You’ve heard it a thousand times: Past performance is not a guarantee of future performance.

Yet, past performance is all we have to forecast the future. This is true everywhere. If you play fantasy football, you make decisions for next weekend based on past performance. When hiring or promoting someone, managers make decisions based on past performance.

So, it makes sense to consider the past when thinking about the future for the stock market and how to invest your money.

I use several mathematical tools based on the past to forecast the direction of price moves. And my tools tell me 2018 could be a challenging market environment.

My 2018 Stock Market Forecast

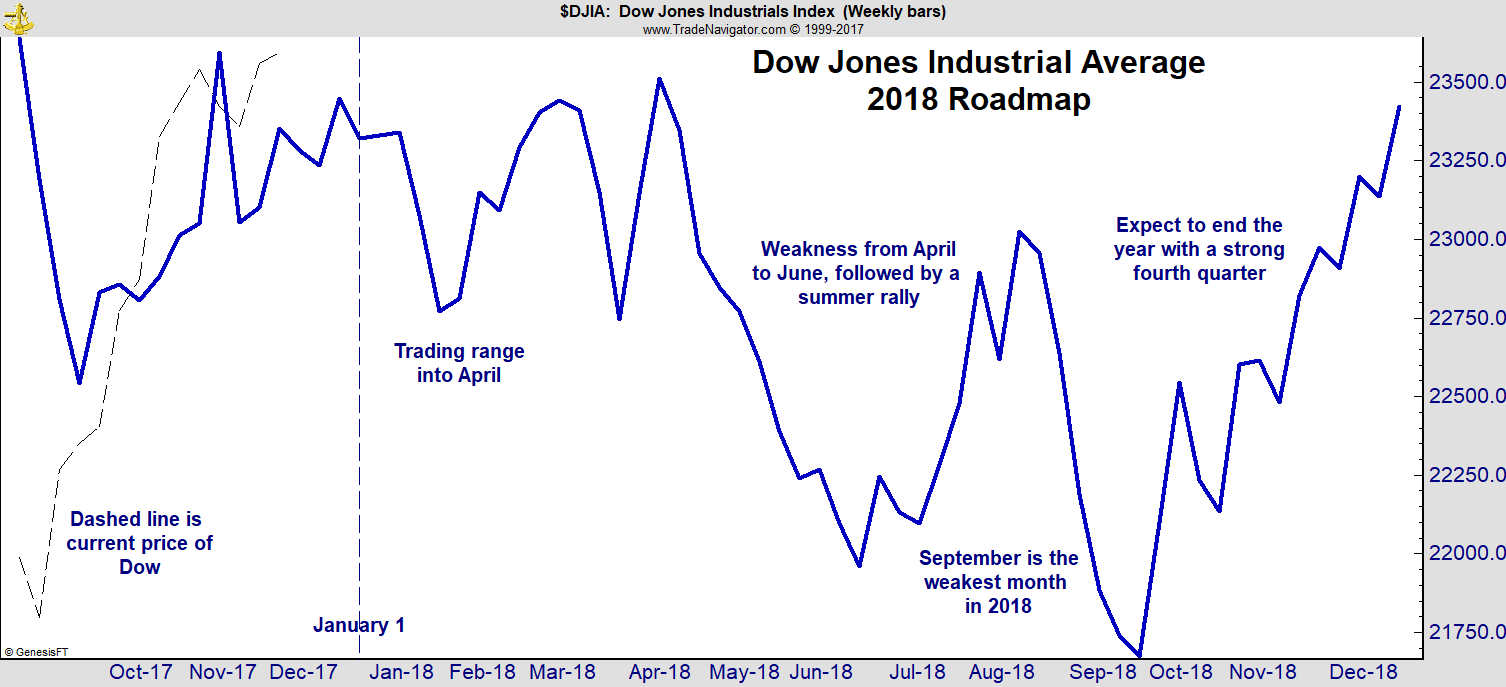

The chart below shows my 2018 forecast for the Dow Jones Industrial Average.

The forecast shows the direction of the expected trend, not price levels. For prices, I expect new all-time highs for major stock market averages in the first months of 2018.

This forecast is based on a combination of the recent price action and longer-term cycles. For example, one of the cycles is the presidential cycle. This is a recurring four-year pattern related to the president’s term in office.

According to a recent article in in The Wall Street Journal, the second year of a president’s term has the lowest average return. That includes data going back to 1896.

This is a great example of why you shouldn’t believe everything you read in The Wall Street Journal. The 20th Amendment to the Constitution moved the presidential inauguration from March 4 to January 20. That means the presidential cycle shifted slightly in 1937.

In the chart above, I combined the presidential cycle since 1937 with other cycles and then accounted for recent market action. The result is generally a more accurate roadmap for the year ahead than simpler models.

How to Invest Your Money in a Difficult Market

In 2018, we should expect a difficult stock market. The chart shows a trading range is likely to develop in the first months of the year. This will likely include at least one pullback of 5% or more.

Between April and June, a drop of 10% or more is likely. Treat that as a short-term buying opportunity. But be ready to sell quickly in September, where there is a high probability of a decline.

It’s too early to tell with certainty, but the decline I expect in September could be the beginning of a bear market.

A bear market beginning next fall fits with my forecast that the Federal Reserve is set to trigger a recession at its December meeting. I explained why in an earlier article.

But, as I noted then, the stock market tends to climb before a recession. The S&P 500 rose an average of 22% in the year before the past three recessions triggered bear markets.

The roadmap confirms my Fed recession indicator. This all means that now is the time to buy stocks, with a plan to sell next year when the bull market finally ends.

Over the next few weeks, I’ll go into more detail on my 2018 forecast.

Regards,

![]()

Michael Carr, CMT

Editor, Peak Velocity Trader