Today, I want to talk to you about the global energy crisis that we’re all feeling.

If you’ve been at a gas station or recently checked your winter heating bill, you know exactly what I’m talking about.

And with every crisis comes an opportunity.

In this case, you have the chance to profit from the evolution of the energy markets.

So, here’s the No. 1 ETF to buy for the energy crisis.

(If you’d prefer to read a transcript, click here.)

Hey everyone. Steve Fernandez here with this week’s edition of Market Insights.

I want to talk to you about the global energy crisis that we’re all feeling. If you’ve been at a gas station or recently checked your winter heating bill, you know exactly what I’m talking about.

And with every conflict, with every crisis, comes an opportunity.

In this case, there’s a huge opportunity to profit from the global energy crisis, and also just the evolution of the energy market over the last couple of years and, really, the evolution that’s going to continue into the future.

Before we get started, if you haven’t already, please subscribe to our YouTube channel. If you’re new to the channel, subscribing helps us grow our content and give you that content every week.

Huge Shake Up In The Energy Market!

Let’s go ahead and jump right in.

So, I’m sure you’re following the Russia situation right now. We’re seeing a huge shake-up in the energy markets, mainly because of the economic sanctions that we’ve seen.

With the economic sanctions, Russia isn’t really able to trade with other countries. Some of its banks have been removed from the SWIFT banking system, which practically eliminates their ability to transfer or trade with other nations or companies.

Now, is U.S. really directly affected by Russia? Not really. Russia accounts for about 3% of the oil supply in the U.S. It doesn’t really supply any natural gas in the U.S.

But with the entire world affected, it really will put a supply crunch on the oil and gas supply. And this was already a tight supply. So, the crisis we’re seeing in Russia, that conflict has amplified the situation.

I mentioned there has already been that tight supply. That was mainly because of the COVID demand wipe out.

Basically, all demand was eliminated because of the COVID shutdowns. Energy suppliers had to cut supply to stay afloat.

They did a good job, but they were reluctant and have been reluctant to bring back supply. They’re just sitting on the sidelines, pretty much, with limited supply, enjoying the price appreciation in the commodity.

And, you know, why change? They’re all growing profits, so I’m sure they’ll continue to do so.

Now, the global governments are really saying, “Hey, we don’t want to limit global energy supply, but we want to limit the export of refining technology to Russia.”

So, on one hand, you have the U.S. government and global governments saying one thing, but their actions are saying the other. It’s more of a “watch what I do, not what I say” moment.

Also, the U.S. and 20 other countries pledge to cut off financing for most oil and gas project overseas starting this year. So, again, what are we saying versus what are we doing?

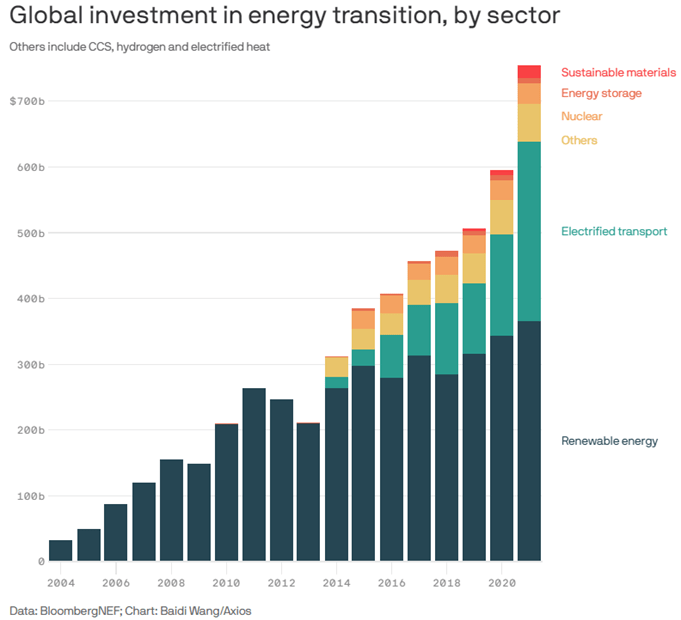

What we’re definitely doing is prioritizing clean energy spending. We saw over $900 billion in 2021 in terms of investment.

And you can see in this chart that that number has been climbing every year, essentially. And that should continue over the coming years.

Oil’s Historical Price Changes

So, how should you play this? How should you play the tight supply in the energy markets and the crisis in Russia?

The first thought is, well, I’ll buy oil companies, or I’ll buy an oil ETF.

There might be some upside in the short term. Maybe even in the medium term. But, generally, supply and demand normalize over time, and chasing oil prices has proven to be a very tough trade.

Back in ‘08, we saw oil surge to $140 a barrel. We’re at about $110 right now. I’m not an oil and gas expert by any means, but simply by prices, you know, you could see some upside there.

But it was a tough trade in ’08. When it touched $140, it was back to $40 within six months. So, a 70% decline in price in just six months. It was a really tough trade there.

The Case For Renewable Energy

Obviously, if you bought into oil back in the COVID shutdown when everybody was fearful, you know, you’d be sitting very fat right now. But I think the better idea is to buy into where the money’s going, and that’s renewable energy.

I’m most excited about solar energy. There are a couple of reasons why, and I think this crisis amplifies these reasons.

With solar energy, you’re not actually dealing with an energy cartel, right? We’re not dealing with Russia. We’re not dealing with Saudi Arabia. We’re getting energy from the sun.

Granted, we still need components for solar panels to obtain solar energy. So, we’re still trading with other nations. But it’s harder for countries to bully other countries around when it comes to energy prices and energy supply.

So, I think that’s something that will be amplified here with this recent Russia situation.

And, also, when you look at the electric vehicle (EV) transition and the electricity that’s going to be needed for cars, well, why would you want to be on the oil side of things when you could be on the electricity side of things?

Right now, about 50% of oil is used for motor vehicles. And Ian King and I are in the camp that electric vehicle sales will probably be 90% by the end of the decade, which is substantially higher than estimates of about 50%.

But when you look at the momentum we’re seeing in that market, 9% of vehicle sales last year were EVs. That’s huge. I expect that we’ll see that upward momentum continue.

So, you’re dealing with solar power technology that can get electricity from the sun, and that technology is getting cheaper over time. We’ve already seen a 90% decline in solar panel prices over the last decade.

Now, it’s hard to know where solar panel prices are going to go in the next couple of years because that’s really entirely dependent on the semiconductor market. Our solar panels are rich in semiconductors, and we’ve talked several times about the semiconductor shortage.

But, generally speaking, technology gets cheaper over time. You also don’t want to fight the government. You want to go, like I said, where the money’s going. And obviously the money’s going into renewable energy. It’s going into solar.

If the government is going to continue handing out tax subsidies to consumers and corporations, you have to assume that more and more spending will be going into solar.

And you can see in this chart that solar capacity has increased dramatically over the last 10 to 12 years. It’s up 20 times since 2010, and it’s expected to nearly quadruple by 2030.

Steve’s ETF Pick

So, the money is going into solar. That’s where the investment opportunity is. It’s my favorite way to play this clean energy transition.

And I think the crisis that we’re seeing now will amplify that. It kind of highlights the energy market problem that we have, where we really depend on other nations.

The world is dependent on other nations. Why not be dependent on the sun? Why not be dependent on technology?

So, to get exposure to solar stocks, I recommend the Invesco Solar ETF (NYSE: TAN).

It’s a basket of solar stocks. So, it’s going to give you diversified exposure to that market.

We’ve seen now that if you’re really coming in late, like you came in after the election, you’re sitting at a loss in the solar ETF. But, generally speaking, the solar ETF is really just consolidating to where it was before the election.

Obviously, with the Biden administration coming into office, it was really high on the renewable energy shift. So, we had a ton of optimism around that, and that led to parabolic prices.

We’re seeing that consolidation back to where it was before the election. In my view, that’s not a bad thing considering that the market has been relatively weak recently, and solar stocks are still where they were before the election.

I think that speaks pretty highly of the strength in those stocks. The market just might not see it that way because we’re very, you know, short term in how we view our investments.

So, TAN is a good opportunity to get exposure to solar.

And that’s going to do it. Thanks for tuning in this week. And stay tuned for next week’s video.

Regards,

Research Analyst, Strategic Fortunes

Morning Movers

From open till noon Eastern time.

Polymetal International plc (OTC: AUCOY) is a Russian precious metals mining company that is up 58% this morning. The stock is on a rebound as investors see a cheaper price after its recent heavy losses related to Russian sanctions.

Indonesia Energy Corp. Ltd. (NYSE: INDO) is an Indonesian oil and gas stock that is up 49% today. The stock is continuing its upward climb from Thursday due to the surge in oil prices as a result of energy crisis fears stoked by the Ukraine-Russia war.

Sweetgreen Inc. (NYSE: SG) operates fast-casual restaurants serving healthy foods prepared from seasonal and organic ingredients. The stock is up 19% after the company reported strong revenues in its first quarter since its IPO, citing a recovery from pandemic conditions.

Tabula Rasa HealthCare Inc. (Nasdaq: TRHC) is a health care technology company that is up 17% this morning. The stock is up as it recovers from the analyst price target cuts following its recent fourth-quarter earnings report.

PBF Energy Inc. (NYSE: PBF) is an oil and gas refining company. It is another oil and gas stock that is up 12% today as oil prices rise due to the uncertainty from the Ukraine-Russian war.

Funko Inc. (Nasdaq: FNKO) designs, sources and distributes licensed pop culture products. The stock rose 11% after the company reported great results for the fourth quarter with strong performance across all segments and geographies of the business.

Agilon Health Inc. (NYSE: AGL) offers health care services for seniors through primary care physicians. The stock is up 11% after the company reported results for the fourth quarter that beat revenue estimates and shows strong growth prospects for the current year.

Grab Holdings Ltd. (Nasdaq: GRAB) operates a transportation and fintech platform in Southeast Asia. The stock is up 10% on a bounce-back after a sharp decline Thursday when the company reported earnings for the fourth quarter showing a decline in quarterly revenues.

MultiPlan Corp. (NYSE: MPLN) provides data analytics and technology-enabled cost management, payment and revenue integrity solutions to the health care industry. The stock is up 10% as part of the broader move in health care stocks as investors look for safer investments in the current market environment.

Gold Fields Ltd. (NYSE: GFI) mines and produces gold worldwide. It is one of the gold stocks that is up 9% today as the price and demand for gold rises as investors look for safe havens as the Ukraine-Russia war continues.