Let’s face facts.

The cost of housing is becoming more expensive with each passing year.

Nationally, the average price for a new home is up nearly 50% since 2012. The average price for an existing home is up 53% over the same time period.

These rising prices are making homeownership for potential homebuyers a pipe dream instead of a reality. This especially holds true for those millennials who wish to buy a home.

A significant portion of first-time homebuyers, around 45%, are millennials. And they, most of all, are facing an uphill battle in their house hunting search.

Unaffordable Homes

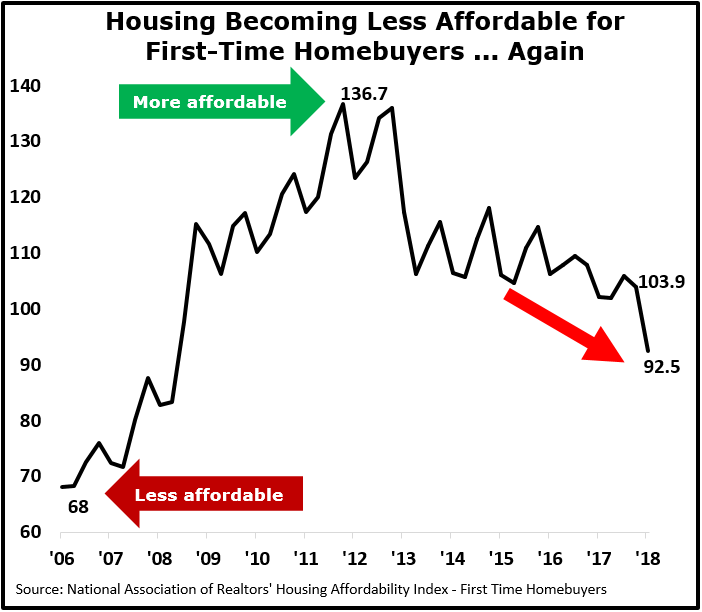

According to the most recent National Association of Realtors’ First-Time Homebuyer Affordability report, U.S. housing was less affordable in the second quarter of 2018 than the previous quarter. The index dropped to 92.5 from 103.9.

For this index, a value of 100 means that a typical family earning the national median income has the exact income to qualify for a mortgage on a median-priced home. A decrease in the index means that a family is less likely to be able to afford the median-priced house.

Therefore, regarding this affordability index, the lower the number, the less affordable the house.

U.S. housing prices peaked in early 2006 and then began to decline year-over-year, hitting new lows in 2012.

The below first-time homebuyer affordability index chart demonstrates these events.

In 2006 when housing prices peaked, the index declined to 68. Then in 2012 when home prices fell, the index reached a high of 136.7.

Since 2012 this index has been declining once again, demonstrating that homes are becoming less affordable.

Moreover, the price for a starter home up is up $31,300, or 16%, in just the last year alone, from $197,400 in 2017 to $228,700 in 2018.

Meanwhile, first-time homebuyers’ median annual income increased by just 3%, or $1,585. That’s while 30-year mortgage rates have ticked higher from 3.81% in September 2017 to 4.59% today.

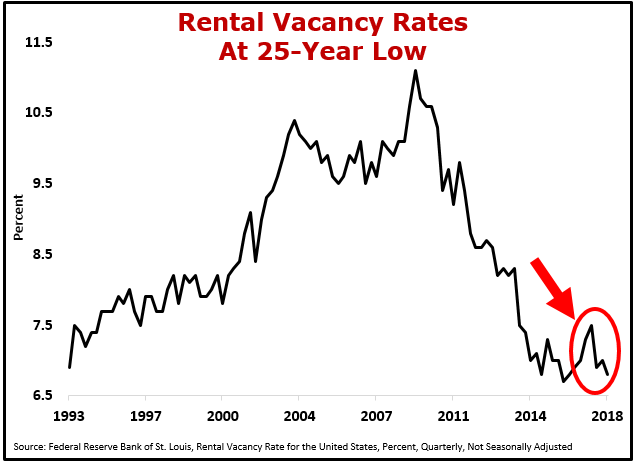

As a result of these trends and other factors, demand for rental properties continues to increase.

According the Federal Reserve Bank of St. Louis, rental vacancies are at a 25-year low.

This supply crunch is a problem for home seekers, but it can mean good news for real estate investment trust (REIT) investors.

REITs are companies that own and operate income properties.

In order to qualify as a REIT, companies must meet a number of stringent criteria. REITs are liquid and easily tradeable on the major stock exchanges.

Investors looking for dividend income, and potentially higher capital appreciation with likely lower risk, often turn to REITs as an alternative to stock and bond investments.

Since 1960, REITs have helped investors acquire ownership in a variety of income-producing real estate portfolios.

Here’s how they work.

Apartment REITs Are Heating Up

A REIT leases a space and collects rent. That rent generates income, which is then paid to shareholders as a dividend. Each year REITs must pay out a minimum of 90% of their taxable income to shareholders in a form of dividend.

There are various REIT types, including mortgage, health care, retail and residential. Residential REITs own apartment buildings, manufactured homes and single-family homes.

For the purpose of this article, lets focus on apartment REITs.

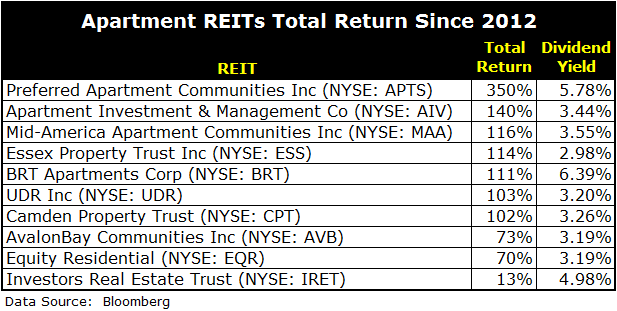

So, while rental conditions are favorable, here’s a list of the best-performing apartment REITs since the 2012 home price low.

They each pay a decent dividend yield and have experienced notable capital appreciation over the last six years.

In light of the current home affordability problem, consider adding these apartment REITs to your long-term investment portfolio:

Until next time,

Amber Lancaster

Senior Research Manager, Banyan Hill Publishing