When I asked you if we’d see a recession in 2022, I wasn’t expecting all hell to break loose in the market.

But that’s exactly what happened over the past week.

On Wednesday, the Federal Reserve announced an interest rate hike of 0.5%. It was the largest raise in over 20 years.

At first, the markets were thrilled. They rallied sharply higher, posting their best day in two years.

But those gains were wiped out in Thursday’s trading session.

The Dow Jones Industrial Average and the Nasdaq Composite Index both saw their worst single-day drops since 2020.

The S&P 500 Index, meanwhile, experienced its second-worst day of the year.

Last week’s market mayhem made your poll results all the more insightful.

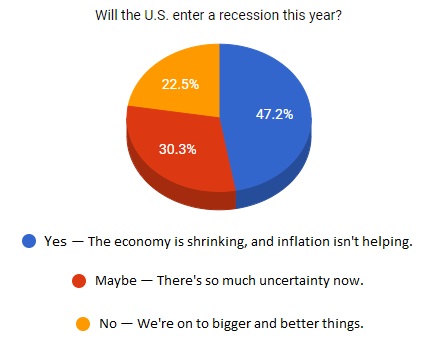

Will we see a recession in 2022? Here’s what readers like you had to say:

Nearly half of Winning Investor readers believe that the economy is shrinking, while one-third think there’s too much uncertainty to tell.

But, as Ian King discussed in his latest article, the odds of a recession right now are only 35%.

So while we need to keep an eye on market volatility for the foreseeable future, it looks like a recession is off the table. (At least for now.)

Keep reading below for this week’s Winning ideas.

This Week’s Winning Ideas

Gear Up for the Semiconductor Super Cycle — Steve Fernandez and Ian King are gearing up for a long rally in semiconductor stocks. Here’s why.

This Historic Bear Market Sets Up a Snapback Rally — If history is any guide, we may be setting up for a snapback rally in the second half of the year.

Real Estate Is Getting a Crypto-Fueled Upgrade — Some startups are tackling Miami’s real estate problem by creating a next-generation mortgage product.

Has Warren Buffett Finally Lost His Mind? — Warren Buffett loves to hate bitcoin. But he never mentions its incredible track record…

Jamie Dimon Should Be Terrified of DeFi — Here’s how the DeFi industry is reinventing what it means to be a bank.

Best Wishes,

Senior Managing Editor, Banyan Hill Publishing