“Uncle … UNCLE!”

As the father of two young boys, I often hear those words hollered when one has the other pinned.

The stock market is screaming a similar phrase right now as Federal Reserve Chairman Jerome Powell puts equities in a chokehold.

But he’s not letting up.

Last week, the Fed hiked short-term rates by 0.5% as expected and detailed plans to start shrinking its $9 trillion balance sheet.

At first, investors were overcome with joy when it seemed that Powell was loosening his grip. During a press conference, the Fed chair indicated that the central bank was not considering an even faster pace of rate hikes. The S&P 500 soared 3% in response … all in one day.

But then, markets started screaming “uncle” again … dropping almost 7% in the last four days.

Here’s why stocks can’t break the Fed’s grip.

Have Mercy!

Despite assurances that the rate hikes won’t accelerate, investors seem to think otherwise.

Right after the meeting, investors were assigning a 79% chance that a 0.75% hike would happen at the next meeting in June. The Fed hasn’t increased rates by that much at a single meeting in nearly three decades!

The pressure to keep raising rates quickly remains intense, especially after this morning’s inflation report that showed consumer prices jumped over 8% in April compared to last year.

And fears are growing over the impact of “quantitative tightening,” which is the balance sheet runoff. That’s when the Fed will reduce its holdings of government bonds, which are supposed to start in June and ultimately, reach a pace of $95 billion every month.

With all that supply needing to be absorbed by other investors, yields on longer-term bonds are shooting higher as well. I explained HERE why this matters for stocks.

Surging bond yields and plummeting stock prices … but the Fed won’t listen to the market’s cry for mercy until this happens.

Blunt Tools

Stocks are used to getting their way with the central bank. Just look at other episodes that occurred in 2015 and 2018. The Fed tried to tighten, but reversed course once stocks entered a correction.

But inflation is a much bigger obstacle this time around, which means the Fed wants to cause a little havoc in the markets to help tighten financial conditions.

That’s a term used to describe if money is cheap and available. And research shows that financial conditions have a big impact on economic activity. So, by making conditions worse, the Fed can achieve its objective of slowing activity and thus inflation … at least in theory.

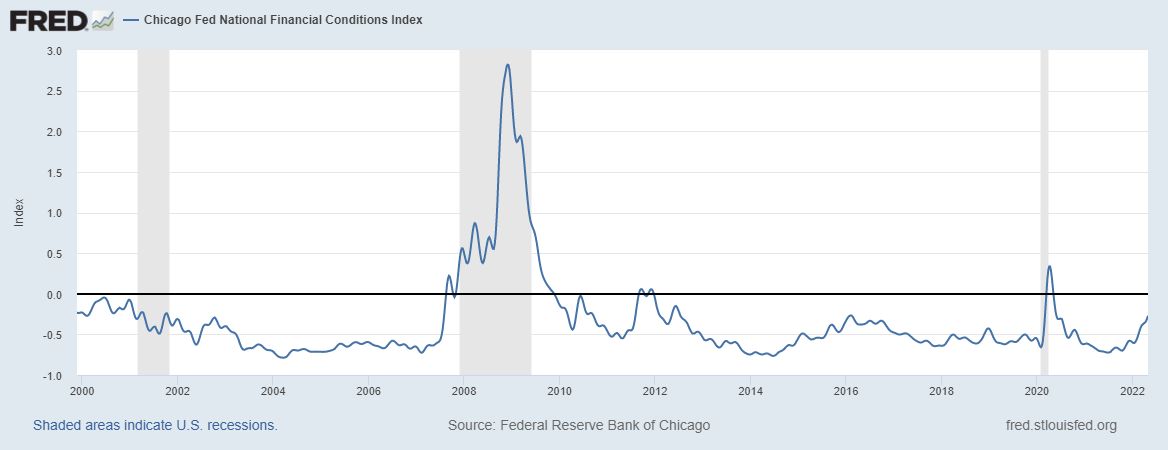

But despite the sharp declines in the stock market, overall financial conditions are still looser than average. You can see that in the chart below. The further below the black zero line, the looser conditions are:

And that’s why the Fed won’t loosen its grip on stocks and bonds until financial conditions get worse.

After all, Powell did refer to the Fed’s policy options as “famously blunt tools,” and they’re going to keep hitting the market until something starts to break.

Best regards, Clint LeeResearch Analyst, The Bauman Letter

Clint LeeResearch Analyst, The Bauman Letter