Everyone wants an edge in life.

For example, I watched Carlos Alcaraz battle his way back to win the French Open this summer.

And he has a huge edge as a tennis player.

Carlos Alcaraz is currently ranked world No. 1 in men’s singles by the Association of Tennis Professionals.

Carlos started playing tennis at just 4 years old!

And he started, of all places, at his father’s tennis club, Real Sociedad Club de Campo de Murcia.

Any athlete who starts at a young age is sure to have an edge. But Carlos was also born into a tennis family and grew up in a highly competitive environment for the sport.

I used to play tennis too, until an injury ruined my career. That’s when I found trading.

And I’ve used the same skills from tennis to find an edge in the market…

One of the most effective ways to gain an edge in the stock market is by using information inefficiencies.

Essentially, it means that market news will reach people at different times. And as a result, we all react to the news at different times.

We see this strategy at play in the market when Wall Street pays for early news. We also see it from trading firms that lay exclusive fiber optic cables for lightning-quick order executions.

Side-hustle traders can leverage this equation.

You don’t have to be first to the news if there’s an event that stops other traders from buying shares.

Thanks to Saturday and Sunday, when the market is closed, we can extend the time it takes for other traders to act on critical news.

That gives us a huge advantage in the market.

And it’s the main idea behind my weekend pattern.

Understanding the Perfect Setup for Weekend Trading

We made it to the end of the week.

Right about now, you probably hope to finish work ASAP so that you can start the weekend and relax.

But there’s something very important that you need to do first.

As traders, market masterminds, hustlers … We have to go the extra mile to ensure that we’re ready to profit while everyone else slacks off.

Make no mistake, some traders will pack up early today and go home. And it’s their loss.

That’s what creates these valuable Friday-afternoon setups … Part of the Weekend Trader strategy I’ve talked to you about.

When lazy traders leave the market early, they miss out on the strongest runners of the day as the stocks move into the close.

Then, over the weekend, the traders find these Friday runners. That’s when they enter orders to buy.

But my students and I already bought shares on Friday afternoon!

When the weekend orders are filled on Monday morning, voila! We’ve got a morning spike to sell into.

It’s like clockwork …

Every Friday afternoon, I look for the same price action in the market.

Here’s an example for you…

Strong Weekend Stock Trade

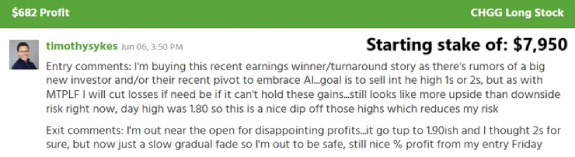

I used this pattern to profit off of Chegg Inc. (CHGG). Look at my trade notes:

(Click here to view a larger image.)

Notice in my trade notes on CHGG…

I was interested in the stock because it announced bullish earnings.

There were also rumors of a big potential investor and a pivot toward a more AI-focused business.

When I buy shares of a stock, there needs to be a reason for the spike. Otherwise, I’m gambling that a random stock will spike higher.

I’m not here to gamble.

I’m here to take calculated positions of the hottest stocks with clear trade plans.

CHGG was also a good play on Friday because the share price was low.

I mostly trade stocks with a share price below $5. The low share price makes it easier to load up on shares and ride the percentage gain.

The trading volume that day was off the charts.

It traded 26 million shares on Friday, June 6. That was the highest volume day in the last 52 weeks.

The price spiked more than 20% intraday.

Any stock that spikes 20% can spike higher.

These are the factors that make a strong stock spike.

After we find a stock that matches these requirements, we look for my weekend pattern in the price action.

When I wrote about CHGG’s price action from Friday to Monday, I said, “Let this be the only trade that you make today.”

There’s no need to complicate things on a Friday.

There are 52 weeks in a year. That’s 52 opportunities to make this trade.

One good trade a week can make all the difference for your account.

If you want to learn more about my Weekend Trader strategy, click here.

And you can always send me your questions at SykesDaily@BanyanHill.com.

Cheers,

Tim Sykes

Editor, Tim Sykes Daily