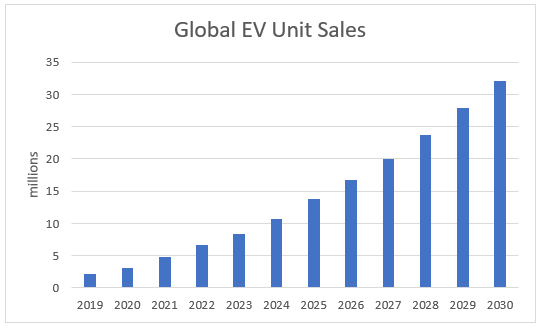

Electric vehicle (EV) adoption is reaching a whole new level.

Recent sales numbers have been insane.

There were 4.3 million EVs sold during the first three quarters of 2021.

That dwarfs the 3.1 million sold in all of 2020.

And that’s just the beginning.

Total sales for 2021 should come in at 6.1 million. That’s nearly double last year’s number.

And this rapid growth comes as overall auto sales are declining.

New car sales through September were down 11% from the previous five-year average.

The obvious way to play this trend is to buy automakers that produce EVs.

But the market already drove up automakers. So, by buying them now, you’re a bit late.

Instead, here’s what you should be buying to profit from EV growth…

The Key to Tech Mega Trends

A recent CarMax survey found that 56% of people are likely to purchase an EV as their next vehicle.

We’re firm believers that EVs will account for over half of vehicle sales by 2030.

At only 7% share of new vehicle sales now, there’s a ton of growth ahead.

(Source: BloombergNEF.)

Lithium-ion batteries are in virtually all EVs. They account for 30% of an EV’s total cost.

So, as EV adoption enters full swing, lithium will see huge demand.

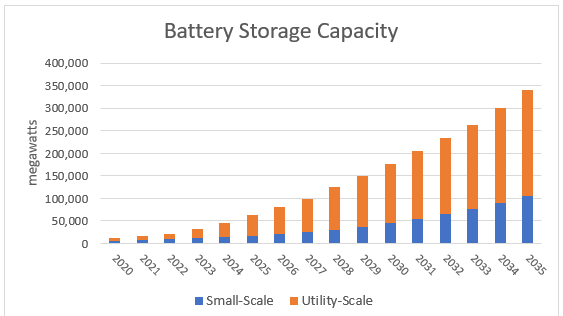

And it’s not just EVs that need lithium.

There’s another major use case that makes lithium stocks even more compelling.

Small and utility-scale battery storage depends on lithium.

It’s the key to storing renewable energy from sources like solar and wind.

And power from renewable energy will increase six times by 2035.

BloombergNEF estimates that battery storage capacity will increase by 2,950% during the same time frame.

(Source: BloombergNEF.)

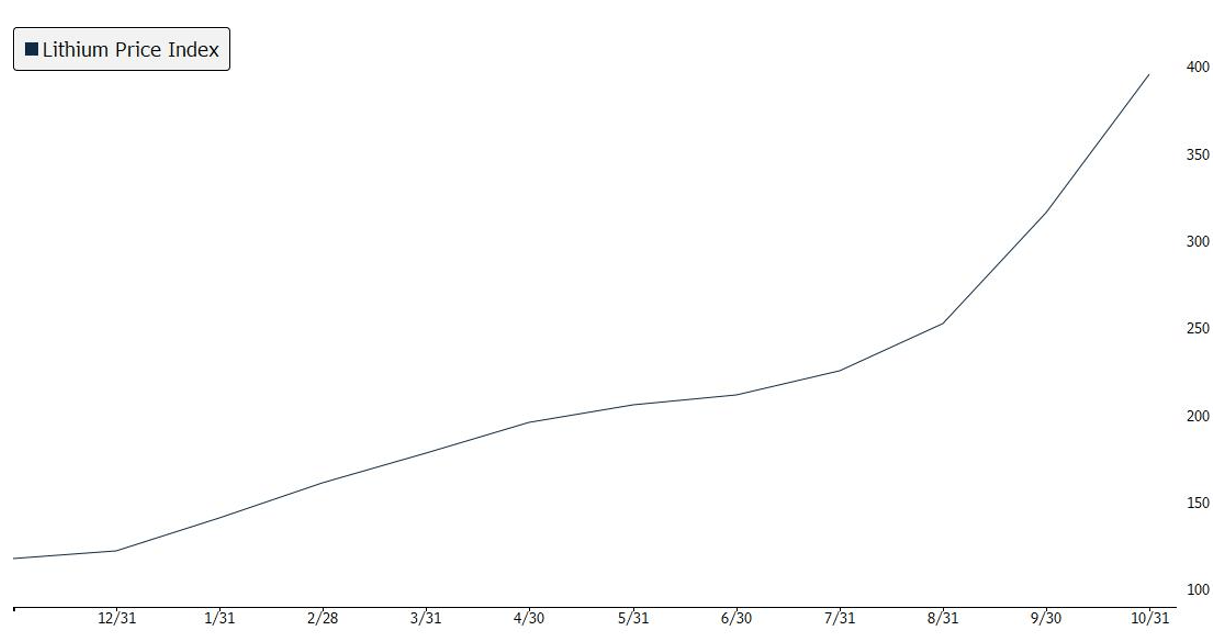

We’re Bullish on Lithium Stocks

Lithium’s soaring price reflects this massive demand.

The price of lithium has more than tripled in just the past year.

(Source: Bloomberg.)

Ian King and I recognized early that lithium is the key to mega trends like renewable energy and EVs.

So, in May, we recommended that his New Era Fortunes subscribers buy lithium-producer Livent Corp. (NYSE: LTHM).

Those that followed would be sitting on 70% gains in just six months.

But it’s not just Livent that we’re bullish on.

Ian recommended another lithium stock to his subscribers that’s currently trending higher.

You can check out Ian’s brand-new presentation about his New Era Fortunes strategy by clicking here.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

On Holding AG (NYSE: ONON) is a sports apparel and accessories company that is up 21% this morning. The move came after the company beat both top- and bottom-line estimates for its first quarter as a public company.

IonQ Inc. (NYSE: IONQ) is a company that develops general-purpose quantum computing systems. The stock is up 16% after Q3 results for the recently public company, showed that it is ahead of its competitors in the quantum computing space.

Canoo Inc. (Nasdaq: GOEV) is an electric vehicle manufacturer that is up 16% this morning. The move came after the company announced during earnings that it is accelerating its manufacturing schedule to begin in late 2022 instead of the initially announced timeline of 2023.

Lucid Group Inc. (Nasdaq: LCID), the luxury electric vehicle maker, is up 14% today. Even though the company missed estimates for Q3, it provided data on reservations for the Lucid Air, which shows high demand and revenue potential in the future.

Youdao Inc. (NYSE: DAO), an internet technology company, provides online services in content, community, communication and commerce in China. It is up 15% today after reporting earnings for Q3 that were upbeat despite the recent regulatory challenges Chinese stocks have faced.

I-Mab (Nasdaq: IMAB) is a clinical-stage biopharmaceutical company that develops biologics to treat cancer and autoimmune disorders. It is up 13% as it trades in sympathy with its competitors that have recently made regulatory advancements with the same type of growth hormone deficiency drugs I-Mab is working on.

Rackspace Technology Inc. (Nasdaq: RXT) operates as a cloud technology services company. It is up 13% after it reported strong results for Q3 and raised guidance for the rest of the year, delivering an encouraging revenue trajectory for Wall Street analysts.

Global-e Online Ltd. (Nasdaq: GLBE) provides a platform to enable direct-to-consumer cross-border e-commerce. It is up 12% today, continuing its upward trend from last week when it reported strong results for Q3.

Thyssenkrupp AG (OTC: TKAMY) is a German multinational conglomerate that focuses on industrial engineering. It is up 12% on the news that it is pursuing a $5.7 billion IPO for its business unit that builds hydrogen power plants.

Peloton Interactive Inc. (Nasdaq: PTON), the at-home-exercise equipment company, is up 12%. The stock has been on a downward slide since its poor Q3 earnings, but that trend was reversed this morning when the company announced a secondary stock offering worth $1 billion.