I live and die by one straightforward investing rule.

If I can’t sum up what a business does and how it makes money in 10 seconds, I don’t buy it.

I’d rather jump over a 1-foot hurdle than a 7-foot hurdle. So, I look for companies with products and services I can understand.

Once I’ve found a company I want to invest in, I start digging deeper into its business.

Most Wall Street firms spend tens of thousands of dollars researching new companies to invest in.

In fact, I know one hedge fund that spends over $20 million a year on research!

But I can find the exact same information on any publicly traded company I want.

Better yet … I can do it free.

Knowing where and how to research companies is mission critical if you want to make real money in the stock market. And yet it’s a skill very few investors actually have.

So, in today’s video, I show you how to evaluate companies before you invest, and we’ll do it the easy way.

Learning this simple trick will give you a tremendous edge over other investors. And it’ll put more money in your pocket over the long term…

Learn How to Target Undervalued Stocks Yielding Massive Returns

Most main street investors don’t realize that stocks really are just pieces of a business. It sounds so simple because, well it is that simple. If you want to know how to invest in a company, well the simple answer is through stocks. And that fundamental idea is vital to understanding how to evaluate a company before you invest as well.

Stocks are pieces of a company. Choosing a stock means buying a small piece of that business.

A stock is only as valuable as that business, and your ability to research a stock is directly related to your ability to analyze a company for investment. If done right, your investments will grow and so will your fortune.

How To Determine a Company’s Value

Today, I’m going to share with you something really important: How to figure out what the business is all about, and where to learn about the business. Because if you can do that, you’ll have a tremendous edge over other investors who look at stocks as nothing more than wiggles and jiggles on a chart. And by doing that, you’re going to put more money in your pocket.

Today, I’m going to share with you something really important: How to figure out what the business is all about, and where to learn about the business. Because if you can do that, you’ll have a tremendous edge over other investors who look at stocks as nothing more than wiggles and jiggles on a chart. And by doing that, you’re going to put more money in your pocket.

Most research on Wall Street costs in the tens of thousands of dollars. In fact, I know one hedge firm that spends over $20 million a year on research … But the information I’m going to give you today is free. You’ll learn how to evaluate a company before you invest in just a few easy steps.

Yes, this is easy, and all this information is freely available.

Understanding how analyze a company for investment gives investors a tremendous edge. Because if you know something about the business, you’re much more likely to invest wisely, stay informed and make educated investment decisions based on that information — and, ultimately, more money.

But before I share that with you, I want to just talk about a recent video that I did. It really pays to watch my last video, “How to Buy Stocks in 2020: How Real Money Is Made” I told you there, if you view stocks as wiggles and jiggles on a chart, you’re leaving serious money on the table.

I also showed you that there’s a much easier way to invest which puts more money in your pocket with less stress. I call them the 3 Knows:

- Know the business

Now, first thing is to know the business and what the business does. Because you have to figure out what the key is that drives the business — what I call the “business drivers” — and how these things make the business more money by either selling more products or more services.

You should be able to sum up a business and what they do in 10 seconds. Famed investor Peter Lynch said, “Never invest in any idea you can’t illustrate with a crayon.” [1]

- Know the numbers

To research a stock or analyze a company for investment, you must know the numbers. For some investors this is the most intimidating step. The general fear is that you aren’t going to understand a business balance sheet, and you don’t want to feel foolish pouring over math problems like this. You want to invest with your gut.

That just doesn’t work that way. There is an easy way to evaluate a company before you invest and it comes down to looking for a few simple numbers. I will show you exactly where to find these numbers and how to interpret them.

- Know the product or service

The third thing is to know the product or service. I like to pick companies with simple businesses that I can understand. It’s easy to buy a business where you are a consumer of the goods or services because you get to try it, touch it, feel it and you know what drives the business.

I’m going to show you where to find this information so you can research a stock anytime. It’s quick, easy and free.

Remember, you don’t make more money on complex situations. Wall Street doesn’t give you more money for doing that. Try to find the easy, one-foot hurdles and jump over them instead of trying to find the seven-foot hurdles.

Lesson 1: Know the Business

The place to begin is the SEC (Securities Exchange Commission) site. That’s where every company that’s publicly traded must file reports each year, each quarter and any time there’s an event. Now, that is really important. Because this is the information they don’t want to tell you all the time — but the information they have to tell you.

As I always like to think … The annual report that a company puts out is what they want to tell you. The SEC documents are what they have to tell you.

Once there, look at the upper right hand corner. There’s a search bar. Ignore that. I want you to click on “More Search Options” which is right underneath it.

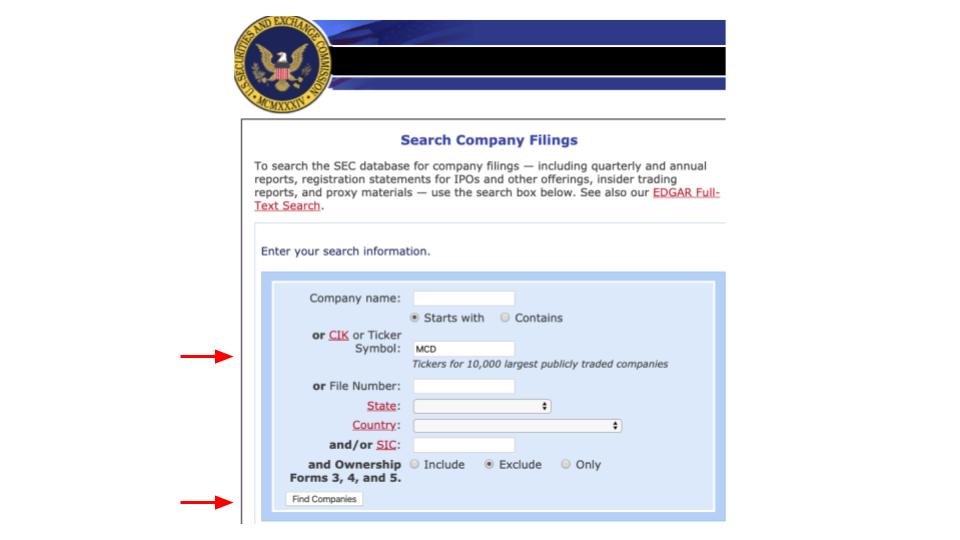

When you get to “More Search Options,” you click on that. It’ll bring you to this page…

This page is where you can search for the company’s filings. I typed in MCD, which happens to be the ticker symbol of McDonald’s. If you don’t know the ticker symbol of a company, just type in right above it. It says “Company Name.” Just type in what the company’s name is, and it’ll fill that in.

Once you type in the ticker symbol, then you go to click on “Find Companies.”

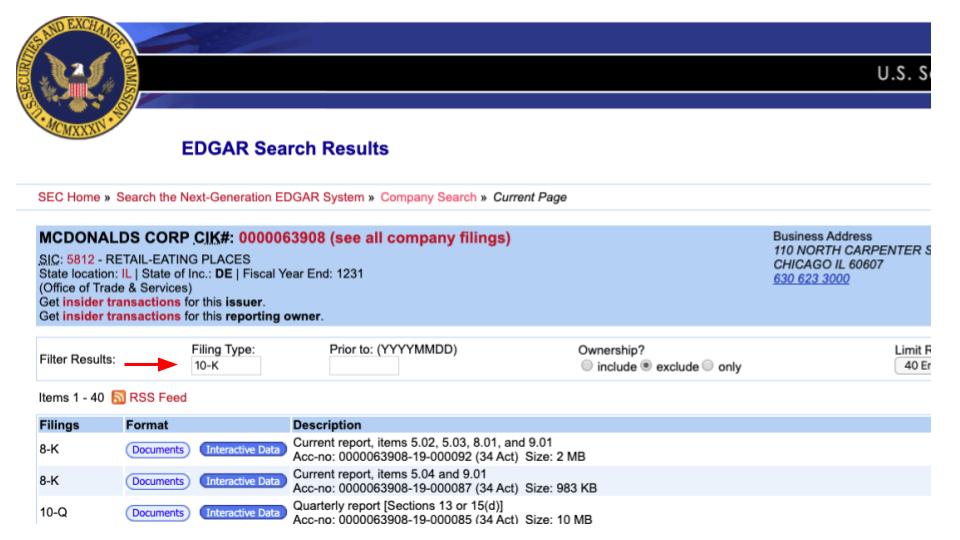

Now, when you get to this page, that’ll bring you here. This is going to list all of the company’s filings. The only one that we’re concerned with today is where I put the red arrow — the 10-K.

What is a 10-K? Nothing more than the annual report.

We want to look at the 10-K because it’s what the company must file each and every year. It’s very exhaustive. Lawyers look it over and they want to make sure they’re not going to get sued by shareholders or get in trouble with the SEC, so they throw all the information about the company right up there. They throw in the kitchen sink.

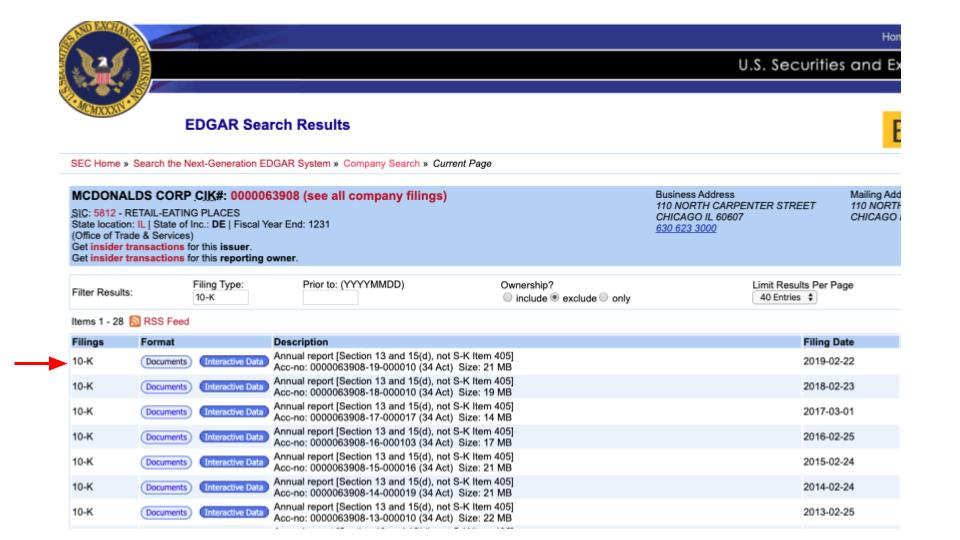

Type in 10-K, and boom — you’re going to get every 10-K that the company filed, sometimes up to 20 years back. What I like to do is take the last five years, start with the furthest year and read forward through each one of them.

It tells you what the company planned on doing, what they did and, more importantly, what they planned on doing and didn’t do. I want to know why. Are they covering up something? Is something not straight?

Some documents read like a novel. Others make it so difficult. I just toss the ones that are difficult — the ones I can’t figure out — in the too-hard pile. This game is not a game where you have to pick complexity. I try to pick things that I understand once or twice after reading them and I don’t need a PhD to figure out.

McDonald’s is one of those simple ones, so it lists the 10-K’s in order. We just want to go to the most recent one, which was filed in February of 2019. When we click on 10-K, we’re going to come to this screen.

This screen is going to show us the form 10-K, and we’re going to click on the hyperlink.

Once we do that, we’re in. This is now the company’s form 10-K.

In the past when you wanted to evaluate a company for investment, you had to mail away and you had to write or call up. I remember just going down on lower Broadway in Manhattan to go and request these and have them printed out and wait. Sometimes, mail took weeks.

Today, all of this is at your fingertips. It’s really a joke how simple it is. Yet most investors don’t even know this exists.

When you go to this page, this tells you that you’re at the right page of the SEC 10-K document. And if you just scroll down a little further, you’re going to see the index. Every one of them is more or less the same.

Item one is the business. That’s the one I want to focus on, because in the business description is the narrative description of the business. In other words, it tells you in pretty simple English what the business does.

I just highlighted certain parts of McDonald’s so you can see how simple a business it is and how you don’t need to be a rocket scientist or have a PhD to understand the business…

This kind of simplicity is what you want to look for when investing in a business.

“The company operates and franchises McDonald’s restaurants, which serve a locally relevant menu of quality food and beverages in more than 100 countries.”

So right off the bat, we learned that McDonald’s business is restaurants — which we probably knew — and they are in over 100 countries. If you think about it, there are close to 200 countries in the world, and they operate in half of them! This is staggering.

“McDonald’s franchised restaurants are owned and operated under one of the following structures — conventional franchise, developmental license or affiliate.”

Now we know that the company is basically franchises and licenses.

“We continually view our mix of company- owned and franchised restaurants to help optimize overall performance, with a goal to be approximately 95% franchised over the long term.”

So, the company’s goals are telling you, right up front, that they want to have 95% of all of their restaurants in the hand of franchisees. McDonald’s is the franchisor, and they just want to make a percentage of sales. That’s it. Continue…

“The company is primarily a franchisor, with approximately 93% of McDonald’s restaurants currently owned and operated by independent franchisees.”

Now you see that nine out of 10 McDonald’s are owned by individual investors, individual franchisees, entrepreneurs — people who took the chance to open up their own restaurant. And they’re going to work damn hard to make sure that they make money.

“Franchising enables an individual to be his or her own employer and maintain control over all employment related matters, marketing and pricing decisions, while also benefitting from the strength of McDonald’s global brand, operating system and financial resources.”

This is not a difficult business to understand. In fact, they described exactly what the business does. And I learned something there: Most McDonald’s are not company owned, which they were several years ago. Now, most of them — 93% — are owned by franchisees.

And last thing … We just scroll down a bit more and we get to the products. The company lists all the products they sell.

“McDonald’s restaurants offer a substantially uniform menu, although there are geographic variations to suit local consumer preferences and tastes. In addition, McDonald’s tests new products on an ongoing basis.”

They’re telling us the menu includes hamburgers, cheeseburgers, Big Macs, Quarter Pounders, Chicken McNuggets, soft drinks, yada, yada … you got it.

“McDonald’s restaurants in the U.S. And many international markets offer a full or limited breakfast menu. Breakfast offerings may include Egg McMuffin, Sausage McMuffin with Egg, McGriddles, biscuit and bagel sandwiches and hotcakes.”

That’s information that I’m sure you knew, but I wanted to use MacDonald’s as a benchmark; an example of a fantastic company to invest in. This kind of simplicity is what you should look for when researching a stock to invest in.

We used the SEC document to define the business operations of a multibillion dollar company like McDonald’s. They told us what they did. They told us what percent of their stores are franchised. We learned something about their menu. This is a business that anyone could understand.

And if you can understand this business, you know right off the bat that what drives sales at McDonald’s is the number of restaurants. The more restaurants they have, the more food sales they could have. And McDonald’s takes a percentage of that on larger food sales. That’s the business.

So, every publicly traded company has to file here. I encourage you to take a simple business — like McDonald’s or Coca-Cola or Nike — and do exactly what you just learned here.

Final Thoughts

You can follow these steps to evaluate any company before you invest.

And the more you practice, the better you’ll get.

If you are new to value investing, vetting companies and researching stock, then stick with the very simple stuff. If you cannot understand the business, then move on.

You can also look at companies that you already understand to get a sense of the language these SEC documents use. Check out Nike, Starbucks, Walmart or any other company you understand and look at their SEC documents.

In the next article, I’m going to share with you how to know the numbers, and show you what numbers I look at. Because in the same document, it tells us a balance sheet — financial statements that are really important to know.

Keep in mind that you’re investing in a business. The more informed you are about the business, the better decisions you make and, most importantly, the more money you’ll make.

Always remember that when you invest in a stock, you’re really investing in a business.

So the more you know about a business, the better decisions you’ll make and the more money you’ll earn.

That’s why I encourage you to follow along with today’s video and practice doing exactly what I show you.

Take an easy-to-understand business — such as Coca-Cola or Nike — and walk through each of the steps I lay out. Doing so will help you feel more comfortable and confident the next time you go to invest in a company.

Each month, my team and I tear apart a list of companies that I’m tracking.

We look into each company’s financial statements to learn more about the business and its future growth potential.

Then, using my 35 years of experience, we find the best businesses trading for a bargain price and issue a new portfolio recommendation based on our research.

In other words, we do all the heavy lifting so you don’t have to.

If this sounds interesting to you, click here for more details on how to subscribe to Alpha Investor Report.

Regards,

Editor, Alpha Investor Report

P.S. Check out my YouTube channel and click on the subscribe button. That way, you won’t miss any of the content I post on how to make money in the stock market and how to be a better investor.

Sources:

[1]: Forbes – Peter Lynch Quote