When I was a kid, we would often shoot rubber bands when we were bored at school. We would pull the rubber bands back as far as they would go, take aim at paper targets and shoot.

This was many years ago, before we knew you should never allow elementary school students to hold rubber bands without proper eye protection, and I am not advising anyone to undertake such a dangerous activity today. I was thinking about rubber bands because energy stocks meet all of the requirements for what I call the rare “rubber band trade.”

When a rubber band is stretched too far, it tends to snap back. The same is true of stocks in the long run … with the long run measured in years.

The rubber band trade works well for sectors. Buying a single stock that has been stretched too far to the downside is risky. That stock might slide into bankruptcy. But when a diversified sector is stretched too far to the downside, it is likely to snap back.

This means the biggest losers tend to be among the biggest winners. Sometimes we see both prices and earnings get stretched too far. That’s the situation right now in energy stocks.

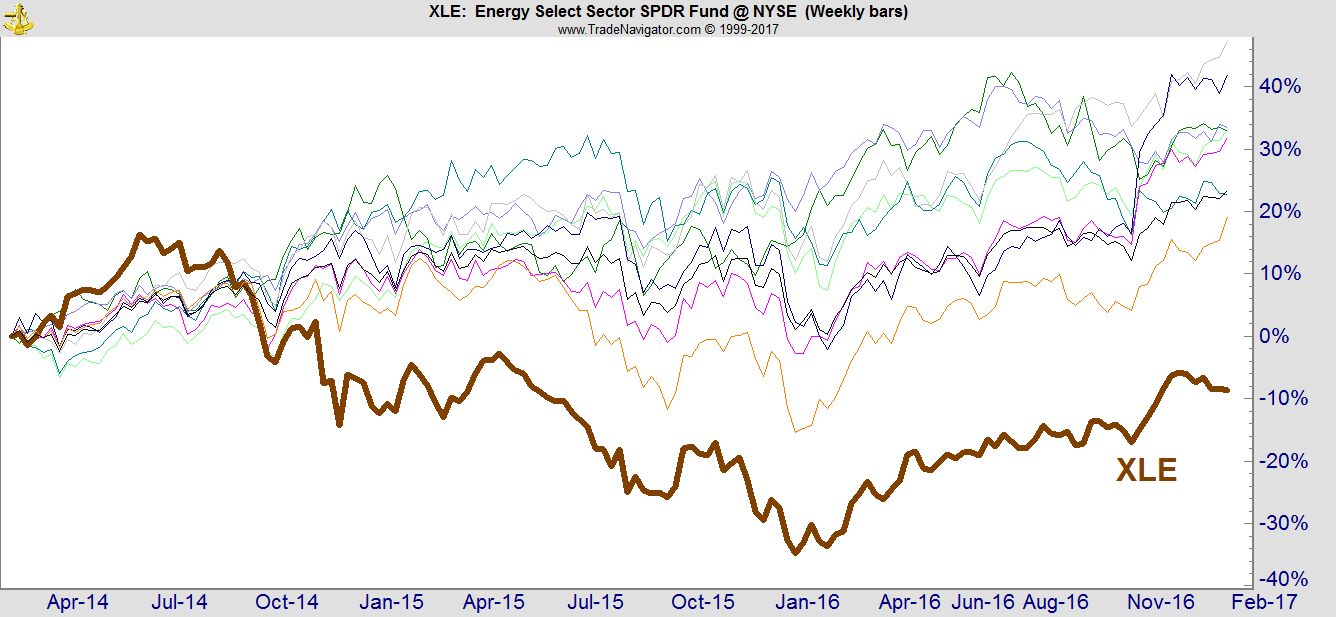

Energy Select Sector SPDR Fund (NYSE Arca: XLE) is the worst-performing sector fund over the past three years. It’s the only one of nine sectors with a loss over that time.

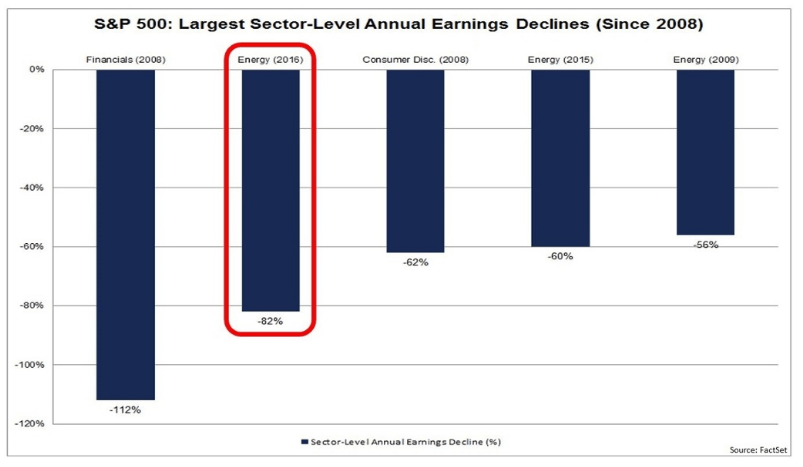

Earnings have collapsed and are now 96% lower than they were three years ago. Last year’s 82% decline in earnings is the second worst collapse for any sector in the past 10 years.

(Source: FactSet)

In the year after financials set the record for a one-year decline in earnings, Financial Select Sector SPDR Fund (NYSE Arca: XLF) gained more than 190%. Consumer Discretionary Select Sector SPDR Fund (NYSE Arca: XLY) gained 112% in the 12 months after earnings fell off a cliff. Energy has made the list of biggest losers in the past and delivered market-beating returns both times in the 12 months after making the list, gaining almost 60% after the 2009 crash and nearly 40% after the 2015 dip.

With both earnings and prices stretched about as far as we can expect them to go, just like a rubber band that’s been stretched, the energy sector seems ready to snap back.

Regards,

Michael Carr, CMT

P.S. Gains of 60%, 112% and even 190% are very exciting, so imagine what 1,000%-plus gains would be like. Paul has a strategy for achieving these kinds of humongous gains, and he’ll be revealing it to the attendees of his Extreme Fortunes Summit webinar. Make sure that you’ve signed up to attend Paul’s summit so you don’t miss out on these incredible investment opportunities.