One thing I’ve learned over the years as both an investor and former financial journalist…

It’s not the obvious news that counts. It’s the stuff no one pays attention to that has the biggest payoff.

So last week was a momentous one for inflation-watchers — but not for obvious reasons.

McDonald’s, the world’s largest fast-food chain, said it will no longer lobby against increases in the minimum wage.

The company will “not use our resources, including lobbyists or staff, to oppose minimum wage increases” for its 800,000 employees.

This announcement is huge.

It’s not just an indication that the political fight over a $15-an-hour minimum wage is already over. On that battlefield, it’s only a matter of when, not if, such bills win support in more cities and states, and eventually even at the federal level.

It also shows the slow-burning inflationary reality of today’s economy.

A Monumental Blue-Collar Labor Shortage

Millennials are entering the white-collar workforce in huge numbers.

Meanwhile, baby boomers are retiring in droves. But they still buy lots of stuff, eat at restaurants and need their lawns cut and their leaky faucets fixed — all occupations in desperate need of reliable hourly workers.

Put the two trends together and we have a monumental blue-collar labor shortage.

It’s why Target last week decided to raise its minimum wage to $13 an hour, with a target of hiking it to $15 by next year.

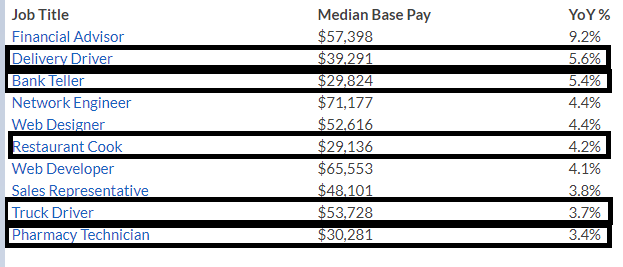

It’s why half of the top 10 jobs with the highest wage hikes in Glassdoor’s monthly local pay report now go to hourly wage positions:

(Source: Glassdoor.com)

It’s also why the U.S. economy added 196,000 new jobs in the March employment report despite predictions to the contrary. And why wage gains rose 3.2% after a 3.8% increase in February.

Inflation: The New Economic Reality

So far, we haven’t seen a large inflationary jump in the U.S. economy. But my view is, give it time.

In recent years, we’ve all benefited from lower energy costs. But we forget that oil prices plummeted from $110 a barrel in 2014 to less than $30 by 2016.

Since then, prices have rebounded. They’re now closing in fast on 2018’s highs of $75 a barrel.

If oil hits that milestone soon, there’s a high likelihood of a return to $100 a barrel in the next couple of years.

For investors, there’s a warning in all this.

Corporate profits will likely take a major hit from inflation. It won’t happen all at once, but in bite-sized pieces.

That means many of your favorite mega company stocks — already fully valued by Wall Street for maximum growth and popularity — may not be able to sustain the kind of earnings growth necessary to support their prices.

On the other hand, value stocks, turnaround plays and generally any company that’s unloved and unappreciated by Wall Street ought to do quite well indeed as we pivot toward the new economic reality.

Kind regards,

Jeff L. Yastine

Editor, Total Wealth Insider