Wall Street, You’re Much Too Fast

I guess I should’ve known by the way the chip market turned sideways that it wouldn’t last.

See, Wall Street’s the kinda place that believes in investing once — love ‘em and leave ‘em fast.

General Motors (NYSE: GM) must be dumb. It’s got a pocketful of revenue and boosted guidance, all of it new. But Wednesday night, I guess it makes it all right. Mr. Great Stuff says: “What have you got to lose?”

Little Red Corvette! Baby, you’re much too fast…

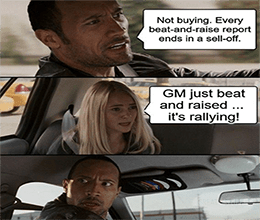

Right you are, Great Ones. I watched General Motors trade today, and I’ve gotta say … I don’t think Wall Street knows how to deal with GM right now.

On one hand, investors are apparently terrified every time a company hints at production slowdowns due to the semiconductor shortage.

On the other, General Motors’ quarterly report and solid guidance are just oh so tempting.

For example, GM said it earned $2.25 per share in the first quarter, more than doubling the consensus estimate for $1.08 per share. Revenue was roughly in line at $32.5 billion … about $300 million off from Wall Street’s “official” target.

Typically, that revenue miss would’ve sent GM shares into a tailspin. But these are unusual times, and GM was already smacked lower after Ford’s (NYSE: F) quarterly report last week. In other words, some caution was already baked into GM’s price ahead of earnings.

The big news, though, was GM’s guidance. CEO Mary Barra backed the company’s full-year earnings forecast, leaving 2021 projections untouched despite the global chip shortage.

“The company is highly confident in its full-year 2021 guidance outlined earlier this year as it works to manage through the semiconductor shortage,” GM said.

How confident? According to Barra, GM’s earnings should be at the higher end of its full-year guidance for earnings of $10 billion to $11 billion, or $4.50 to $5.25 per share — well above Wall Street’s current target of $5.03 per share.

Barra went on to say: “We think Q2 will be the weakest and start to recover in Q3.”

All in all, GM’s quarterly report was a master class in how to deal with adversity and Wall Street’s expectations. Barra reassured investors on the chip shortage front while holding firm on full-year guidance. GM also provided ample leeway to boost expectations as the U.S. economy improves … in fact, it all but guaranteed that expectations will rise heading into the second half of 2021.

How? Let’s look at full-year earnings again. GM expects $10 billion to $11 billion for 2021. But in the first quarter, GM earned $4.4 billion, putting the company almost halfway to its goal. GM would only need to make $1.1 billion in the second quarter to hit the halfway mark.

That’s an ultraconservative target if ever I’ve seen one. In other words, GM set the bar low. Like, really low. Any outperformance from here on out will be good news for GM investors.

Given the company’s strong outlook for the second half of 2021, there’s bound to be a beat-and-raise quarter in there ripe for the taking.

Clearly, GM is a love that’s gonna last. But that’s just like, my opinion, man…

What do you Great Ones think about GM’s prospects? Are you invested in GM? Why or why not? Let me know at GreatStuffToday@BanyanHill.com.

Editor’s Note: Here’s Something I’ve Been Thinking About Lately…

How did the idea of a dream retirement … become a waking nightmare for so many Americans?

Ian King knows why, and today, I want to share with you his simple solution to this devastating crisis.

Ian’s 20-Minute Retirement Solution is a simple blueprint inspired by the strategies billionaire investors and hedge fund managers use every day that can deliver potentially life-changing results. He lays out all the facts right here — including the simple steps you can start taking now to make your dream retirement happen.

This earnings season, we’re getting schooled on what it means to invest in value. Yesterday, we saw two companies (Pfizer and CVS Health) beat and raise, then watched their stocks rise as a result. Is the 2020-two-step really gone? Does beat and raise not mean a sell-off anymore?

Well … only if you aren’t a tech stock, it seems. Today’s value lesson comes from Under Armour (NYSE: UA). Clearly not a tech stock, expectations were low for UA coming into earnings as retailers suffered during the pandemic. Those low expectations kept UA shares from going bonkers last year … and it’s paying off now.

Under Armour’s first-quarter earnings of $0.16 per share quadrupled the consensus estimate. Revenue surged 35% to $1.26 billion, also topping Wall Street’s target. Meanwhile, UA put earnings guidance at $0.28 to $0.30 per share, more than doubling analysts’ expectations for $0.12 to $0.14 per share.

It’s almost like Under Armour kept its head down in 2020, reorganized and came out of the pandemic leaner and meaner than before. Kinda makes you feel bad about all that Netflix binge-watching you did during the lockdown, huh?

Wanna know what the 2020-two-step looks like? Look no further than ride-hailing No. 2, Lyft (Nasdaq: LYFT).

The company has had “speculation” written all over it since its IPO, and that speculation took off in spades near the end of 2020 as investors projected big things for Lyft after the pandemic.

Well … those expectations are coming back to earth this earnings season. Lyft posted a narrower-than-expected loss of $0.35 per share — $0.25 better than Wall Street expected.

The company also reaffirmed its outlook that it would be profitable by the third quarter this year — effectively reporting a beat-and-raise quarter since analysts continue to doubt Lyft’s ability to turn a profit.

So, Lyft beats expectations, raises guidance … and LYFT falls more than 3%. This, Great Ones, is why most of Wall Street’s bigwig players shifted to value stocks in the first quarter of 2021.

Amid the locked-down year, Call of Duty has been as big as it ever was, and Activision Blizzard’s (Nasdaq: ATVI) cash cow kept on cranking out moolah. That one franchise drove Activision-specific revenue up 72% year over year!

Though, its Blizzard biz isn’t doing as hot, with revenue only growing a cool 7%. Both earnings and revenue beat the Street’s expectations with room to spare.

With the company’s games available on just about every platform — cough Apple cough — Activision is understandably hyped up about how its “wholly-owned entertainment franchises offer the opportunity for limitless innovation.”

But … given Call of Duty’s reputation as a series created by copy-pasting from one game to the next, we all know that quip is a load of, well, duty.

But hey, if the template still prints money after almost two decades of near-world-ending virtual wars, keep printing away. Also, Blizzard made World of Warcraft — the gaming world’s golden goose of subscription revenue. Trust me: The company won’t sleep on any opportunity to further milk its franchises on the regular. But the “subscription of everything” (SoE) trend is much, much bigger than any one game.

And since the pandemic began, SoE has started to soar. Charles Mizrahi expects it to reach $2.7 trillion within the next decade … and the No. 1 SoE company leading the charge is ripe for the picking.

It’s earnings day for pretty much the only housing stock I care about these days: Zillow (Nasdaq: ZG). Last quarter, the company’s revenue grew to $1.2 billion and topped estimates for $1.1 billion, while earnings beat expectations by 81%.

Pretty much all of Zillow’s side hustles beat revenue estimates as well, from its Zillow Offers to premier agent services and even mortgages.

As you’d expect, site and app visits are up 19% from last year due to the insane amount of browser-window-shopping and dreaming y’all got up to in the pandemic.

Zillow’s growth is largely due to what it’s calling “The Great Reshuffling” — the massive cross-generational hordes homing in on the housing sector and relocating.

It’s a bit, I don’t know, heavy-handed of a term? But what do you think? Any of y’all escaping your old four walls and reshuffling out there? Let me know. Anyway, ZG shares rose 4% after the report but sank 3% beneath today’s red deluge.

Last week, we asked for your deepest, unrestrained thoughts on this whole nonfungible token (NFT) nonsense — namely, if you think the hype over NFTs is a warranted boom or an ill-fated bust in the making.

About 81% of you leaned on the side of reason and hard passed on NFTs, while another 19% of you are braving the new digital Beanie Baby gold rush. What can I say? It was hard to stay impartial on this one so, good luck, stay safe and I hope you have a great time buying those digital pet rocks or whatever you’re up to…

If you didn’t answer last week’s poll, well … ‘tis a bit late for that, wouldn’t you say? Let’s move on to bigger and better things — this week’s poll!

We’ve got Zillow on the mind here at Great Stuff headquarters. And though the team and I have all gone down Zillow’s “I totally deserve this mansion upgrade” rabbit hole … none of us here have actually, um, used the site’s services. But what about you?

Click below and let me know:

Oh, and if you’ve used the company’s mortgage or offer services, be sure to let me know too! I’d like to hear your personal stories behind Zillow’s banger of an earnings report. Spin the yarn, and lemme hear your tales! GreatStuffToday@BanyanHill.com.

And for all those numerous readers writing in saying “Add me!” or “Sign me up!” … first off, how’d you receive this? Second, all you have to do to sign up for Great Stuff is click here!

Once again: Just click here if you want to sign up for Great Stuff!

Finally, remember what Mr. Great Stuff always says: Like Stuff? Share Stuff! So be sure to share ‘Stuff with everyone right down your email list. Send it all! But, if that’s still too many virtual hoops to jump through, why not follow along on social media? We’re on Facebook, Instagram and Twitter.

Until next time, stay Great!

Joseph Hargett

Editor, Great Stuff