January marked the 30-year anniversary of the market’s most popular investment product: the exchange-traded fund (ETF).

ETFs are designed to be a simple, turnkey way of diversifying a portfolio. The oldest ETF, the SPDR S&P 500 ETF (SPY), does exactly what it says on the box. It gives investors direct exposure to the S&P 500 for just $0.09 of every $100 investment.

That’s a steal! And it’s hard to argue with the performance. Since it launched in 1993, SPY has returned investors over 930% as of this writing.

That’s why I’m not here to argue against SPY. No, really, I have nothing bad to say about broad-based ETFs like SPY, QQQ for the Nasdaq 100 or IWM for the Russell 2000.

But investors should be aware of what’s “under the hood” of what they’re buying.

You see, there are thousands of other “themed” or “sector-based” ETFs that attempt to give investors exposure to more concentrated types of stocks or strategies — 8,754 of them, to be exact. That figure alone should strongly suggest to you that they aren’t created equal.

These ETFs seem like a fine solution for a niche investment need. But, as you likely can discern, I believe it’s far from optimal.

You see, there’s no rule saying a stock must be a high-quality, well-run capital grower for it to earn its place in an ETF. Honestly, from what I’ve found, a lot of ETF stocks are plain garbage … and can seriously gimp your potential future returns.

As I see it, you can do so much better with just a little bit of research. And, of course, my absolutely killer Green Zone Power Rating system backing you up.

Today, I want to show you a technique my team and I have been using to separate the good ETFs from the bad … and even better, pick out the outlier stocks from any of them.

Wheat From the ETF Chaff

Here’s an example…

If you’re looking to invest in the energy industry — which I have been pounding the table on all year — there are no shortage of ETFs available to you.

- Want to place your chips on “clean energy?” There’s an ETF for that — iShares Global Clean Energy ETF (Nasdaq: ICLN).

- Want strictly oil and gas exploration and production companies? You want the SPDR S&P Oil & Gas Exploration & Production ETF (NYSE: XOP).

- Looking for a more pick-and-shovel play that’s less exposed to commodities prices? Check out the SPDR S&P Oil & Gas Equipment & Services ETF (NYSE: XES).

- And if you aren’t comfortable playing in “niches,” there’s always the good ol’ SPDR Energy Select Sector ETF (NYSE: XLE), which will give you general exposure to all these subsectors and more.

But … are these ETF stuffed with quality energy companies, poised to beat the market?

Or … simply a number of energy companies that meet certain listing standards?

On Monday, I asked my lead analyst Matt Clark to run an “X-ray” — our internal cue for an analysis of an ETF’s Green Zone Power Ratings — on each of the energy ETFs I mentioned. I wanted to compare their overall quality to the kind of energies companies I’ve been recommending in Green Zone Fortunes.

Here are the results:

- ICLN is fairly abysmal at a 5 out of 100 average rating across all its holdings, with only one stock carrying a “Bullish,” market-beating rating. The top average factor is Growth, though with a middling score of 54.1.

- XOP fares much better, with an average rating of 67 and a “Strong Bullish” value factor of 84.5.

- XES is more “middle of the road,” with an average rating of 53.9 and Growth as its top factor at 64.4.

- And finally, XLE rates an average of 63.9 with similar high factor average ratings of around 80 on Value, Quality and Growth.

If you absolutely must pick any of these ETFs, XOP is your best bet by Green Zone Power Ratings standards.

But I’d recommend you do something different.

You can break from the herd of $6.5 trillion in capital following ETFs, earning average returns … and follow the Green Zone Fortunes portfolio instead.

Why It Pays to Get Picky: Especially With an Energy ETF

Going off our historically proven rating system, the energy portion of the Green Zone Fortunes model portfolio is just about the highest-quality energy stock “ETF” you can buy.

Out of respect for my subscribers, I won’t reveal their names and tickers here. But I will show you this:

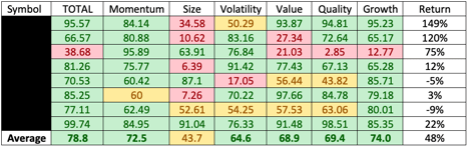

These are the precise Green Zone Power Ratings for each of the energy stocks in the portfolio, along with each of their factors and their return since we’ve added it to the portfolio.

All but two of these stocks sport a Bullish rating of 60 or above, or a Strong Bullish rating of 80 or above. (0-20 is High Risk, 20-40 is Bearish, and 40-60 is Neutral.)

On the individual factors, you can see that almost all of them have multiple strong factors holding them up.

Your eyes might be drawn to some of those red and yellow cells above. To respond, let me say that nothing in life is perfect, and that’s even more true in the stock market. But these stocks have characteristics beyond the Green Zone Power Ratings that make them strong inclusions in our portfolio.

On average, these stocks have earned us 48% since we added them — counting all the losers and winners (keep in mind, this is just the energy portion of our portfolio.)

This is why it “pays to be picky,” so to speak, when investing. An ETF will deliver you average returns because it’s spreading your investments across dozens, if not hundreds of stocks that vary wildly on quality.

Using my Green Zone Power Ratings system to help you find only the best names is a far better approach.

With that in mind, I have an exercise for you.

If you own one or more ETFs, go ahead and look up their top holdings and run them through the Green Zone Power Ratings system on my website, MoneyandMarkets.com. Just click the search bar in the top right and look through any individual ticker.

If you see your ETF isn’t chock-full of quality stocks like the ones above, give a second thought to how much capital you have tied up in it.

And if you’re looking for more hands-on guidance with highly-rated stock picks every month, go here to learn more about a Green Zone Fortunes membership for less than $4 a month.

To good profits,

Adam O’Dell

Adam O’Dell

Chief Investment Strategist, Money & Markets