Friday Four Play: The “Two Wrongs Don’t Make A Right” Edition

Great Ones, today I’m tempted to change my opinion on a stock out of simple spite alone. That stock is solid-state battery researcher QuantumScape (NYSE: QS).

Regular Great Ones know that QuantumScape is my go-to punching bag for everything that’s wrong with the SPAC market. It has no products. It has no revenue. And it won’t have either for years — if at all.

And yet, QuantumScape has a market capitalization of more than $13.6 billion. It attained this valuation from electric vehicle (EV) market hype, easy Wall Street money and more EV hype.

Talk about money for nothing…

And your chicks for free?

Yeah, that ain’t working. But one of the few things that sets me on edge just as much as no-product SPACs is short selling hedge funds. Yesterday, Scorpion Capital called QuantumScape a “pump and dump SPAC” scam. Here’s a bit more from Scorpion’s paper:

First off, I despise the fact that a hedge fund can short a stock and then publicly put out a hit piece on that stock to deliberately manipulate the market. This seems like it should be illegal.

Second … Scorpion Capital? Really? Did the founder let his pre-teen, Fortnite-playing son name his company?

Bruh, dad bruh … scorpions are pretty kickass. Just look at this Mortal Kombat game! He yeets spears and fire and stuff. You should, like, totally call your company that. Bruh!

Whatever…

QuantumScape’s response was typical denial: “QS stands by its data, which speaks for itself.”

Unlike other failed SPACs, EV companies and alternative-energy firms — cough Nikola cough — QuantumScape’s research and data do back up its claims.

QuantumScape’s only real problem is upscaling its technology from small, proof-of-concept displays to full-size mass-production quality. However, accomplishing this feat is no small hurdle at all.

It’s why QS’ technology has been “just four years away” for some time.

But, Mr. Great Stuff, wouldn’t that mean that Scorpion is right?

Shudder… Right Scorpion may be in its research on QuantumScape, but that doesn’t change the fact that it’s profiting from a tactic that neither you nor I have access to. Nor should we … or should Scorpion, for that matter.

But I thought we were trading in a free market!

You’re foolin’ yourself. Listen: Strange hedge funds short selling stocks and bashing companies is no basis for a system of trading. Supreme trading power derives from a mandate from the masses, not from some farcical hedge fund ceremony.

I mean, if I went around saying I think QuantumScape is a fraud all while massively shorting the company, the SEC would put me away.

Help! Help! I’m being repressed!

Too right, Great Ones. Too right. But there are ways for you to play Wall Street’s game of thrones and win.

Is it possible to learn this power?

Yes, but not from a Jedi. Did you ever hear the story of Michael Carr the wise? I thought not. It’s not a story the hedge funds would tell you. It’s a ‘Stuff legend…

Last year, Mike tried a new approach that’s completely different. It’s just one trade at a time — even better, it’s the same trade every time. And it did eight times better than the stock market’s leading benchmark.

If you find yourself tired of tracking too many stocks and too many different strategies, then give Mike a few minutes, and he’ll simplify everything for you forever. Click here to learn more.

And now for something completely different, here’s your Friday Four Play:

No. 1: It’s A Trap!

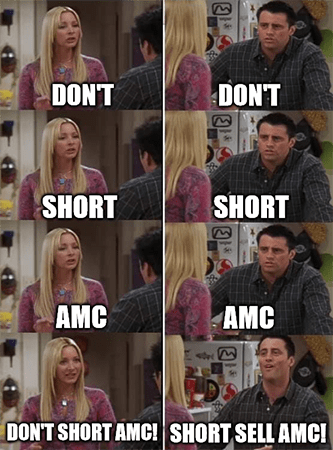

It’s not just SPACs and EV companies that short sellers are heavily targeting. AMC Entertainment (NYSE: AMC), the world’s largest theater chain operator, is also under fire from the shorties.

In a recent YouTube interview, AMC CEO Adam Aron claimed that the movie maven was “under attack” from short sellers. During March, AMC short interest surged 50% to 73.8 million shares.

But the AMC tale is different from QuantumScape. AMC actually provides a service and sells products. However, those products and services were severely hampered by the COVID-19 pandemic. AMC dealt with the issue by reorganizing its debt and seeking approval for the sale of 500 million new shares.

On that last point, Aron said in the interview that AMC will not sell any of those new shares during 2021, but in future years. Maybe to help deal with lower ticket sales due to online streaming?

Oddly enough, the effects of the pandemic have made theater operators like AMC leaner and more efficient. And they’ll need that lean efficiency to deal with the growing digital storm of first-run, on-demand streaming blockbuster movies.

That said, I would not want to short AMC right now. The company is poised for a significant boom in business as vaccinations ramp up and the U.S. economy reopens to its full potential.

No. 2: Ultra PEP

If you were looking for non-bank-stock earnings this week, PepsiCo (Nasdaq: PEP) is what your trading taste buds seek. Revenue came in $270 million above analysts’ $14.55 billion estimates, while per-share earnings topped expectations by $0.09 — a narrow beat but a beat nonetheless.

With restaurant-based sales falling off the face of the Earth, snack foods saved the day for Pepsi amid the pandemic — who would’ve guessed that?

PepsiCo CEO Laguarta gave a shout-out to Doritos 3D Crunch and Cheetos Crunch Pop Mix for much of its salty sales growth. Rockstar Energy is now back to positive sales growth ever since Pepsi bought it out last year and promptly defiled the brand as it “revamped” (ruined, according to caffeine-fiending Great Ones) its most popular drinks.

No. 3: You Better You Better EBET

One gamble you can make pretty safely right now is the Street’s appetite for more gambling — and gambling stocks. New IPO Esports Technologies (Nasdaq: EBET) looks to take over the online betting space for esports. And the stock instantly skyrocketed over 500% … until this morning’s launch party hangover, at least.

But … but are esports really that big?

Yeah, they are. Combined, virtual sports’ viewership is second only to the NFL, according to our home-skillet-biscuit Steve Fernandez over at Smart Profits Daily. And it’s not all just about that Fortnite, dude, bruh.

Esports Technologies is apparently a huge name in, well, esports technology. But fresh off its public debut, the company’s now adding in a betting and trading exchange — kinda like the DraftKings (Nasdaq: DKNG) of esports. Which is quite unfortunate for DraftKings since I thought it wanted to be the DraftKings of esports.

No. 4: Turkey Day Crash

Tryptophan? No, crypto ban!

Turkey joins the rest of the paranoid anti-crypto world today, announcing that crypto payments will be banned nationwide at the end of the month. Why? Apparently because bitcoin and other cryptos lack a “central authority regulation,” … which, unless I’m forgetting something, is the entire point of crypto.

China’s already banned cryptos for payments and financial transactions, but you can still own and trade them … for now. India is weighing an extremely harsh ban, making even owing a digital wallet a crime.

Yet, never fear — national cryptocurrencies will soon be here! Wouldn’t you love to replace your home fiat currency for … er, a virtual one? Is there even a difference?

Understandably, bitcoin has ebbed from recent highs following the news. Oh, and Coinbase (Nasdaq: COIN) fell from its lofty post-IPO perch because of the crypto clampdown uncertainty.

Great Ones, Fall In!

Listen up, you stock-slinging soldiers and crypto cadets. Yes, the weekend is upon us, but there will be no slouching — no time for relaxin’ — on my watch. If you’ve yet to share your bright, brimming thoughts with the rest of your fellow Great Ones, what’s stopping you?

Drop us a line with your market musings, portfolio ponderings and yes, all those lyrical requests too. Let us know what’s on your mind (or playlist) this weekend!

GreatStuffToday@BanyanHill.com is where all the coolest Great Ones hang all weekend long. Join us!

And you can even click right here to save a step. Finally, remember what Mr. Great Stuff always says: Like Stuff? Share Stuff! So be sure to share ‘Stuff with your friends, family and everyone right down your email list. Send it all!

And don’t forget that you can always check out Great Stuff on the web (click here) or follow us on social media: Facebook, Instagram and Twitter.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff