The Wall Street Journal’s headline said: Saudi Arabia, Russia Want to Extend Oil Production Cuts.

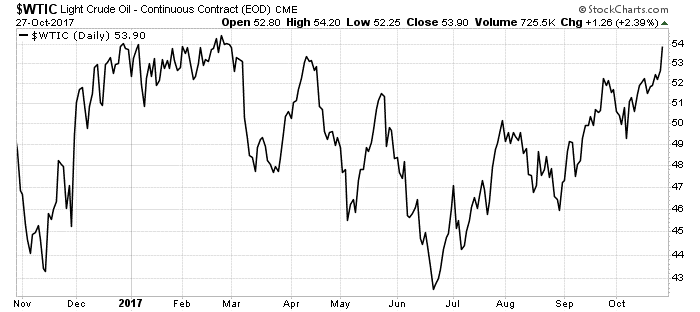

Those are just two of the many news outlets that carried this latest story. That was the tenor of the news for the last couple of weeks — Saudi Arabia says it wants to extend the oil production cuts. As you can imagine, that had an impact on oil prices:

As you can see, the price of oil rose on those comments. At $53.90 per barrel, it is close to a 52-week high. That would also be the highest price since mid-2015.

The truth is, Saudi Arabia isn’t really cutting production. It averaged 12.2 million barrels of oil per day over the past year (from July to July), according to the Energy Information Administration. That’s more average daily production than it’s had since the 2013-2014 period.

But it does talk a great game.

However, supply isn’t the only thing driving the oil price up. Demand is rising around the world.

I believe we could see oil prices spike higher this year. And Saudi Arabia is doing all that it can to help that happen.

Good investing,

Matt Badiali

Editor, Real Wealth Strategist