Government spending is too high. That crowds out private sector spending. And, inevitably, high government spending triggers a recession.

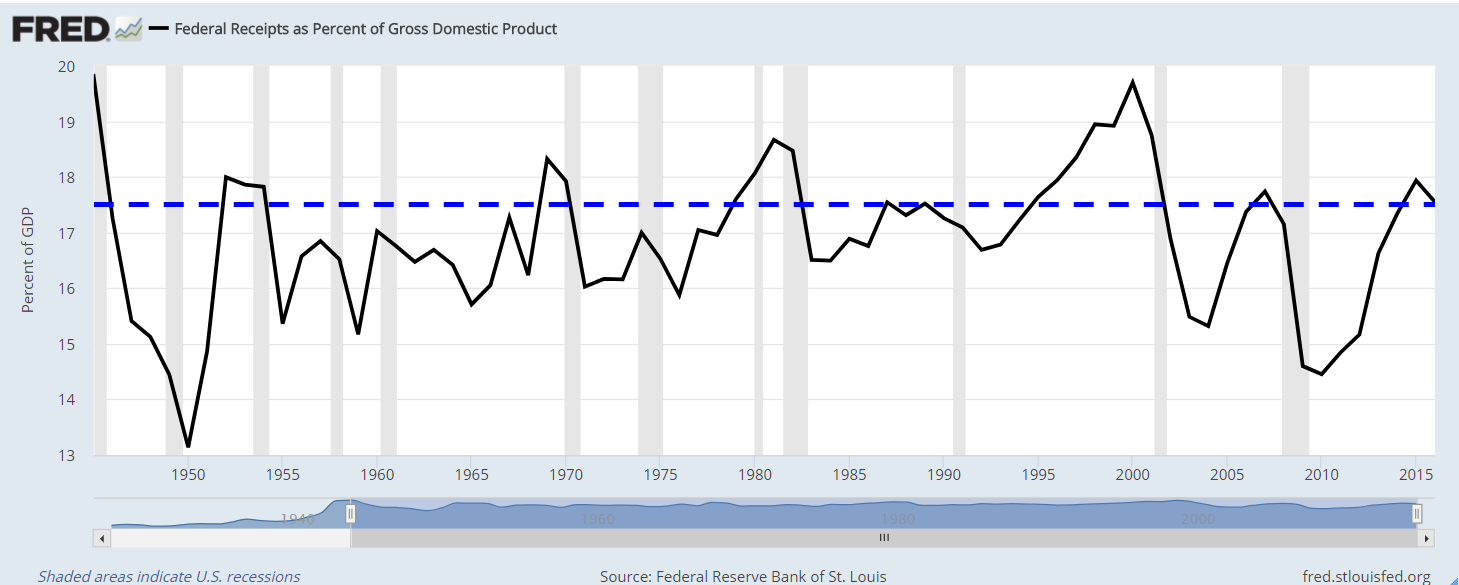

The chart below shows that we can define the level where government spending becomes too high. It’s 17.5% of gross domestic product (GDP).

That’s the magic number since 1945. Whenever spending exceeds that level, a recession follows. Gray bars mark recessions in the chart.

(Source: Federal Reserve)

Like most economic indicators, this isn’t a pinpoint timing tool. This is just a warning that the federal government took too much money out of the economy. That forced consumers and businesses to cut back on spending.

At some point, the cutbacks resulted in an economic slowdown.

The result is the cycle we see above. Washington takes more and more money until the economy can’t give anymore.

When recessions hit, tax cuts, even temporary ones, follow. Lower taxes pull the economy out of recession. This demonstrates that Washington knows the key to economic growth. But cutting government spending is hard for a politician to do.

We’re at the point where we, as consumers and businesses, gave until it hurt. That means we should expect a recession within the next two years, and a bear market in stocks.

The good news — and there is always good news in the stock market — is that stocks generally rally before a recession. This means now is the time to buy stocks for double-digit gains.

Regards,

Michael Carr, CMT

Editor, Peak Velocity Trader