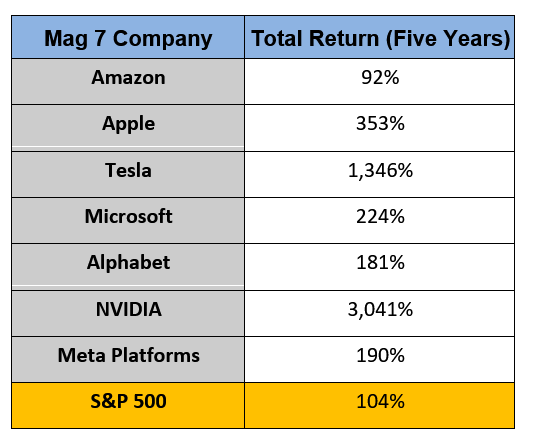

The Magnificent 7 have been stealing the headlines for the past few years.

And rightly so.

The performance of these companies is off the charts.

Professional money managers have a hard time just beating the market by a smidgen.

In fact, 90% of them can’t even outperform the S&P 500 index!

That’s why the Magnificent 7’s performance is a jaw-dropper.

Over the last five years, Mag 7 stocks have returned 775% on average compared to the S&P 500’s 104% return … more than 7X!

There’s one thing that is common to the Mag 7 that I haven’t heard anyone talk much about…

And it’s this: They are all managed by their founders — or were for a very long time.

That made all the difference.

Did you own any of the Mag 7 stocks? And if so, how were your returns? Let me know here.

What Drives the Mag 7 and How Can YOU Invest?

If you’re looking to make big returns in the stock market, investing in founder-led companies can really stack the odds in your favor.

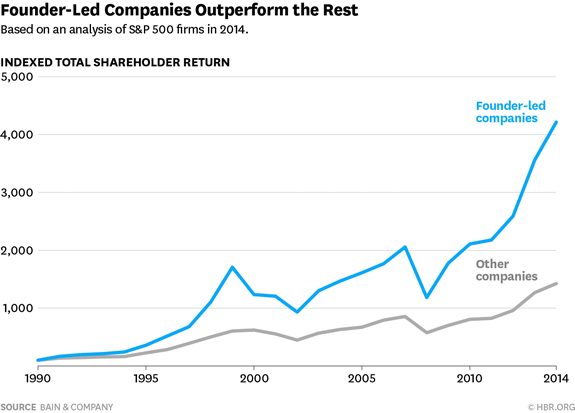

In fact, a 2014 study by professors at Purdue’s Krannert School of Management found that over a 15-year period, founder-led companies beat the market by over 3X.

Bain & Company developed a database of all public companies in the global stock markets and tracked their performance over 25 years.

They concluded that the the most profitable companies over the long term … were founder-led.

It’s not too hard to figure out why that is.

Companies led by the founder are more innovative, create more valuable inventions and are more willing to take risks to grow.

Founder-led companies…

- Have a clear purpose and try new things.

- Care a lot about their customers and pay attention to small details.

- Have attentive owners who take responsibility and make decisions quickly.

And that’s why founder-led companies top our checklist of ones that make it into our portfolio.

A great example of this is Herb Kelleher and Southwest Airlines.

He had the founder’s mentality by the bucket-load, and as a result, Southwest Airlines (LUV) became one of the most successful airlines in history.

Its stock is up a massive 16,160% since 1980.

So, anyone who invested $1,000 into Southwest Airlines in January 1980 and held onto it, is sitting on more than $160,000 today.

Companies that are managed by their founders have massively outperformed.

That’s why it’s one of the 5 key traits of what makes a special class of stocks with the potential to 10X…

No. 1 Small-Cap Stock with Extreme Growth Ahead

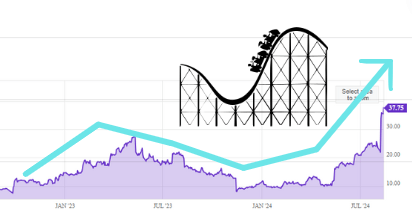

One of the founder-led small-cap stocks I recommended to a group of my readers has been on a roller coaster ride since we added it to the portfolio in 2022.

After it reported earnings last week, the stock price jumped 50% in one day…

(Click here to unlock the name of my small-cap stock.)

That’s great! But over the past few years, when the stock price fell, I was not concerned.

That’s because we focus on the business, not the whims and short-term movements of Mr. Market.

A lower stock price is an opportunity to buy more shares of a business with strong fundamentals.

My top small-cap has a strong business. So, we ignored the gyrations.

To smart investors like us … Mr. Market’s mispricings are golden opportunities to profit.

When no-knowing investors dump shares without understanding the business … the advantage swings to us.

That’s because we can make intelligent decisions instead of following emotional traders who know the worth of everything and the value of nothing.

Now is that moment for us.

The way I see it, this small-cap stock is still in the early innings.

Since the company is still very small, with a market cap of just $1 billion, the potential for growth is huge. It could become the next trillion-dollar Magnificent 7 stock…

Mr. Market is still offering us an outstanding opportunity to buy this stock at a great price…

Right now, we’re seeing a rare “market rotation.” Money is flowing out of large caps and into small-cap stocks.

I have no idea how long this will last.

So don’t procrastinate. As my father used to say, “Procrastination is the thief of all profits.”

Regards,

Charles Mizrahi

Founder, Alpha Investor