People often blame rampant speculation in the housing market for the 2008 financial crisis and the subsequent burst of the housing bubble.

Excessive output of new homes before the crisis created high inventories. So, new-home construction fell dramatically in the aftermath.

Now, over a decade later, the housing market’s bust continues to show up in the figures.

Housing starts, which were most recently reported at 1.3 million units, have yet to return to their long-term average.

This creates a whole new set of issues.

According to a report by Freddie Mac, the U.S. faces a housing shortfall of up to 4 million units.

And the problem will only worsen as the millennial generation starts to reach the peak age of first-time homebuyers, which is typically early 30s.

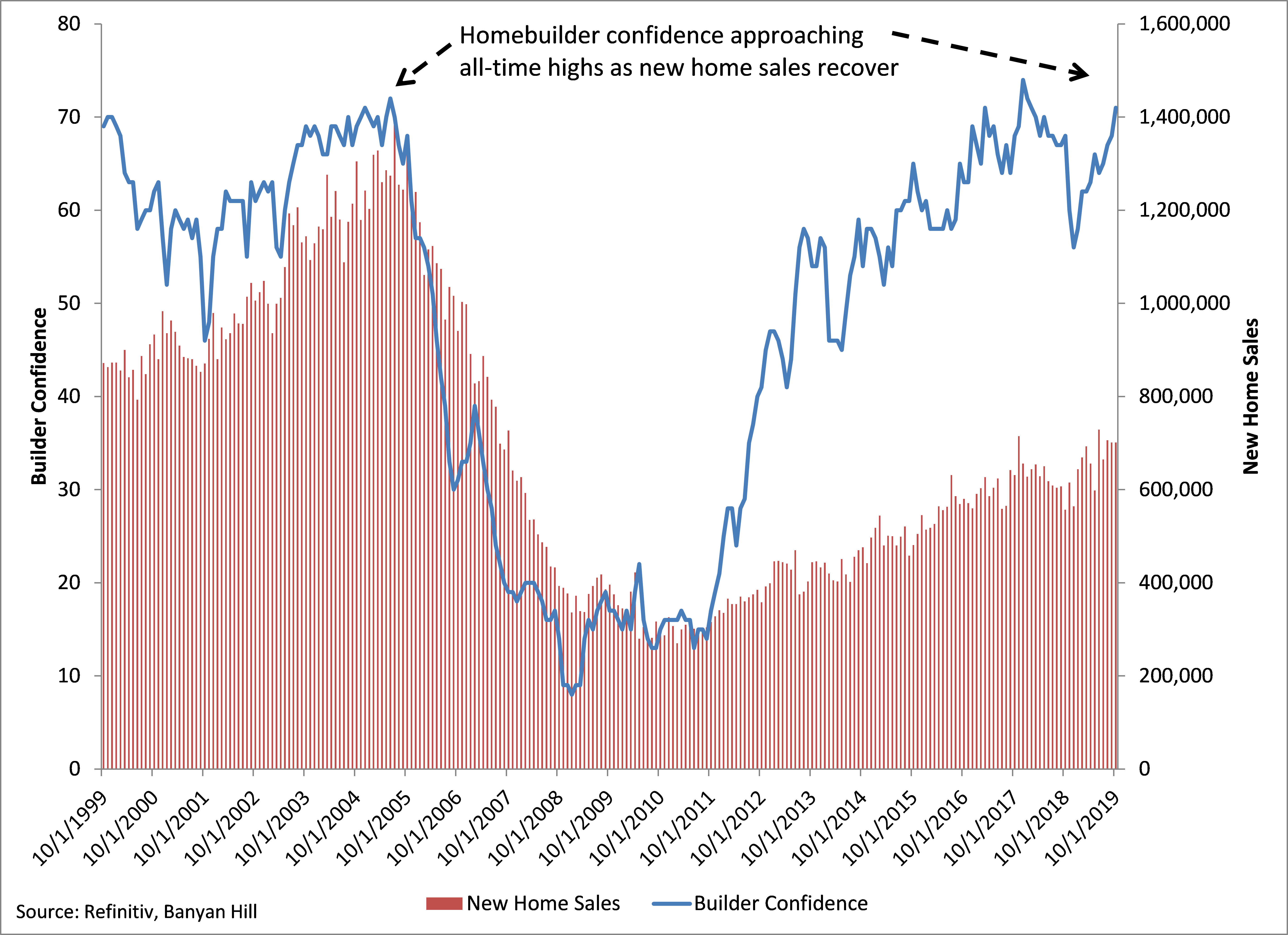

Fortunately, homebuilding activity has picked up. New home sales are now at their highest level since 2007.

The chart below shows homebuilder confidence, as measured by the National Association of Home Builders, is close to a new all-time high.

Homebuilder Confidence Approaches a New High

A reading over 50 for the blue line is considered positive. That means homebuilders have an optimistic outlook for new home demand.

To profit from the ongoing recovery in the housing market, you should pick up shares of the SPDR S&P Homebuilders ETF (NYSE: XHB).

This exchange-traded fund (ETF) provides exposure to a wide range of companies that will benefit from increased homebuilding activity.

Best regards,

![]()

Research Analyst, Alpha Stock Alert

P.S. Some of the most valuable tax breaks go ignored because people are unaware of them, or because they assume they won’t qualify. In a new special trading strategy report, my colleague Ted Bauman explains how you can save money on your taxes next April — even if you make over $150,000. To find out more, click here to watch Ted’s video.