Warren Buffett has been in the news recently.

He hit the headlines when his Berkshire Hathaway sold all its airline stocks — 190 million shares total — in early May.

He’s also getting flack for not buying anything…

Berkshire had $137 billion of cash on its balance sheet at the end of the first quarter. That’s $80 billion more than just four years ago.

“What is Buffett waiting for?” investors asked.

Today, he’s still waiting. He hasn’t done a big deal.

But he did grow his position in a name many of you are familiar with.

You should check it out…

Warren Buffett Continues to Crush the S&P 500

The media accused Buffett of losing his touch. President Donald Trump even said Buffett made an error when he recently sold his airline stocks.

Despite the naysayers, Buffett is thriving. He has beaten the performance of the S&P 500 Index in seven of the past 10 years.

And in the 55 years through 2019, he grew the market value of Berkshire by 20.3% per year. That’s more than double the S&P 500!

I also know he’s doing fine because of Berkshire’s recent purchase of Liberty Media SiriusXM Group (Nasdaq: LSXMK).

Last week, Berkshire reported it added 12.4 million shares, increasing its position by 40%.

SiruisXM Reaches a Huge Audience

SiriusXM entertains people. It offers 24-hour commercial-free entertainment to listeners. SiriusXM and Pandora, its recent purchase, reach more than 100 million customers each month.

Most listen to SiriusXM in their cars. It comes pre-installed in new cars from every major automaker in the U.S. They’re putting it in more pre-owned cars, too.

Subscribers can also listen in their home and on the SiriusXM app. Content includes “The Howard Stern Show,” music, sports, talk, news and other channels.

Pandora is the largest ad-supported audio streaming service. Users can personalize their listening experience to listen to the music and podcasts they wish to. It offers both subscription and free services.

SiriusXM and Pandora reach a huge audience. They have more than 40 million subscribers, and Pandora has another 60 million monthly active users.

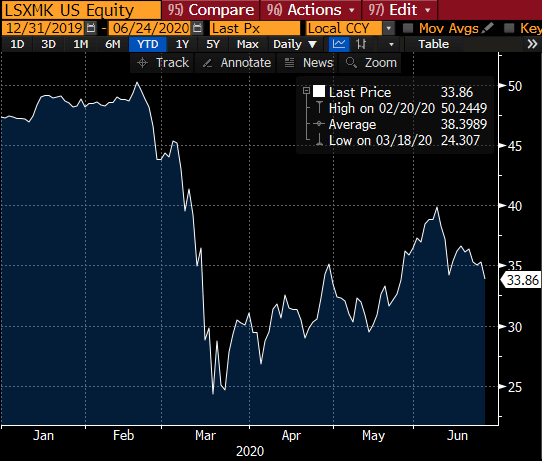

Shares fell during the recent drop. Now they’re back on the right track:

Liberty Is up About 40% Since March

(Source: Bloomberg)

But wait, there’s more.

The Bonuses for Owning Liberty Shares

Liberty’s 71% stake in SiriusXM is worth $18 billion. However, Liberty’s market cap is only $11.7 billion.

The main reason for the disconnect is that Liberty is a tracking stock. It tracks the performance of SiriusXM. It doesn’t control SiriusXM’s assets.

The shares of Liberty’s stake in SiriusXM, and SiriusXM Holdings Inc. (Nasdaq: SIRI), as each trade in a similar fashion. The shares are highly correlated.

Here’s the bonus: Liberty doesn’t just own a stake in SiriusXM. The tracking stock also owns interests in the following companies:

- Live Nation Entertainment — 33%.

- Atlanta Braves — 4%.

- iHeartMedia — 4%.

- Formula One — 2%.

Some of these names are weak right now. Live Nation hosts concerts. The Braves and Formula One host sporting events.

These aren’t all happening en masse today. But the Braves will play baseball by the end of July. And Formula One plans to resume its season on July 10 in Austria.

Live Nation sells 500 million tickets per year. Business is slow, but that’ll change as we control the virus.

And iHeartMedia owns radio stations, digital services and podcasts. It hosts concerts, too.

LSXMK shares haven’t shot back as fast as many other stocks. It makes sense to consider buying now, like Buffett did.

There’s at least 50% upside in shares from here. It can happen by the end of the year, though early next year is more likely given the recent growth in COVID-19 cases.

Good investing,

Editor, Profit Line