In today’s Roaring ’20s video, I discuss:

- How the explosion of consumer credit fueled the booming economy of the 1920s.

- The everyday convenience that’s going to be killed off over the next decade.

- The new technology that will power the dominant payment system of the 2020s.

To watch my new video, click the play button below…

At the beginning of the 1920s, most Americans paid for things in full at the time of purchase, including big-ticket items like houses and cars.

By the end of the decade, 60% of consumer purchases were made on an installment plan.

Today, about 30% of Americans pay for things using an app on a mobile device.

It’s a safe bet that number will be a lot higher by 2030.

It’s a safe bet that number will be a lot higher by 2030.

The way people pay for things has a profound impact on consumer behavior, and thus on the economy.

In the 1920s, a combination of rapid economic growth, rising real incomes, low interest rates and aggressive marketing led to an explosion of consumer credit in a country that had historically prioritized savings.

The explosion of consumer credit in the 1920s meant that sales of automobiles, home appliances and furnishings, clothing, jewelry and even farm equipment and home improvements skyrocketed, fueling the booming economy.

From the end of the post-World War I recession in 1922 until the end of 1928, U.S. gross domestic product (GDP) grew by 40%.

Industrial production grew by 70%. Productivity grew by 75% and corporate profits grew by 62%.

That would simply not have been possible were it not for the explosive growth of consumer credit.

Conservative-minded businessmen reluctant to use installment sales were swiftly put out of business by those who embraced the new way of doing things.

Who will be the winners and losers in the battle of payment systems at the end of the 2020s?

Savings Down, Debt Up

In the 1920s, the balance of savings and debt shifted dramatically.

In 1920, the average U.S. household saved almost 13% of its income.

By 1930, that figure had dropped to just over 4%. By then, 80% of Americans had no savings at all. The top 2% of U.S. households held nearly 70% of the nation’s savings.

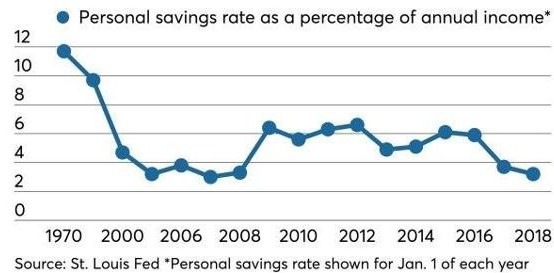

We approach 2020 with a somewhat different situation.

The difference today is that the U.S. savings rate has already fallen to extremely low levels. Chances are we will start the 2020s with a household savings rate of around 3%:

The decline in savings in the 1920s was matched by a dramatic rise in consumer credit.

From almost nothing in 1920, outstanding consumer credit grew to $1.38 billion by 1925.

By 1927, 15% of all consumer durables were bought on an installment plan. Sixty percent of automobiles were financed, as were 80% of radios.

By 1929, there was $3 billion of consumer credit outstanding, and $7 billion worth of consumer goods were purchased on installment plans — about 6% of GDP.

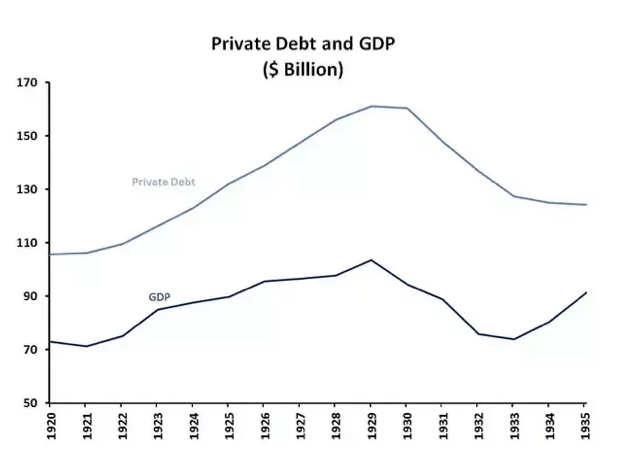

Overall, private debt rose at a much faster rate than GDP throughout the 1920s:

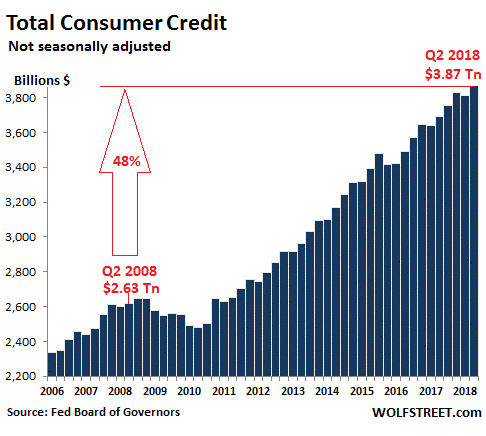

As with savings, we approach the 2020s with a different situation. U.S. consumers have already run up a large tab of credit.

Consumer credit outstanding rose by nearly 50% in the decade from the second quarter of 2008. Today it stands at all-time highs:

A New Revolution in How We Pay

The 1920s saw a revolution in the use of credit to finance consumer consumption.

That revolution has already happened. So in terms of savings and debt, we start the 2020s where the 1920s ended: low savings and high debt.

But we enter the “Roaring 2020s” with something unthinkable in those days.

In the 1920s, ordinary Americans paid for things with cash — including their credit installments. Many had bank accounts, but they were usually savings accounts without checking facilities.

Things couldn’t be more different today.

After World War II, U.S. banks introduced affordable checking accounts, which quickly became popular.

Starting in the 1950s, U.S. banks began to issue charge cards that had to be paid in full every month. In 1958, Bank of America launched the first modern credit card. Since then, credit and debit (payment) cards have rendered the use of checks obsolete for most everyday transactions.

Payment cards are next on the chopping block. Two things are going to kill them off during the 2020s — just as installment sales changed the nature of consumption in the 1920s.

First, mobile payment apps such as Apple Pay, Google Pay and Samsung Pay are already making the physical use of payment cards unnecessary.

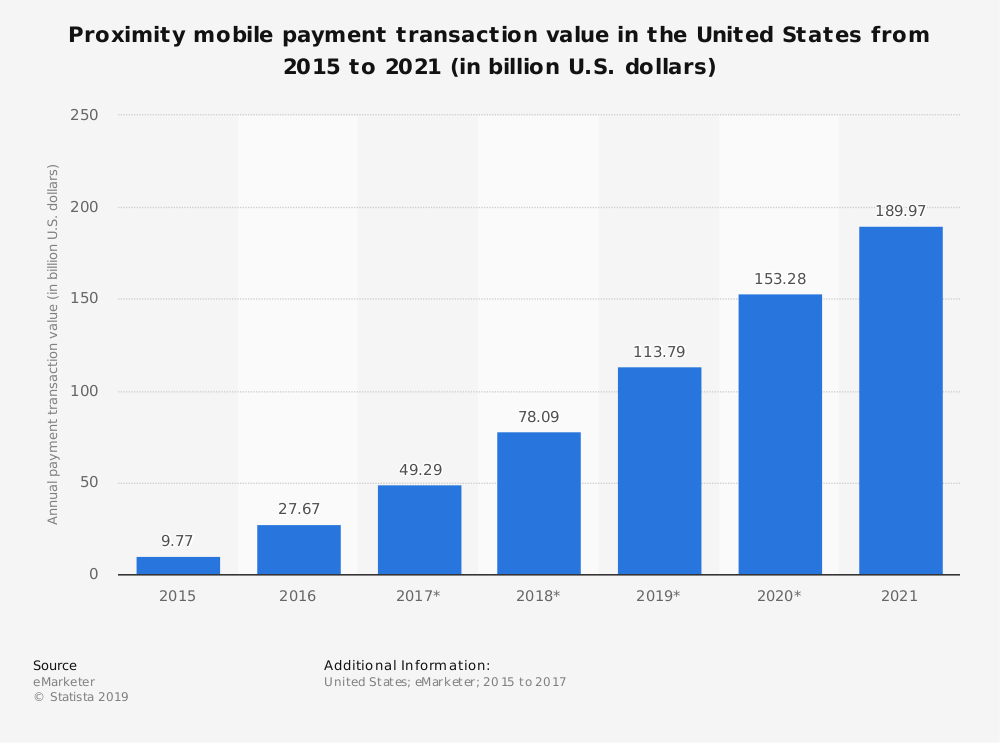

Over 50% of American consumers have some sort of “digital wallet.” Consumer payments using this technology are rising rapidly in the U.S.:

But mobile wallets such as Apple Pay are precisely that — just a place to store information about bank-based payment methods like debit or credit cards.

That’s why the second payment revolution of the 2020s will involve the removal of banks from the payment equation.

Even when you use a mobile wallet app like Apple Pay, you’re still transferring money from your bank or credit card account to the merchant’s account. It’s definitely safer than using a conventional payment card, but it’s not necessarily cheaper. Banks still get their cut.

In the 2020s, blockchain technology — the common ingredient in bitcoin and all other cryptocurrencies — will lead to new payment systems that bypass banks altogether.

Blockchain Will Be the Payment System of the 2020s

Blockchain payment systems don’t have to be coupled together with cryptocurrencies. U.S. companies are already working to develop blockchain-based payment systems that will use the U.S. dollar.

By the end of the 2020s, you’ll be going into a store and paying for things using technology that will draw on a virtual “account” of dollars that you hold in a private digital wallet.

Instead of transferring money from a bank account or credit card to pay, you’ll simply transfer some of those digital dollars to the merchant’s own digital wallet. No bank fees, no commissions and no interest payments

More than 1,500 installment credit companies sprang up in the 1920s, competing to capture a share of the rapidly expanding market for consumer credit. Some of them evolved to become major players in the 20th-century U.S. economy.

The same thing is going to happen in the 2020s.

Companies are going to emerge to provide blockchain-based payment systems. Some of them are going to become big winners.

We’re going to help you identify them at the start of their trajectory … so you can be a big winner too.

Kind regards,

Ted Bauman

Editor, The Bauman Letter

P.S. The stock market averages about 8% to 10% per year. But my colleague Michael Carr’s One Trade strategy made 30 times that much in one day. And considering you place the same trade on the same ticker symbol every time … it’s easy enough that anyone can do it. So click here now to watch Michael’s special presentation on how One Trade works.