Last week, Pfizer Inc. delivered good news. The company is working with partner BioNTech SE on a coronavirus vaccine.

The two companies announced that their vaccine was more than 90% effective in phase 3 trials.

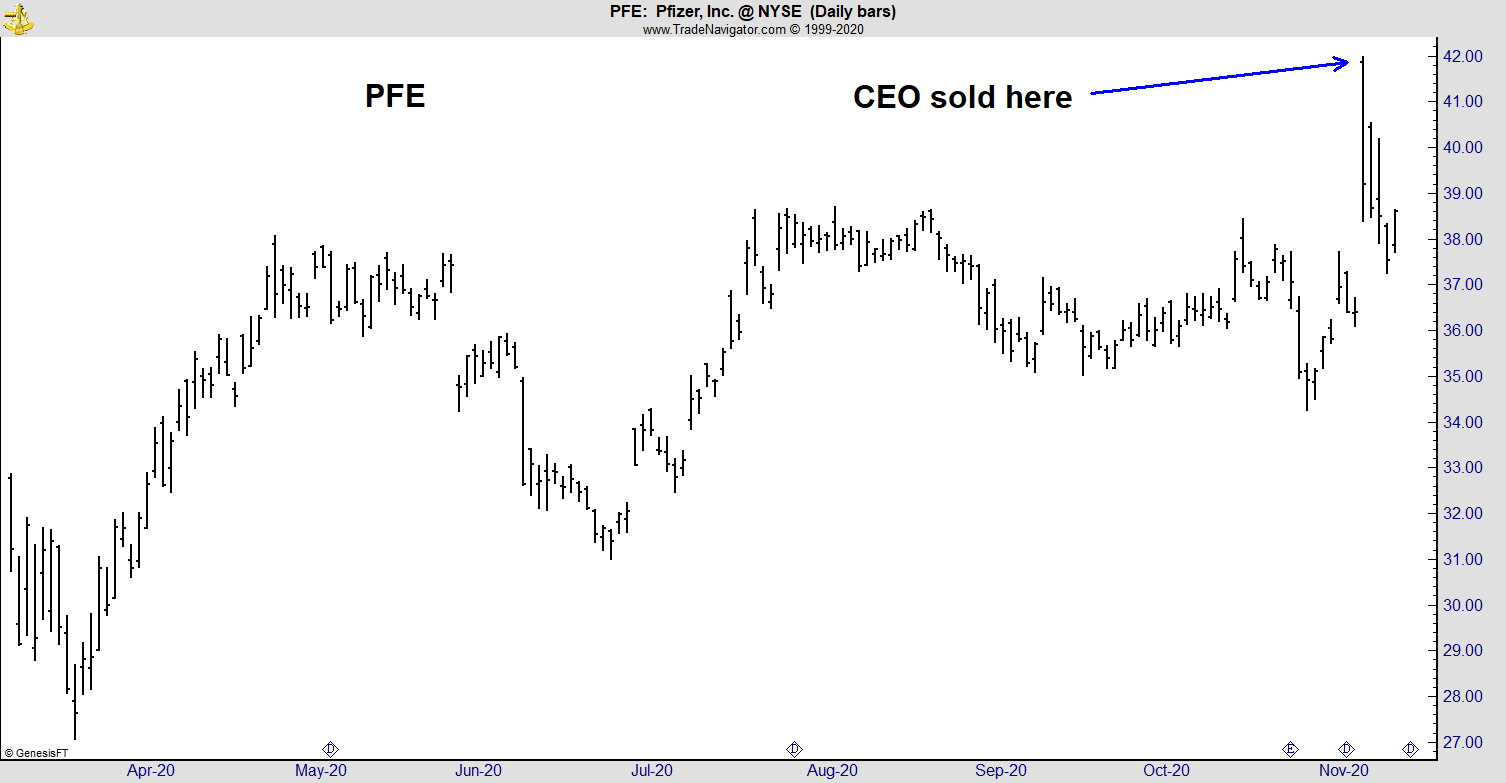

The stock market rallied on the news. Shares of Pfizer Inc. (NYSE: PFE) jumped more than 15% at the open that day.

The next day, the company made a filing with the Securities and Exchange Commission (SEC).

The filing reported that CEO Albert Bourla sold 132,508 shares of Pfizer stock at $41.94. The high that day was $41.99.

Pfizer’s CEO Sells Shares at the Stock’s High

(Source: Trade Navigator.)

Predictably, a watchdog group called for the SEC to investigate the sale.

However, there was nothing wrong with the sale. Although it attracted headlines as possible insider trading, it was simply the result of sound financial planning.

As individual investors, we can learn from this timely sale.

CEOs Face Risks

As CEO, Bourla was awarded shares in the company as part of his compensation. Owning shares in a company you work for, whether you’re the CEO or a low-level employee, carries unique risks.

If the company performs poorly, there could be layoffs or salary cuts for senior employees. This is a risk of employment.

At the same time, the stock could decline. This is a risk shareholders face in any company.

When you own shares in the company you work for, the risks are that you could face financial ruin if you lose your job as the stock declines.

Understanding this, Pfizer’s CEO developed a plan to take profits on the stock if it rallied. Under SEC rule 10b5-1, Bourla filed a plan to sell shares if the stock reached a certain price.

It seems likely that he ordered his broker to sell if Pfizer traded above $40.

When the stock opened at $41.86 that morning, the order was triggered. The sale was then executed in the next few moments.

Plan Ahead to Take Profits

The CEO knew when he wanted to take profits to diversify his portfolio. He followed all SEC rules and filed his plan in advance.

Selling was then out of his hands. This prevented him from getting caught up in the emotion of the vaccine announcement.

And Bourla wasn’t the only Pfizer executive to take profits that day.

Sally Susman, an executive vice president, sold over $1.3 million worth of stock that morning, also at $41.94. Pfizer stock later dropped more than 10% from that peak.

Establishing profit-taking targets as part of a trading strategy helps to manage risk and reduce the mistakes made due to emotional selling.

Company CEOs and officers often know exactly when they will sell shares — and we should too.

Regards,

Editor, One Trade