The price of copper is down, drawn back by fear over what trade wars and a strong dollar mean for growth in China and emerging markets.

Slower-than-expected growth trends to reduce copper demand, and prices.

But natural resources expert Matt Badiali likens it to someone pulling back a bowstring. When let go, the string snaps back.

And the price of copper is set to snap back in line with its bullish fundamentals.

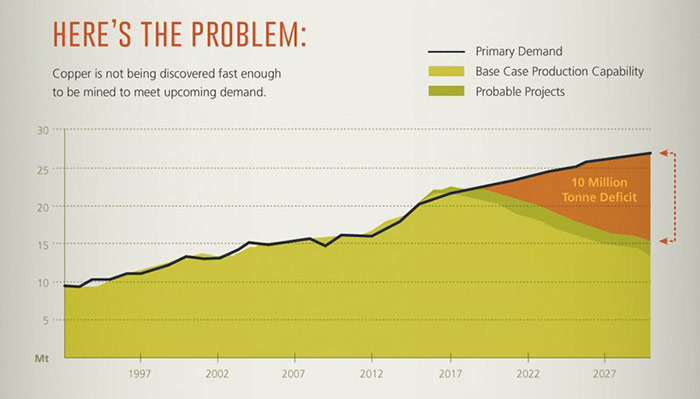

This chart from VisualCapitalist.com shows that copper is approaching a supply deficit. There won’t be enough copper above ground to satisfy demand for infrastructure projects and electric cars.

Without new discoveries, that deficit is expected to widen to 10 million tons in as many years.

Traders anticipated this in 2017.

Copper speculators grew more bullish than ever before. When 2017 ended, the price of copper reached a three-year high of $3.38 per pound.

We just witnessed the snapback. The price of copper fell 20% in the last 10 weeks.

That’s a natural reaction.

The bears will let go, prices will snap back and copper’s bullish fundamentals will add to the momentum, propelling copper prices higher.

Copper could rally by 50% in two years. Shoot, it could rally by 20% before the end of the year!

Now is a great time to put some money on the table.

If you want to bet the copper price will rise, you can buy shares of a copper producer. Stocks tend to move farther and faster than copper, which lets you enhance your return. But shares come with company-specific risk.

If you prefer, you can buy the Global X Copper Miners ETF (NYSE: COPX) instead. It’s a good proxy for the copper price, and it tracks a basket of the world’s biggest copper mining companies.

A supply deficit and rising prices give these companies every incentive to ramp up production. Buy now before this story lures the crowd back to copper.

Good investing,

John Ross

Senior Analyst, Banyan Hill Publishing

P.S. We originally published this article in August 2018. Since then, copper is up 6%! And John expects the copper price to rise by another 35%, especially as the electric-vehicle revolution ramps up.